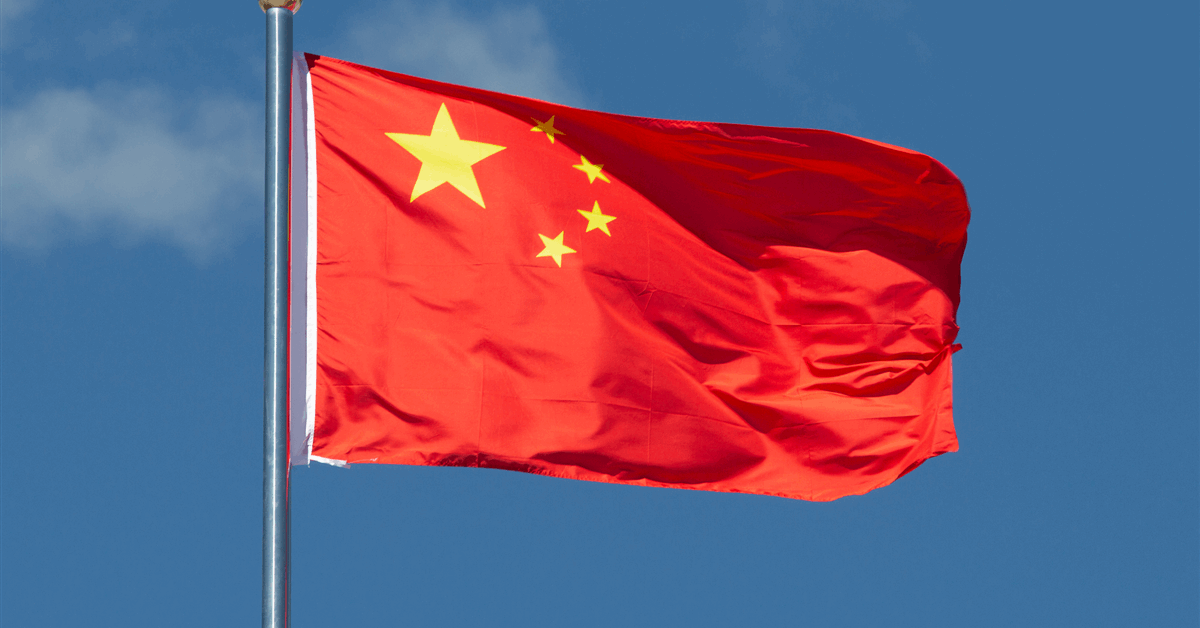

China has purchased some Venezuelan oil that was bought earlier by the US, in line with Power Secretary Chris Wright.

“China has already purchased among the crude that’s been bought by the US authorities,” Wright instructed the media in Caracas, with out giving particulars. “Reputable Chinese language enterprise offers underneath legit enterprise situations” can be nice, he mentioned, when requested about potential joint ventures within the nation.

China’s International Ministry spokesman Lin Jian mentioned he wasn’t conversant in Wright’s feedback when requested at an everyday briefing in Beijing on Thursday.

The international oil market was jolted in January as US forces swooped into Venezuela and seized former President Nicolás Maduro, with Washington asserting management over the OPEC member’s crude trade. Since then, merchants have appeared for alerts about how export patterns might change, and the way output could also be revived after years of neglect, sanctions, and underinvestment.

The South American nation’s so-called “oil quarantine” was primarily over, Wright mentioned on Thursday. Forward of the intervention, the US blockaded the nation’s oil flows with an enormous naval power, and seized a number of vessels.

Refiners in China — the biggest world’s oil importer — have been the most important patrons of Venezuelan crude earlier than the US transfer, with the majority of the imports purchased by personal processors. Given these flows have been sanctioned, they have been usually provided with deep reductions, making them engaging to native customers.

After Maduro’s seizure, President Donald Trump mentioned that Venezuela would flip over 30 million to 50 million barrels of sanctioned oil to the US, in line with a publish on Reality Social. As well as, Wright instructed Fox Information in January that the US wouldn’t reduce China off from accessing Venezuelan crude.

A number of Indian refiners have purchased Venezuela’s flagship Merey-grade crude following the US motion, and the federal government has requested state-owned processors to contemplate shopping for extra Venezuelan and US oil. Exports have additionally made their option to different markets, together with Israel.

Some banks anticipate a revival in Venezuelan output over the medium time period. Manufacturing might hit 2 million barrels a day inside two to a few years, Natasha Kaneva, head of commodities technique at JPMorgan Chase & Co., instructed a Bloomberg Oil Markets Outlook 2026 occasion this week.

In December, Venezuelan provides totaled about 896,000 barrels a day, in line with the Group of the Petroleum Exporting International locations.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will probably be eliminated.