In a U.S. pure gasoline targeted EBW Analytics Group report despatched to Rigzone by the EBW staff on Friday, Eli Rubin, an vitality analyst on the firm, warned of “faltering demand” heading into the President’s Day vacation weekend.

“The March contract examined as excessive as $3.316 yesterday earlier than promoting off after a bearish EIA [U.S. Energy Information Administration] storage shock, and forward of deteriorating heating demand into President’s Day vacation weekend and an 11 billion cubic foot per day drop into subsequent Wednesday,” Rubin mentioned in Friday’s report.

“The specter of chilly air in Western Canada and the Pacific Northwest transferring into the U.S. stays a main supply of assist,” he added.

“If the market returns from the vacation weekend with out this risk materializing, nevertheless, sub-$3.00 per million British thermal items could also be in play because the yr over yr storage deficit flips to a 170 billion cubic foot surplus by late February,” he continued.

Within the report, Rubin went on to state that “steep storage refill demand east of the Rockies and free provide/demand fundamentals throughout latest Marches could provide some medium-term assist”.

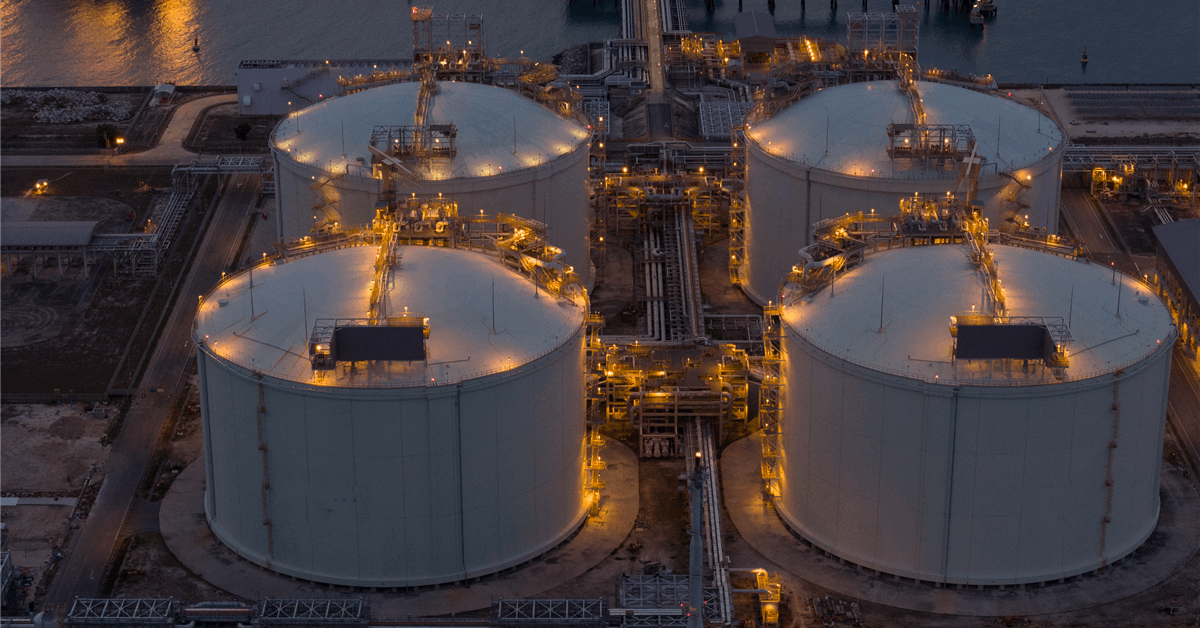

He added, nevertheless, that “storage exiting March close to 1,800 billion cubic toes, with gathering manufacturing tailwinds and decelerating yr over yr LNG development into mid to late 2026, counsel a bearish outlook for NYMEX gasoline futures”.

In its newest weekly pure gasoline storage report, which was launched on February 12 and included knowledge for the week ending February 6, the EIA revealed that, in line with its estimates, working gasoline in storage was 2,214 billion cubic toes as of February 6.

“This represents a web lower of 249 billion cubic toes from the earlier week,” the EIA highlighted within the report.

“Shares had been 97 billion cubic toes lower than final yr right now and 130 billion cubic toes under the five-year common of two,344 billion cubic toes. At 2,214 billion cubic toes, whole working gasoline is throughout the five-year historic vary,” it added.

Within the EBW report, Rubin mentioned the “249 billion cubic foot EIA report matched the Seventeenth-largest weekly EIA storage pull in historical past – and nonetheless got here in near 1.3 billion cubic toes per day looser than analyst consensus estimates”.

“The market rebalancing after Winter Storm Fern follows a sample of post-storm pipeline linepack decreases and industrial demand outages,” he added.

“Industrial demand outages are primarily situated within the South Central, considered one of bigger regional surprises in yesterday’s report. Each linepack and industrial outage components, nevertheless, are more durable to trace quantitatively with accessible knowledge sources – and infrequently underweighted in analyst estimates,” he continued.

“The present 97 billion cubic foot U.S. storage deficit to year-ago values might rapidly flip to a 170 billion cubic foot surplus throughout the subsequent three weeks. The present 130 billion cubic foot storage deficit to five-year norms could also be erased over the following two storage stories,” he went on to state.

In Friday’s report, EBW predicted a “watching early March climate” development for the NYMEX front-month pure gasoline contract worth over the following 7-10 days and a “storage deficits provide assist” development over the following 30-45 days.

EBW states on its web site that it supplies unbiased skilled evaluation of pure gasoline, electrical energy, and crude oil markets. The corporate highlights on its website that it has teamed up with DTN, which it describes as “the worldwide business chief recognized for hazardous climate detection and prediction, forecast modeling, resolution analytics, GIS and interactive mapping”.

Rubin is described on EBW’s web site as “an skilled in econometrics, statistics, microeconomics, and energy-related public coverage”.

“He’s instrumental in designing the algorithms utilized in our fashions, and in assessing the potential discrepancies between theoretical and sensible market results of fashions and historic outcomes,” the EBW website goes on to state.

To contact the writer, electronic mail andreas.exarheas@rigzone.com