Saudi Arabian Oil Co (Aramco) has signed a 20-year settlement to purchase a million metric tons each year (MMtpa) of liquefied pure gasoline from the under-development Commonwealth LNG in Cameron Parish, Louisiana.

“Commonwealth is advancing towards a closing funding choice with line of sight to safe its remaining capability”, stated a joint assertion by the offtake events. “Aramco Buying and selling joins Glencore, JERA, PETRONAS, Mercuria and EQT amongst worldwide power corporations coming into into long-term offtake contracts with the platform”.

Early this month Commonwealth introduced a 20-year deal to produce one MMtpa to Geneva, Switzerland-based power and commodities dealer Mercuria.

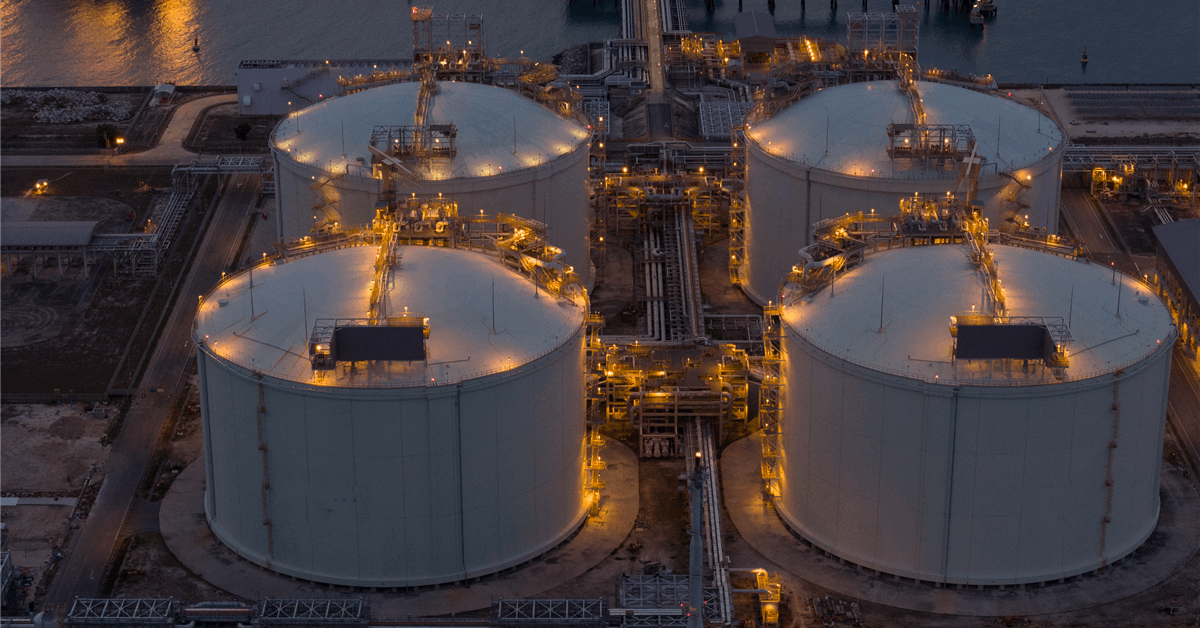

Commonwealth LNG is a venture of Kimmeridge Vitality Administration Co LLC and Mubadala Funding Co via their three way partnership Caturus HoldCo LLC. Anticipated to start out operation 2030, Commonwealth LNG is designed to supply as much as 9.5 million metric tons a yr of LNG.

“This settlement highlights the sturdy worldwide demand for U.S. LNG and underscores how our longstanding relationships and capabilities place Caturus to serve world markets”, stated Caturus chief government David Lawler.

“Our contract with Aramco Buying and selling underscores the differentiated worth Caturus can convey via our world attain in providing wellhead to water companies”, Lawler added.

Mohammed Ok. Al Mulhim, Aramco Buying and selling president and CEO, stated, “This settlement displays Aramco Buying and selling’s efforts to safe a dependable, long-term power provide for world markets whereas strengthening our presence within the LNG sector”.

The Gulf Coast venture is permitted to ship as much as 9.5 MMtpa of LNG, equal to round 1.21 billion cubic ft per day of gasoline in response to Kimmeridge. The US Vitality Division granted the venture authorization to export to nations and not using a free commerce settlement (FTA) with the U.S. in August 2025 and FTA authorization in April 2020.

The builders count on the primary part of the venture to generate round $3.5 billion in annual export income.

On December 22, 2025 Baker Hughes Co stated it had acquired a “full discover to proceed” from Technip Energies to produce main liquefaction tools for Commonwealth LNG. Baker Hughes’ scope consists of six refrigerant turbo compressors comprising LM9000 aeroderivative gasoline generators paired with centrifugal compressors.

Caturus stated then it expects to make a closing funding choice (FID) on Commonwealth LNG within the first quarter of 2026.

Caturus launched final yr as a rebranding of Kimmeridge’s SoTex HoldCo LLC following the acquisition by Emirati sovereign investor Mubadala of a 24.1 % stake in SoTex.

The acquisition “marks Mubadala Vitality’s U.S. market entry and displays its bold growth technique”, stated a joint assertion August 7, 2025.

Caturus’ enterprise consists of an upstream unconventional gasoline place within the Eagle Ford in South Texas, beforehand held through Kimmeridge Texas Gasoline, and Commonwealth LNG.

To contact the writer, e mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in an expert group that can empower your profession in power.