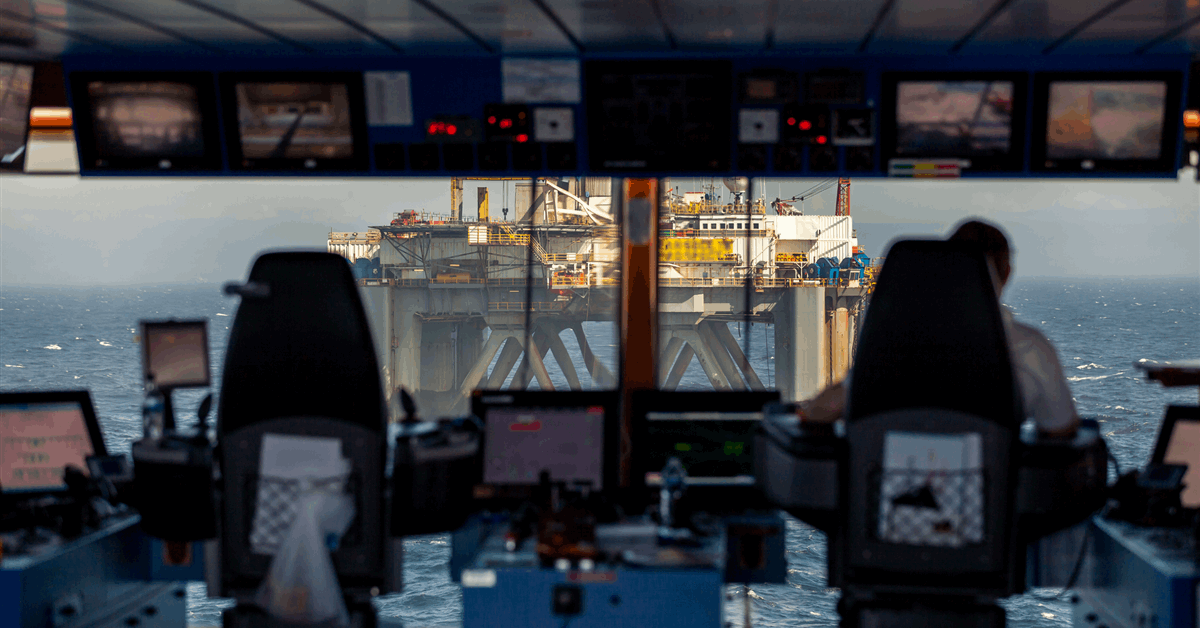

Oil held regular as merchants weighed renewed tariff threats from the US in opposition to the potential for widespread battle within the Center East.

West Texas Intermediate traded in a roughly $2.50 vary earlier than closing the session with a small drop to close $68 a barrel. The commodity quickly inched into constructive territory on an ABC report that Israel is contemplating taking army motion in opposition to Iran within the coming days. Merchants have been on edge since Iran threatened to strike American bases if nuclear talks fell by.

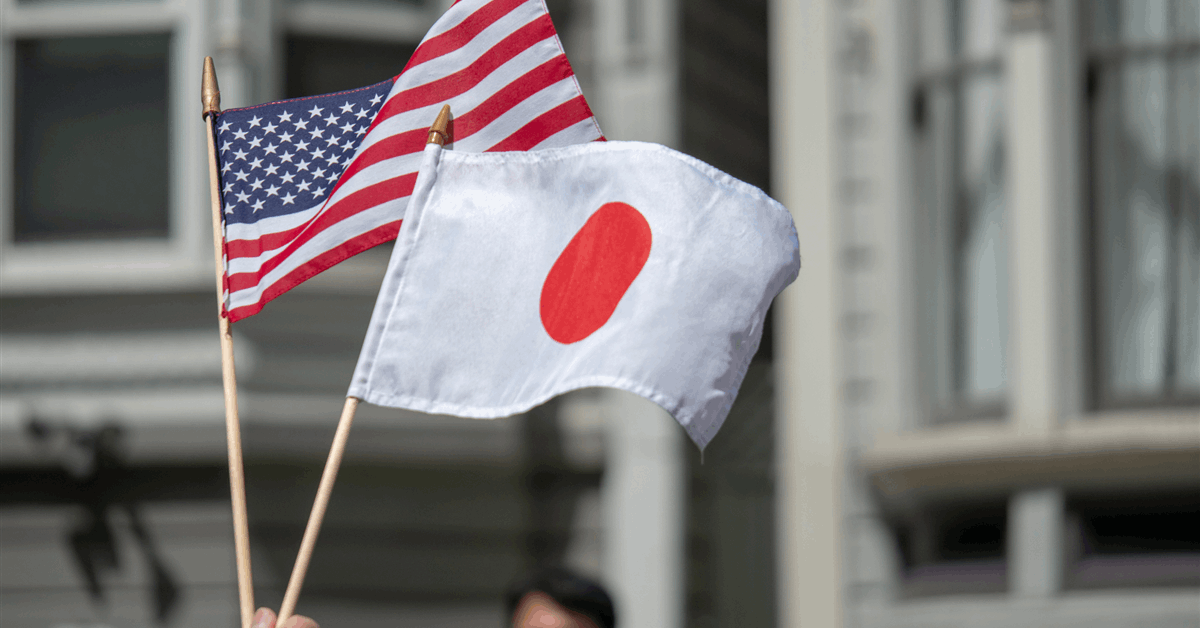

Weighing on costs had been earlier feedback from President Donald Trump that he meant to set unilateral tariff charges on buying and selling companions within the subsequent one to 2 weeks, which blunted urge for food for threat property.

Iran’s threats on Wednesday jolted crude out of the slender vary it had traded in for many of the previous month, highlighting oil’s sensitivity to geopolitical tensions. The Center East produces a couple of third of the world’s oil, pushed by OPEC+ members Iran, Saudi Arabia and Iraq. Costs are up about 12% this month, and JPMorgan Chase & Co. on Thursday stated oil might attain $130 in a worst-case state of affairs.

The transfer has additionally been coupled with huge shifts in choices pricing as merchants assess the chance of escalation. Bullish name choices on the worldwide Brent benchmark are buying and selling at premiums to bearish places, and volatility spiked.

Oil nonetheless is down for the yr on expectations the US-led commerce struggle would erode demand as OPEC+ revives idled manufacturing.

On Iran, Trump has persistently stated he needs an settlement that curbs the nation’s atomic actions and that the US might strike Iran if talks break down, earlier than saying that he would “like to keep away from battle” with the nation. Tehran says it’s making ready a contemporary proposal concerning this system earlier than a sixth spherical of negotiations in Oman’s capital of Muscat on Sunday.

The chief of Iran’s Revolutionary Guard Corps informed state TV that it was prepared for any state of affairs and had army technique at its disposal.

“The introduced drawdown of all non-essential US Embassy workers from Baghdad and licensed departure of non-essential personnel from Bahrain and Kuwait raises the specter of a heightened risk surroundings within the area,” RBC Capital Markets LLC analysts together with Helima Croft stated in a observe.

|

Costs

|

|

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback can be eliminated.