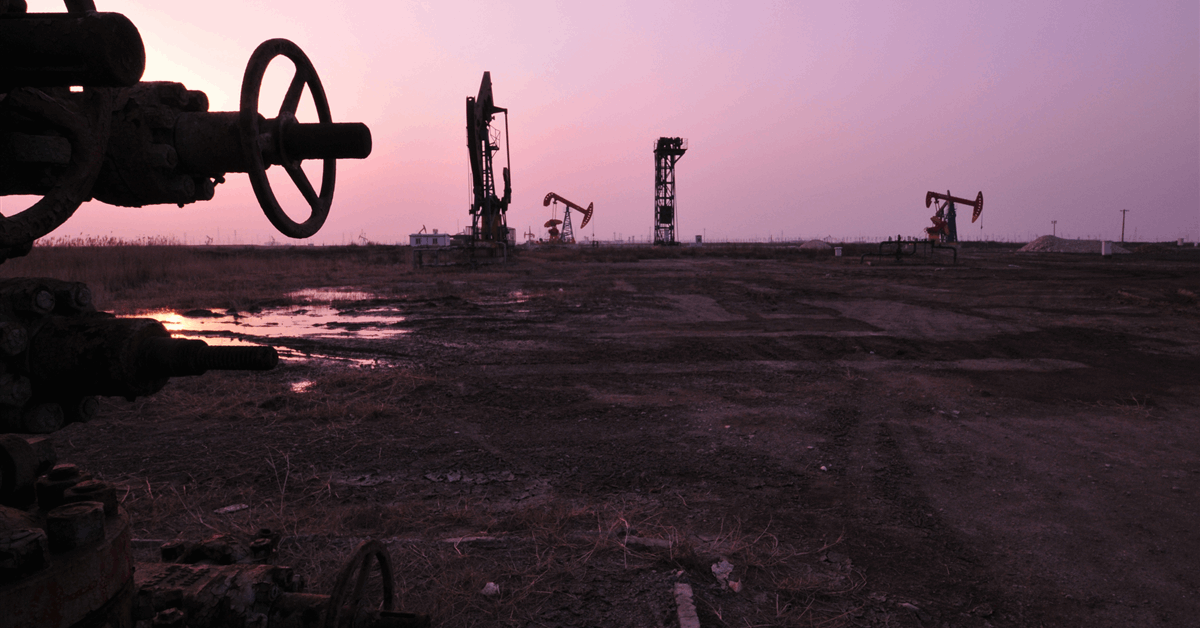

Fort Price, Texas-based U.S. Power Improvement Company (USEDC) mentioned it has acquired roughly 20,000 internet acres in Reeves and Ward Counties, Texas, increasing its complete Permian Basin holdings.

The place features a substantial proved-producing part and multiyear drilling stock to complement its current footprint within the space, the corporate mentioned in a information launch. The transaction value was $390 million.

USEDC mentioned it plans to run a devoted drilling rig on the acquired acreage.

“This transaction significantly enhances the general high quality and resilience of our portfolio, supplementing our reserves with extra proved producing belongings, including years of multi-bench drilling stock, and increasing our operated economies of scale,” USEDC Chairman and CEO Jordan Jayson mentioned. “These components place USEDC for sustained, environment friendly progress and reinforce our dedication to delivering long-term worth for our companions”.

Concurrent with the acquisition, USEDC accomplished a rise within the borrowing base and commitments beneath its syndicated revolving credit score facility led by Citibank, N.A. from $165 million to $300 million. The upsized revolving credit score facility supplies USEDC with vital monetary flexibility to assist its continued progress and has a most credit score quantity of $500 million, the corporate mentioned.

“The upsize of our revolving credit score facility in reference to our lately accomplished acquisition underscores our lenders’ confidence in USEDC’s disciplined technique and positions us to capitalize on future progress alternatives,” USEDC CFO Brandon Standifird mentioned. “We’re happy to have sturdy assist from our banking group as we proceed our trajectory of strategic enlargement”.

In February, USEDC mentioned it deliberate to take a position as much as $1 billion in 2025, primarily within the Permian Basin.

In 2024, the corporate deployed about $850 million in operated and non-operated oil and gasoline tasks within the basin, evaluating over 220 alternatives and finishing 29 transactions.

The corporate mentioned it expects the Permian Basin to stay the first focus of its funding in 2025 due largely to the economics of drilling and working wells within the basin.

The corporate said that it has skilled constant outcomes and “is assured in its capability to proceed to accumulate high-potential Permian Basin properties and effectively handle the prices of operated and non-operated ventures”.

“Our long-term acquisition and manufacturing methods proceed to generate strong efficiency throughout a portfolio of greater than 2,000 wells. Regardless of international value volatility and market uncertainty, the vitality market remained comparatively secure, and our popularity for finishing offers resulted in a report movement of profitable transactions and capital deployment in 2024,” Jayson mentioned in an earlier assertion.

“Now we have constructed a robust monitor report of sourcing and transacting on high-quality alternatives, and our capability to deploy capital effectively continues to drive sturdy outcomes. Our strategy stays the identical – we’ll proceed to guage alternatives that align with our disciplined funding technique and ship worth to our companions. With a robust basis and a focused strategy, we’re well-positioned to construct on our momentum getting into 2025,” he added.

Based in 1980, USEDC describes itself as a privately held exploration and manufacturing agency. The corporate mentioned it has invested in, operated, and/or drilled roughly 4,000 wells in 13 states and Canada and invested greater than $2 billion.

To contact the creator, e-mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will probably be eliminated.