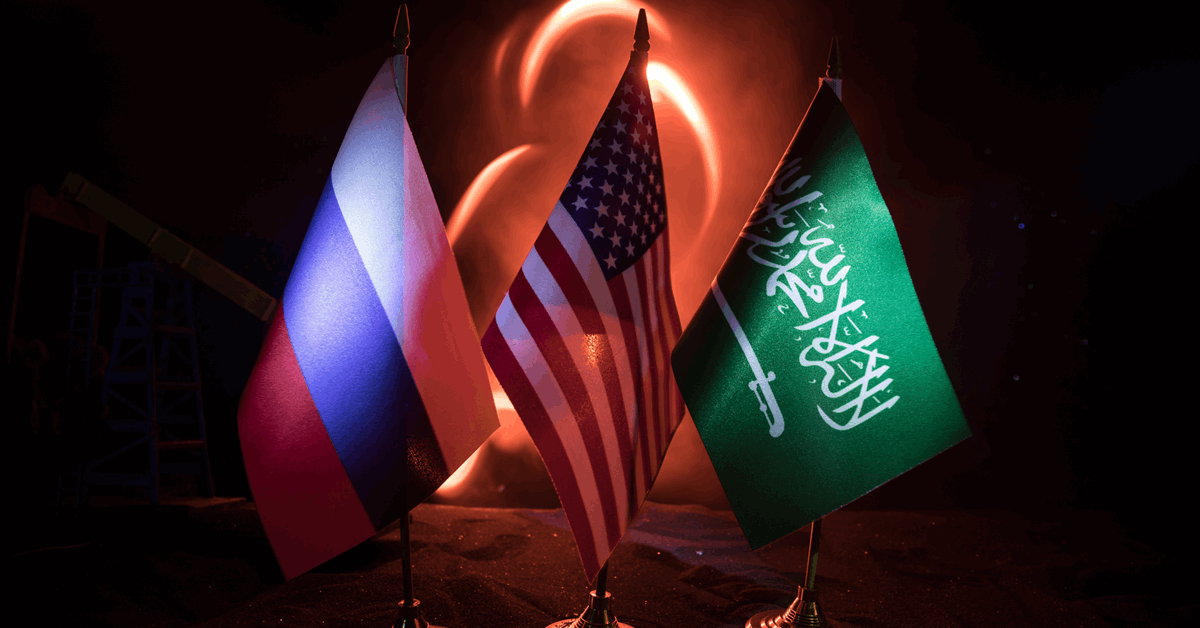

Uncertainties about crude provides from Russia, Kazakhstan and OPEC+ pushed oil costs greater.

West Texas Intermediate edged above $72 a barrel, extending good points to the best closing value in per week. The rally is being pushed by a slew of crude provide issues from throughout the Atlantic and with a key technical degree offering a flooring for losses.

OPEC+ is contemplating pushing again its deliberate output enhance due in April, probably the fourth time it has delayed bringing again manufacturing. Including to the prospect of tighter provides, as a lot as 30% of oil exports from a significant Kazakh pipeline to the Black Sea could also be halted after a Ukrainian drone attacked a pumping station in Russia. The Group of Seven is also contemplating tightening the value cap on Russian crude exports, presumably curbing provides additional.

Even with the latest good points, crude has swung aimlessly in a $5 vary this month, with a gauge of implied volatility declining to the bottom since July. Oil topped $80 earlier this 12 months on chilly climate and tighter sanctions, solely to fall after Trump’s tariff threats rattled markets. The 100-day shifting common at round $71.43 has supported crude costs from declining additional.

“It’s a lifeless market, on the whole, and going nowhere in essentially the most violent manner,” mentioned Scott Shelton, an vitality specialist at TP ICAP Group Plc.

Merchants are additionally monitoring the doable return of a number of hundred thousand barrels a day of Iraqi crude flowing through Kurdistan, however Turkey — residence to the port the provides would finally be shipped from — mentioned it has but to listen to a few restart. Elsewhere, Trump mentioned Chevron Corp.’s potential to proceed exporting crude from Venezuela is beneath overview, underscoring continued tensions that might spill over to vitality.

“Oil’s upside hedging demand is re-emerging,” mentioned Razan Hilal, a market analyst at Foreign exchange.com. “Merchants are positioning for unsure impacts stemming from a mixture of sanctions, tariffs, and geopolitical instability.”

Oil Costs:

- WTI for March supply gained 0.6% to settle at $72.25 a barrel in New York.

- Brent for April settlement rose 0.3% to settle at $76.04 a barrel.

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in an expert neighborhood that may empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg