Var Energi ASA, Norway’s third-biggest oil and fuel firm, sees oil’s provide and demand outlook stabilizing subsequent yr, with costs not dropping considerably beneath $60 a barrel.

“We might even see a brief interval of oversupply, however I feel while you look into subsequent yr, you see that supply-demand steadiness coming again into line,” Chief Govt Officer Nick Walker informed reporters on Tuesday. “Oil goes to be required for a very long time, and the trade has not been investing sufficient.”

Trade watchers, together with the Paris-based Worldwide Power Company, have been predicting a flood of provides for greater than a yr. Further barrels from the Group of the Petroleum Exporting Nations and its allies, in addition to nations outdoors the group, are seen overwhelming cooling demand development. Futures are heading for a third month-to-month loss and prime merchants are braced for an additional slide.

Decrease oil costs will cut back investments and ultimately gradual output, Walker stated, including that “there appears to be a flooring of about $60, it doesn’t go beneath that whatever the volumes coming in.”

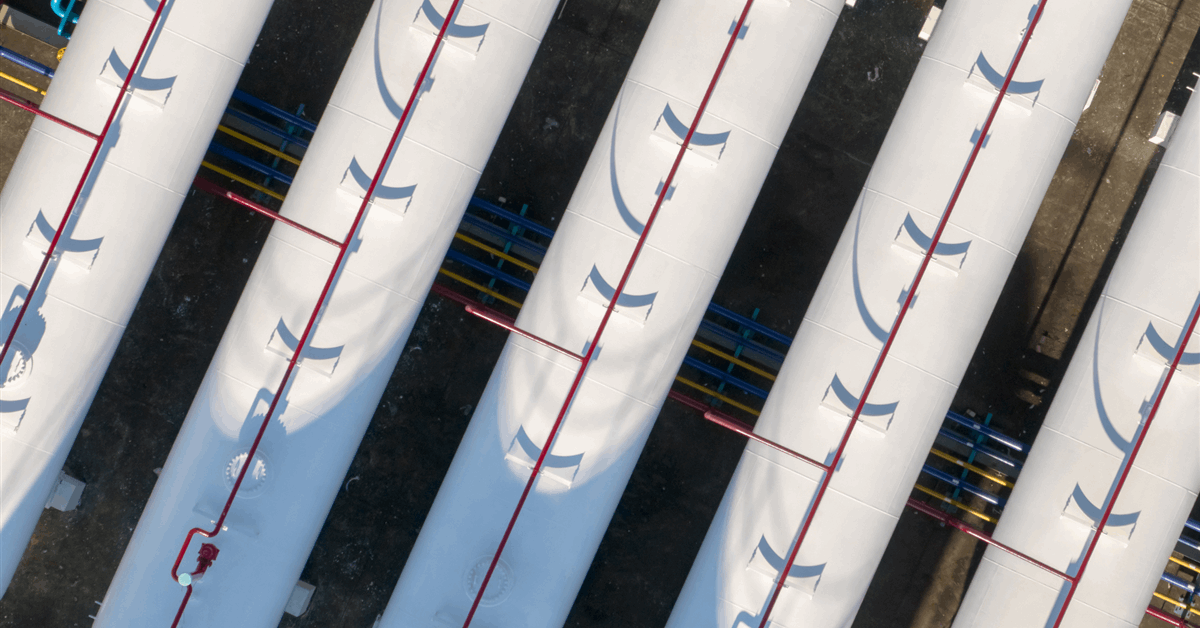

Var Energi has seen a number of fields come on-line this yr, together with Johan Castberg within the Barents Sea and the startup of Balder X in June. Output from each fields will contribute to manufacturing rising to about 430,000 barrels of oil equal a day within the fourth quarter. To take care of barrels by means of the tip of the last decade, the corporate will sanction a complete of ten new initiatives by yr’s finish, Walker stated, with 4 already authorised at break-evens of beneath $35 a barrel.

The oil and fuel firm’s earnings earlier than curiosity and tax climbed to $1.07 billion within the third quarter, beating analyst estimates. Var Energi plans to pay out $1.2 billion in dividends this yr and in 2026.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback will probably be eliminated.