Woodside Vitality Group Ltd has at the moment signed a $1 billion mortgage settlement with the Japan Financial institution for Worldwide Cooperation (JBIC) to fund its Scarborough Vitality Venture.

The settlement follows a memorandum of understanding signed by Woodside and JBIC in November 2022 geared toward securing a secure provide of power for Japan and aiding in reaching its decarbonisation targets, Woodside stated in a information launch.

The mortgage “additional strengthens Woodside’s stability sheet, offering range of funding and liquidity,” the corporate added.

Woodside CEO Meg O’Neill stated the mortgage mirrored the continuing confidence from Japanese traders in Woodside’s Australian liquefied pure gasoline (LNG) tasks. “JBIC has supported all of Woodside’s milestone Australian tasks together with the North West Shelf, Pluto LNG and now Scarborough. It’s subsequently becoming that we’ve executed this settlement in the identical week that Woodside celebrates 35 years of safe and dependable LNG exports to Japan,” she famous.

“Funding in new Australian LNG provide, like Scarborough, can assist Japanese clients meet their power safety wants whereas additionally supporting regional decarbonisation targets,” O’Neill stated.

“This mortgage will contribute towards securing long-term, secure provides of LNG, which is a crucial power useful resource for Japan,” JBIC Deputy Governor Kazuhiko Amakawa stated.

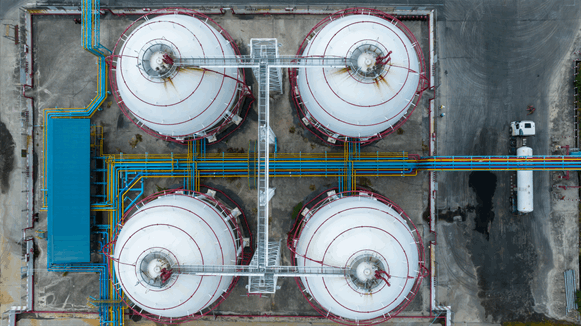

In response to the discharge, the Scarborough Vitality Venture is on schedule for its first LNG cargo in 2026. Work on the Pluto LNG facility is continuing with the continuing arrival and set up of the Pluto Practice 2 modules on website in Karratha, Western Australia. The set up of the subsea infrastructure and the drilling program continues whereas the floating manufacturing unit’s residing quarters have been put in on the topsides, Woodside stated.

In February, Woodside introduced it was promoting a non-operating collaborating curiosity within the Scarborough three way partnership (JV) to JERA Scarborough Pty Ltd, a completely owned subsidiary of Japan’s JERA Co., Inc., for an estimated complete consideration of $1.4 billion.

The overall consideration consists of the acquisition worth of roughly $740 million plus a reimbursement to Woodside for JERA’s share of expenditure incurred from the transaction efficient January 1, 2022. Completion of the transaction is anticipated within the second half.

The completion of the transaction is topic to customary circumstances, together with International Funding Evaluation Board approval, Nationwide Offshore Petroleum Titles Administrator approvals, Western Australian Authorities approvals and satisfaction of the requisite financing approvals, Woodside stated in an earlier assertion.

The Scarborough Vitality Venture contains the Scarborough Joint Enterprise, the Pluto Practice 2 Joint Enterprise and modifications to Pluto Practice 1 to course of Scarborough gasoline. The Scarborough Joint Enterprise consists of the Scarborough area and related offshore and subsea infrastructure.

The Scarborough area is positioned roughly 233 miles (375 kilometers) off the coast of Western Australia and the reservoir incorporates lower than 0.1 % carbon dioxide.

The transaction consists of an choice for JERA to amass a 15.1 % non-operating collaborating curiosity within the Thebe and Jupiter fields, in addition to a non-binding settlement that outlines a long-term collaboration to pursue alternatives for extra feed gasoline and joint funding in offshore gasoline fields for future tieback to the Pluto LNG facility by way of Scarborough infrastructure.

To contact the creator, e-mail rocky.teodoro@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert neighborhood that can empower your profession in power.