The power transition would require oil and gasoline for many years to return, however the provide of lower-cost, lower-carbon “advantaged” barrels stay scarce, threatening emissions targets and inflicting upstream suppliers to pivot to new methods, in accordance with new evaluation from Wooden Mackenzie.

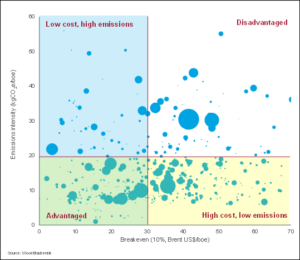

Its evaluation concludes that when it comes to general provide, whole found and potential oil and gasoline assets are greater than double the projected demand in 2050. Nevertheless, actually advantaged assets, with low breakeven (resilience to low costs) and emissions (sustainability in Scope 1 and a pair of phrases) are something however plentiful. Most developed fields have little to supply and solely 28% of the assets in industrial undeveloped fields, roughly 49 billion BOE, are advantaged when it comes to breakeven beneath $30 Brent with emissions depth of lower than 20 kgCO2e/BOE.

“We see sufficient advantaged assets to fulfill solely about half of our base-case oil and gasoline demand forecast to 2050,” stated Andrew Latham, VP Power Analysis for Wooden Mackenzie Upstream. “Even our a lot decrease AET-1.5 demand situation – which lays out what is required to realize probably the most bold targets of the Paris Settlement by conserving emissions inside 1.5 °C of pre-industrial ranges and reaching international internet zero by 2050 – would require some deprived provide.”

Below Wooden Mackenzie’s base Power Transition Outlook (ETO), oil demand peaks in 2030, earlier than declining slowly to 94 million bbls/day in 2050. The AET 1.5 requires 20 million b/d decrease than the ETO by 2035, however will nonetheless be 33 million bbls/day by 2050. Below the ETO situation, gasoline demand will probably be 88 million BOED in 2050, some 12% larger than right this moment. Below the AET-1.5 situation, gasoline demand in 2050 will fall to 59 million BOED.

New exploration, decarbonization applied sciences and biofuels ship some reduction

With few advantaged assets in brownfields and undeveloped fields, exploration might play a key function in finding and growing this provide.

The business found 228 billion BOE in new fields between 2012 and 2021, with a median emissions depth of 16 kgCO2e/BOE, versus the present international common of 23 kgCO2e/BOE (19 kgCO2e/BOE for undeveloped fields). And with a weighted common price of provide in Brent value phrases of simply U$33/bbl.

“We count on high-impact exploration to be an necessary supply of recent useful resource for so long as demand stays at or close to our ETO trajectory. Current outcomes recommend a contribution of round 5-10 billion BOE of recent advantaged barrels a 12 months. Most will probably be discovered inside power tremendous basins. Exploration on this scale over the subsequent twenty years will add oil and gasoline provide of round 10-15 million BOE a day by 2050,” Mr Latham stated.

Decarbonization applied sciences and biofuels might play a good greater function. Bio-based diesel and aviation fuels from plant-based feedstock might emit 80% much less carbon than the crude oil-based merchandise that dominate right this moment’s oil market. Wooden Mackenzie initiatives as much as 20 million bbls/day being doable by 2050.

“That is actually a wake-up name for the business and for the general power transition outlook,” stated Mr Latham. “These are avenues that assist alleviate advantaged provide pressures, however it’s undoubtedly going to be an uphill wrestle.”

A tough highway forward for upstream sector

Whereas these methods could assist, it would grow to be way more tough for corporations to search out and produce the advantaged barrels wanted to fulfill base ETO demand.

Mr Latham stated that it will be very tough for advantaged assets alone to fulfill all ETO oil and gasoline demand: “We’re coming into an fascinating interval within the upstream business. Some corporations will double down and hope for much less competitors within the sector. Nevertheless, many could start or speed up their exit from the sector to pursue low-carbon energies and renewables. If that is so, safety of provide could grow to be threatened, and, sadly, we may even see corporations turning to deprived assets to fulfill demand.”