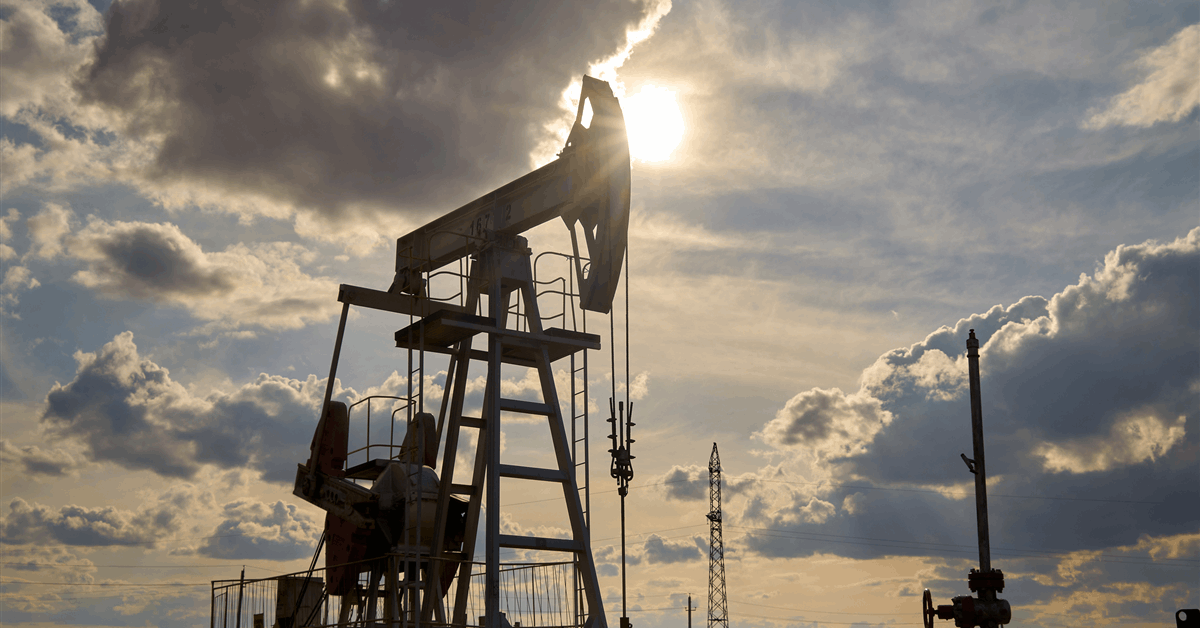

Liberty Power Inc., one of many greatest US fracking firms, expects most producers to stay with their manufacturing plans so long as crude costs can dangle on close to present ranges.

“If oil stayed within the low $60s, nicely, that’s not an thrilling atmosphere for us by any stretch of the creativeness,” Liberty Chief Govt Officer Ron Gusek mentioned throughout a name with analysts Thursday. “At most we in all probability really feel modest ripples in exercise ranges.”

If US oil futures dip into the $50s, nonetheless, firms are apt to start out dropping drilling rigs, Gusek mentioned. However it was untimely, he mentioned, to forecast how a lot manufacturing would gradual.

West Texas Intermediate rose 3% Thursday to $64.54 a barrel.

Liberty, previously run by US Power Secretary Chris Wright, is the primary giant oil-service firm to report earnings since crude costs started plunging within the wake of US President Donald Trump’s commerce conflict and OPEC’s choice to boost a deliberate manufacturing enhance later this 12 months. The route has hammered oil firms’ share costs and threatened to undermine drillers’ plans to modestly enhance US manufacturing this 12 months.

Denver-based Liberty has been among the many hardest-hit firms, with its shares down about 20% since Trump introduced the tariffs earlier this month. The inventory surged as a lot as 13% Thursday after the corporate reported higher-than-expected first-quarter gross sales.

The corporate’s crews are at present working to carry manufacturing flat, Gusek mentioned. Regardless of the current volatility, he doesn’t anticipate oil and gasoline firms to make any sudden adjustments to their drilling plans.

“It’s unlikely that we’re going to have any of our prospects take away a pad within the subsequent month or two,” Gusek mentioned. “It’s my expectation that to the extent we do see some adjustments, that’s going to be again half of the 12 months.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.

MORE FROM THIS AUTHOR

Bloomberg