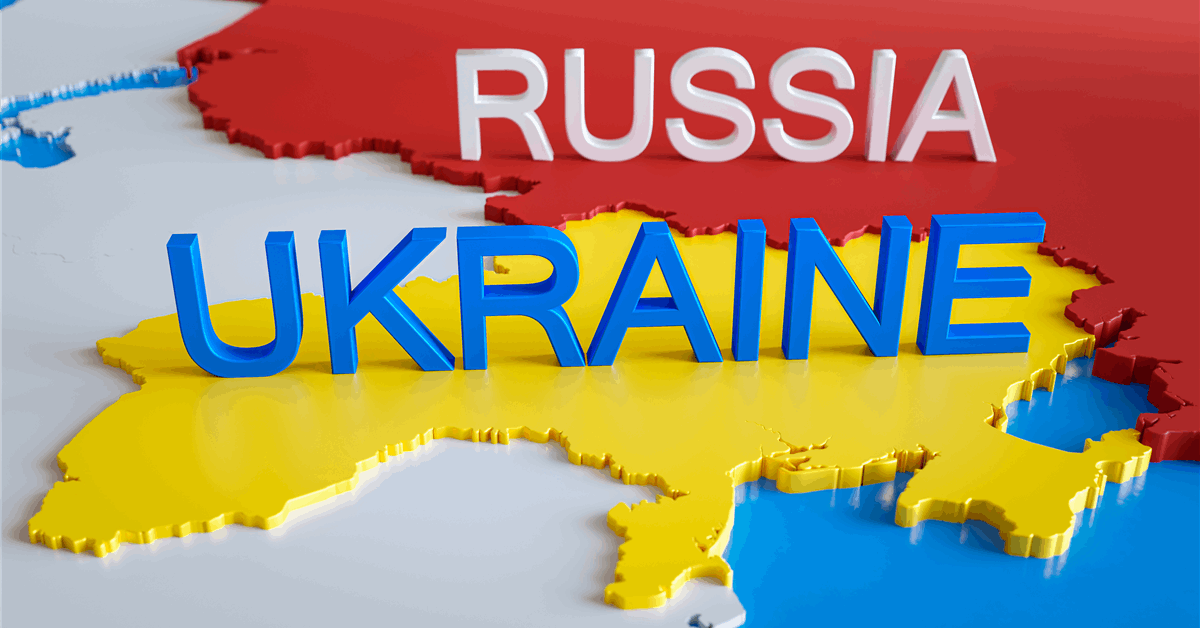

Oil fell after US President Donald Trump mentioned he spoke with Russian President Vladimir Putin, sparking hypothesis that dangers to crude provides within the area might ease.

Trump mentioned the leaders agreed to start talks on ending the battle in Ukraine, reversing three years of US coverage on the battle. West Texas Intermediate slipped 2.7% to settle close to $71 per barrel.

The Ukraine developments deepened earlier declines that have been pushed by higher-than-projected US client worth knowledge, which triggered a short surge within the greenback and made commodities priced within the forex much less interesting.

A ceasefire between Russia and Ukraine throws into query the longevity of US sanctions which are displaying early indicators of hampering Russian crude flows. A number of million barrels from platforms within the Pacific are stranded after the shuttle tankers that hauled them to China have been blacklisted. Nonetheless, the US Power Info Administration mentioned Tuesday that it doesn’t at present count on a big hit to Russian output.

The nascent peace talks suggest that the sanctions “could also be short-lived or have a better likelihood of being rolled again than they did yesterday,” mentioned Rebecca Babin, senior vitality dealer at CIBC Non-public Wealth Group. A whole rollback hasn’t been priced in but, she added.

Oil costs have slumped prior to now three weeks as Trump’s tariffs threaten to spark commerce wars which will weigh on crude demand, and OPEC warned in its outlook on Wednesday that US commerce insurance policies threat stoking additional market volatility. The Worldwide Power Company’s month-to-month report is due on Thursday.

Nationwide US crude inventories rose 4.07 million barrels final week, the third straight acquire, in line with figures launched Wednesday. Futures barely pared losses as the rise was smaller than the 9 million-barrel buildup projected by the American Petroleum Institute.

Underscoring the surroundings of ample provides, WTI’s immediate unfold — the distinction between its two nearest contracts — narrowed to 14 cents a barrel, the weakest since November.

Oil Costs:

- WTI for March supply fell 2.7% to $71.37 a barrel in New York.

- Brent for April supply slid 2.4% to $75.18 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in an expert group that can empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg