Oil rose on indicators of a tighter market and rising geopolitical tensions, however held close to the bottom ranges of the yr as deliberate US tariffs continued to weigh on sentiment.

West Texas Intermediate climbed by 1.9% to settle close to $72 a barrel Monday, following the longest weekly shedding streak since September. Russian oil manufacturing final month fell wanting its OPEC+ quota, easing considerations of oversupply, whereas hovering pure gasoline costs in Europe incentivized the burning of oil for energy. Bodily merchants additionally honed in on flaring tensions within the Center East after Israel and Hamas accused one another of violating the phrases of a six-week ceasefire deal.

Crude costs have tumbled 10% since their January excessive, as Trump’s threats to levy imports from Canada, Mexico and China triggered the longest shedding streak since September. Hedge funds have dumped bullish WTI bets for the final two weeks, whereas elevating brief positions to the best in two months.

That “sharp discount in positioning has created room for a rally as many merchants scaled again their publicity,” mentioned Rebecca Babin, senior vitality dealer at CIBC Personal Wealth Group.

The US president flagged extra tariffs Sunday, this time on aluminum and metal, which might apply to all nations. The duties may ripple via the US vitality business, together with amongst oil drillers that depend on specialty metal that’s not made within the nation. Trump didn’t specify when the levies would begin.

Chinese language tariffs on US items had been set to start out Monday in retaliation towards Trump’s levies that took impact final week. Commerce struggle dangers could trigger OPEC+ to as soon as once more lengthen present manufacturing quotas, Morgan Stanley analysts led by Martijn Rats mentioned in notice.

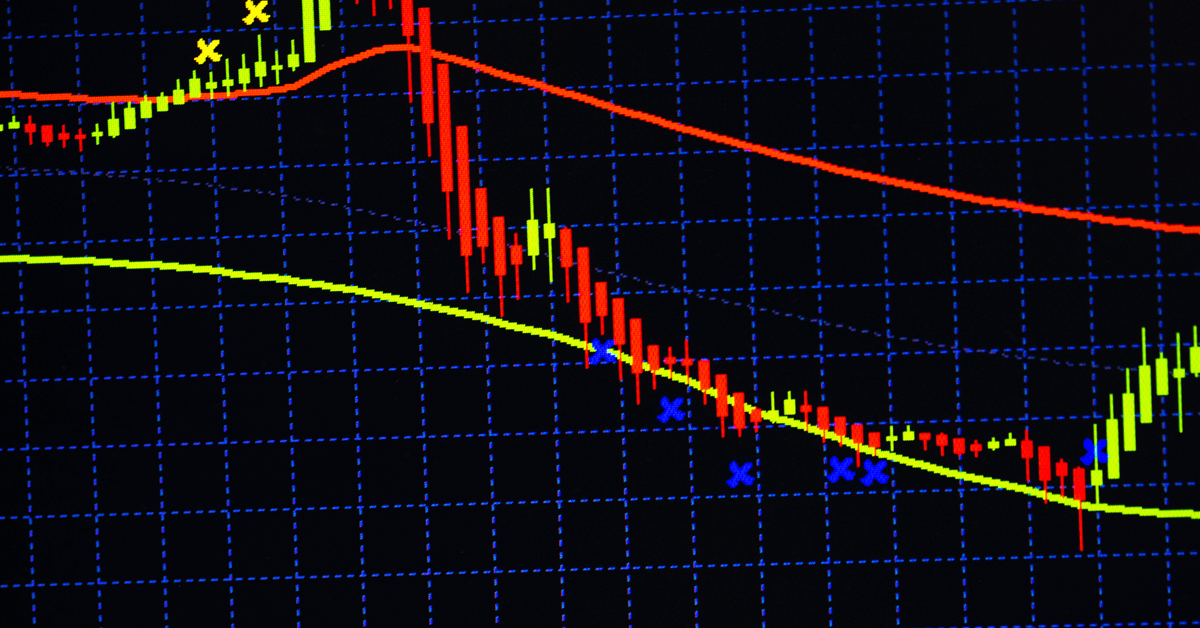

Oil Costs:

- WTI for March supply climbed 1.9% to settle at $72.32 a barrel in New York.

- Brent for April settlement rose 1.6% to settle at $75.87 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share data, join with friends and business insiders and have interaction in an expert neighborhood that may empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg