Will Trump fill Strategic Petroleum Reserves (SPR) ‘proper to the highest’?

That was one of many questions requested in a Q&A format analysis notice by BMI, a unit of Fitch Options, which was despatched to Rigzone not too long ago by the Fitch Group.

Providing a response within the notice, BMI analysts mentioned, “oil storage ranges will rise beneath Trump, however in all probability at a slower tempo than his rhetoric would counsel”.

“There are logistical constraints to contemplate, with the American Petroleum Institute (API) estimating strategic reserves would take at the very least 19 months to replenish,” they added.

The analysts said within the notice that it could even be very expensive.

“The overall capability of the U.S. Strategic Petroleum Reserve is 714 million barrels, 327 million barrels above the extent of oil in storage as of October 2024,” they famous.

“Taking our 2025 annual common forecast for Brent crude, that may price nearly $25 billion, for which Trump would require congressional approval,” they added.

“It will additionally assist to place a flooring beneath Brent, operating counter to Trump’s goal to decrease costs on the pump,” they continued.

The BMI analysts additionally said within the notice that the SPR holds largely medium and heavier grade crudes, which they mentioned are the popular grades for a lot of home refiners. They added that, as the vast majority of U.S. output is now mild or ultra-light, SPR restocking depends on imports.

“The OPEC+ cuts have already tightened the marketplace for medium and heavy crudes, elevating their price, and an SPR shopping for spree may additional distort the market (extra so if compounded by tightening sanctions on Russia and Iran),” the strategists mentioned within the notice.

“Typically, oil markets are usually not overly delicate to SPR-related bulletins, however we may see costs impacted by way of modifications within the fundamentals, if the U.S. immediately inflates demand for particular grades and this then ripples by means of the broader crude complicated,” they added.

“As a aspect notice, it appears to us unlikely that Trump would benefit from the optics of a surge in crude imports within the early phases of his presidency,” the strategists went on to state.

In an opinion piece posted on the Wooden Mackenzie web site final month, Ed Crooks, Wooden Mackenzie’s Americas Vice Chair, mentioned, “filling … [the SPR] utterly would imply including one other 320 million barrels, which, at right now’s value of about $75 a barrel for U.S. crude, would price about $24 billion”.

“With the federal authorities’s funds beneath strain, each the administration and Congress might be able to consider higher issues to do with that cash,” Crooks added within the opinion piece.

Rigzone has requested the Trump transition group, the White Home, the U.S. Division of Power (DOE), Senate Majority Chief John Thune, Speaker of the Home Mike Johnson’s camp, and the American Petroleum Institute (API) for touch upon the BMI analysis notice and Wooden Mackenzie opinion piece. On the time of writing, not one of the above have responded to Rigzone but.

In his inaugural deal with, which was transcribed on the White Home web site on January 20, U.S. President Donald Trump mentioned, “we are going to … fill our strategic reserves up once more proper to the highest”.

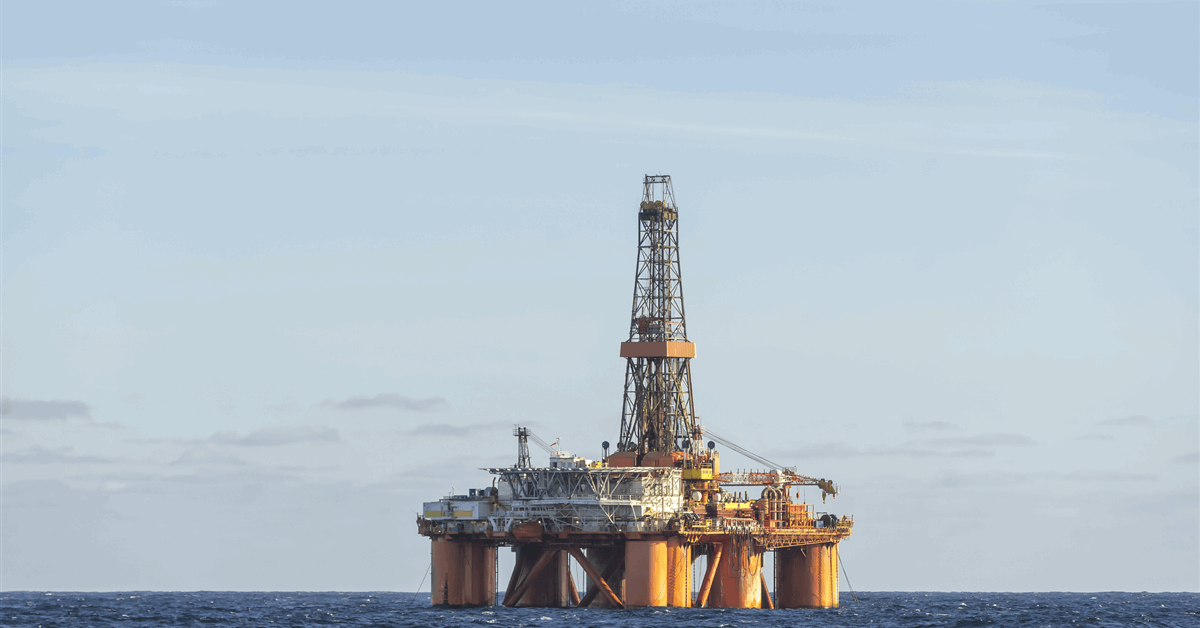

The SPR is described on the U.S. DOE web site because the world’s largest provide of emergency crude oil. The location highlights that it was established “primarily to scale back the affect of disruptions in provides of petroleum merchandise and to hold out obligations of the US beneath the worldwide power program”.

“The federally owned oil shares are saved in large underground salt caverns at 4 websites alongside the shoreline of the Gulf of Mexico,” the DOE website notes.

To contact the creator, e-mail andreas.exarheas@rigzone.com