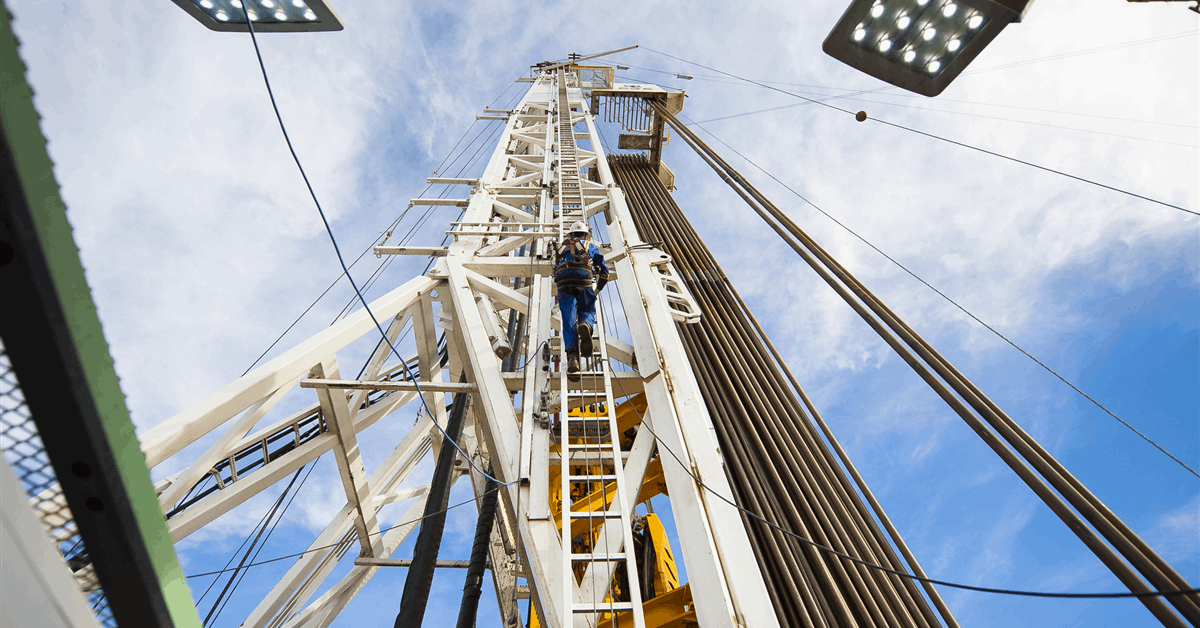

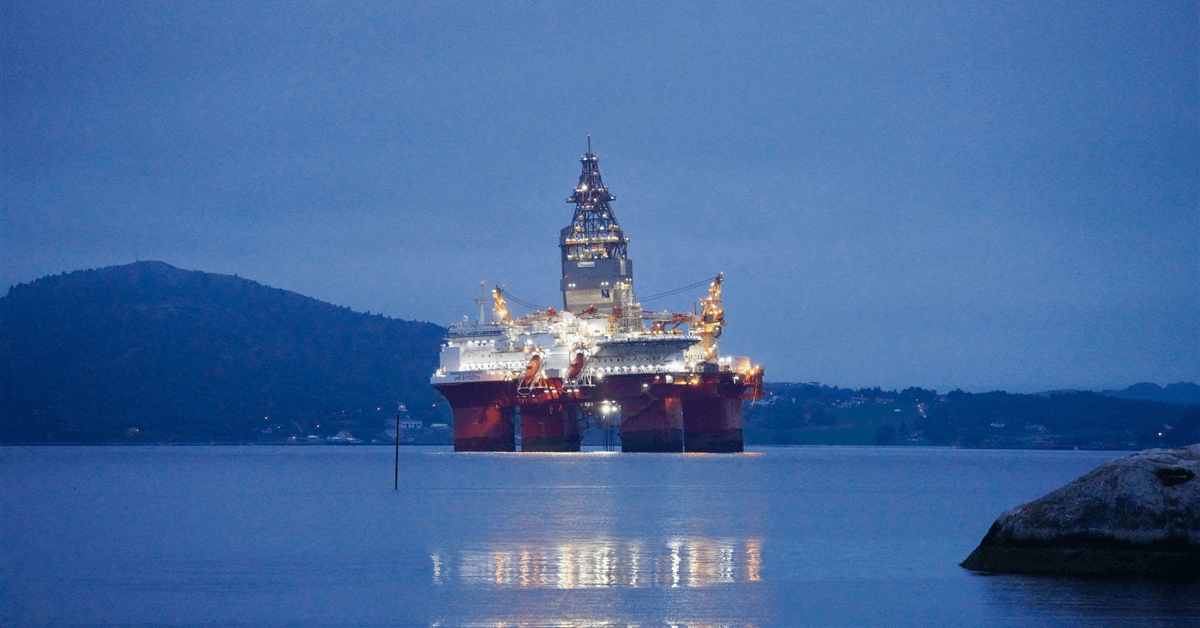

Norwegian oil firm Var Energi ASA plans to green-light a swath of recent initiatives to keep up output from an ageing basin into the following decade.

Chief Govt Officer Nick Walker mentioned he desires to offer the go-ahead to twenty initiatives “over the following few years,” focusing on output of 350,000 to 400,000 barrels of oil equal a day by way of 2030 and past.

Norway, which gives about 15 % of Europe’s crude, sees itself as a strategic provider because the area pivots from Russia. Producers are spending billions to squeeze extra oil from the nation’s continental shelf, the place output peaked within the early 2000s. They’re more and more focusing on barrels that may shortly be tied into current infrastructure to sluggish the speed of decline.

“What we’re going to have the ability to present is that we are able to maintain increased manufacturing for longer,” Walker mentioned on a convention name. The oil and fuel firm, Norway’s third-biggest, has earmarked about $15 billion over the following 5 to 6 years to take action.

The 20 new initiatives would come on prime of 10 it has sanctioned this yr. Future developments are “all tiebacks into current infrastructure,” which helps drive down working bills and capital spending, Walker mentioned.

Maintaining prices in examine is essential, since oil costs have slumped 20 % this yr to round $60 a barrel. There’s little hope of a revival subsequent yr, with international provide forecast to exceed demand by a document margin. But Var Energi and others are betting that, with the vitality transition bumpy and local weather commitments faltering in a number of international locations, crude oil might be wanted for many years to come back.

“We’re clearly in a lower cost atmosphere and a lower cost cycle,” and “that is prone to lengthen for not less than part of subsequent yr,” Walker mentioned. Falling costs will sluggish capital spending in some elements of the world, notably in North America, however “$60 is just not sustainable long-term, and I feel we are going to see costs arising.”

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share information, join with friends and business insiders and interact in an expert neighborhood that can empower your profession in vitality.