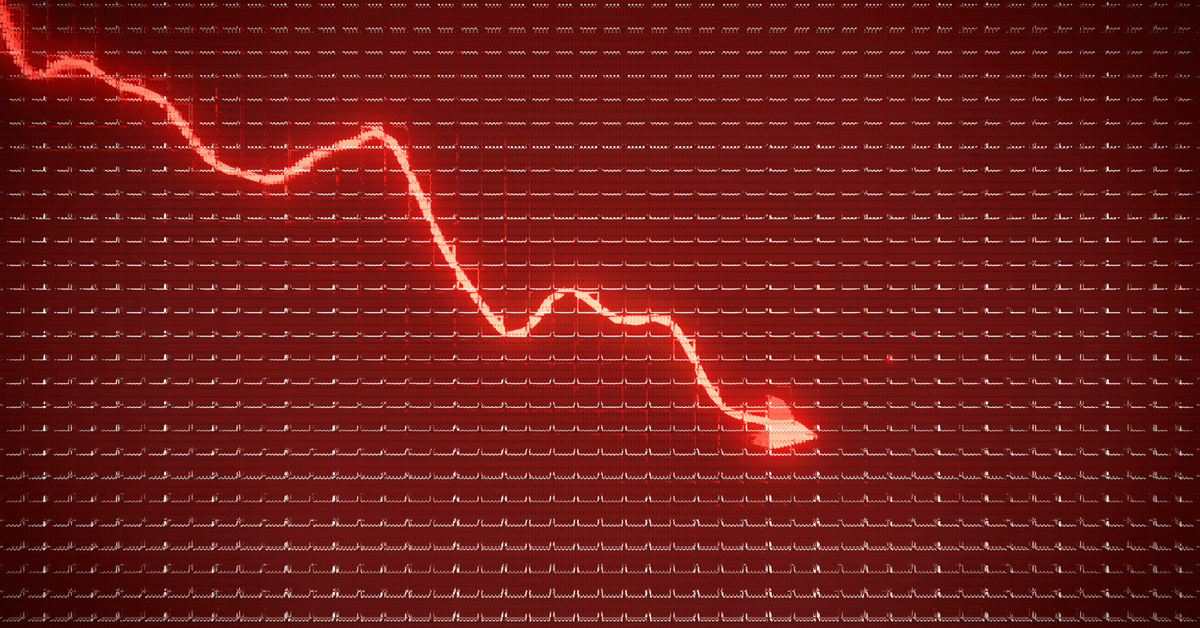

U.S. crude oil on Friday was on tempo for its first weekly loss in three weeks, because the prospect of rising oil provides from Saudi Arabia overshadowed China’s efforts to stimulate its economic system.

The U.S. benchmark West Texas Intermediate is down almost 6% this week, whereas international benchmark Brent has pulled again almost 4%. Costs have fallen at the same time as battle within the Center East escalates, with Israel and Hezbollah buying and selling blows in Lebanon.

“It’s wonderful to see that … struggle would not have an effect on the worth, and that is as a result of there’s been no disruption,” Dan Yergin, vice chairman of S&P International, advised CNBC’s “Squawk Field” on Friday.

“There’s nonetheless over 5 million barrels a day of shut in capability within the Center East,” Yergin stated.

Listed here are Friday’s power costs:

- West Texas Intermediate November contract: $67.51 per barrel, down 16 cents, or 0.24%. Yr so far, U.S. crude oil is down greater than 5%.

- Brent November contract: $71.37 per barrel, off 23 cents, or 0.32%. Yr so far, the worldwide benchmark is down about 7%.

- RBOB Gasoline October contract: $1.9596 per gallon, little modified. Yr so far, gasoline is down about 7%.

- Pure Gasoline November contract: $2.774 per thousand cubic toes, up 0.76%. Yr so far, fuel is up about 10%.

Oil offered off Thursday on a report that Saudi Arabia is dedicated to growing manufacturing later this 12 months, even when it leads to decrease costs for a protracted interval.

OPEC+ not too long ago postponed deliberate output hikes from October to December, however analysts have speculated that the group may delay the hikes once more as a result of oil costs are so low.

The oil sell-off erased beneficial properties from earlier within the week after China unveiled a brand new spherical of financial stimulus measures. Delicate demand in China has been weighing on the oil marketplace for months.

“The factor that is dominated the market is the weak point in China. Half the expansion in world oil demand over quite a lot of years has merely been in China, and it hasn’t been taking place,” Yergin stated.

“The large query is, stimulus, will you see a restoration in China,” he stated. “That is what the market is combating.”