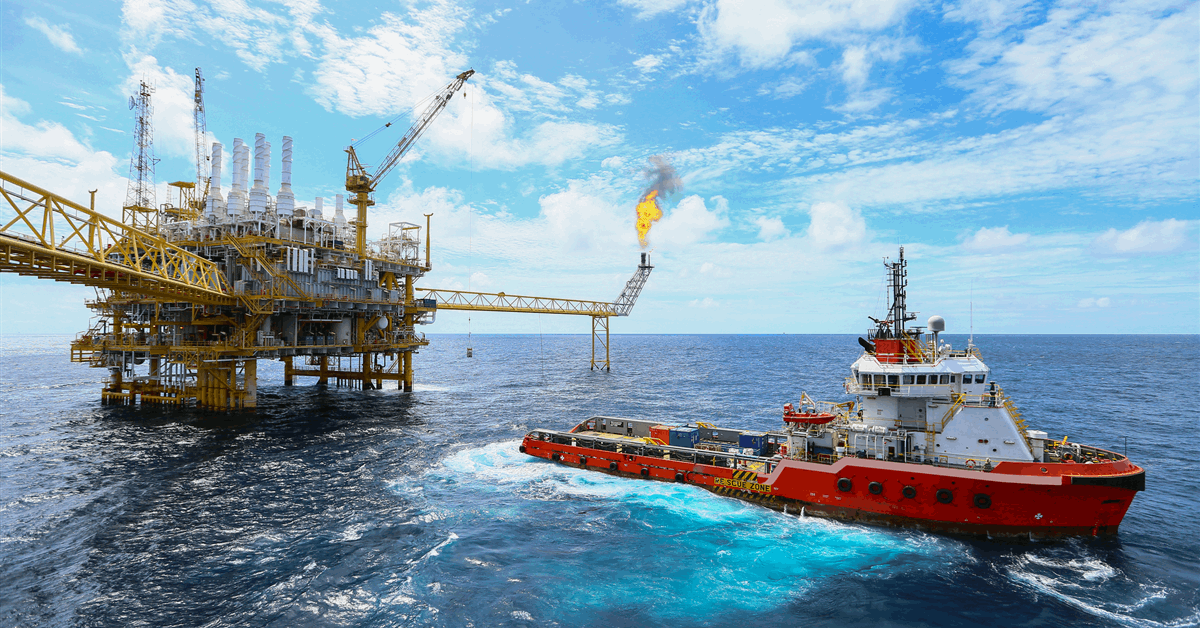

Woodside Power Group Ltd. on Wednesday posted $3.28 billion in income for the second quarter, up eight % from the identical three-month interval final yr as stronger pure gasoline costs offset decrease gasoline volumes.

The Australian firm produced 1.83 billion normal cubic toes a day (Bscfd) and bought 2.05 Bscfd of gasoline within the April-June quarter, each down three % year-on-year.

Liquefied pure gasoline (LNG) gross sales from initiatives at house totaled 20.37 million barrels of oil equal (MMboe), down from 22.28 MMboe in Q2 2024.

The majority of the Australian LNG gross sales got here from Pluto LNG (11.97 MMboe), which posted a 94.9 % reliability. Woodside mentioned it had accomplished the PLA-08 subsea nicely and secured secondary environmental approval for the event of the XNA-03 nicely.

Woodside bought 7.45 MMboe of pipeline gasoline to the home market, up from 6.94 MMboe. Most of those got here from the Bass Strait (3.62 MMboe).

In Trinidad and Tobago, piped gasoline gross sales totaled 2.23 MMboe, up from 1.61 MMboe in Q2 2024.

Within the U.S., Woodside bought 324,000 boe of piped gasoline, down from 336,000 boe in Q2 2024.

Whole liquids manufacturing elevated 46 % year-over-year to 230,000 barrels per day (bpd). Liquids gross sales climbed 50 % to 238,000 bpd.

Australian crude oil and condensate output totaled 4.92 MMboe, up from 4.65 MMboe. Australian pure gasoline liquids (NGL) manufacturing totaled 1.01 MMboe, down from 1.28 MMboe.

Worldwide crude and condensate manufacturing grew from 8.01 MMboe to 14.58 MMboe, due to Senegal’s offshore Sangomar area, which contributed 7.4 million barrels. Worldwide NGL manufacturing elevated from 355,000 boe to 401,000 boe, with the U.S. accounting for 398,000 barrels.

To account for the divestment of its Higher Angostura property in Trinidad and Tobago to Perenco Group, Woodside adjusted its projected full-year manufacturing from 186-196 MMboe to 188-195 MMboe.

Woodside registered common costs of $9.8 per million British thermal models (MMBtu) and $11.4 MMBtu for LNG produced and LNG traded respectively, each up year-on-year.

For pipeline gasoline, Western Australian costs elevated to AUD 6.8 ($4.5) per gigajoule, Australian East Coast costs decreased to AUD 13.4 and worldwide costs elevated to $4.7 per thousand cubic toes.

Woodside oil and condensate declined to $68 a barrel, whereas NGL dropped to $43 a barrel. Liquids traded decreased to $68 a barrel.

“We stay targeted on delivering our Scarborough and Trion initiatives on schedule and funds”, mentioned chief government Meg O’Neill. “In Could, we related the floating manufacturing unit hull and topsides for our Scarborough Power Venture, which is now 86 % full and on observe for first LNG cargo within the second half of 2026.

“Our Trion Venture offshore Mexico is now 35 % full and focusing on first oil in 2028. Building of the floating manufacturing unit is progressing nicely, and we’re making ready for development of the floating storage and offloading vessel to start within the second half of 2025”.

Within the U.S., Woodside mentioned it’s exiting Oklahoma’s H2OK, a liquid hydrogen mission, to assist keep monetary self-discipline.

To contact the creator, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that can empower your profession in vitality.