Vallourec mentioned it has been awarded a “main” contract by Petroleo Brasileiro S.A. (Petrobras) in a bidding course of for the provision of oil nation tubular items (OCTG) services for its offshore operations from 2026 to 2029.

The long-term settlement has the potential to generate complete income of as much as $1 billion, “representing the widest award each in volumes and revenues since Petrobras adopted the open tender technique,” Vallourec mentioned in a information launch.

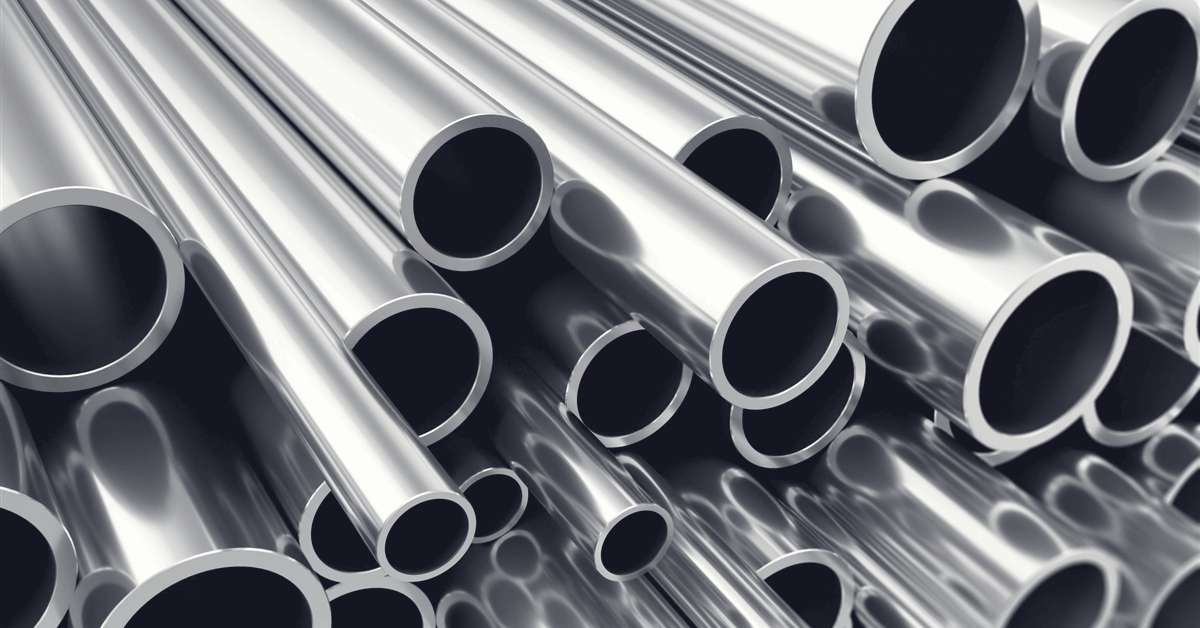

The contract covers the complete OCTG scope of provide for seamless pipes and VAM premium connections required for Petrobras’ offshore wells from 4.5 inches as much as 18 inches, together with carbon and stainless-steel tubulars and related equipment, in line with the discharge.

Underneath the contract, Vallourec mentioned it is going to additionally ship complete value-add companies each onshore and offshore, from desk engineering and materials coordination to rig preparation, offshore supervision, rig return repairs, and re-stocking, “to assist Petrobras in optimizing operational effectivity”.

Vallourec Chairman and CEO Philippe Guillemot mentioned, “This achievement is a strong demonstration of Vallourec’s capability to satisfy clients’ advanced and evolving necessities. It confirms the energy and consistency of our positioning, constructed on technical excellence, an built-in industrial presence in Brazil, and a long-standing partnership with Petrobras based mostly on mutual belief. I want to thank Petrobras for its renewed belief and all Vallourec groups whose dedication and experience made this success potential”.

Second-Quarter Outcomes

Within the second quarter, Vallourec reported revenues of $1.01 billion (EUR 863 million), down 20 % 12 months over 12 months or 15 % at fixed trade charges. The year-over-year comparability is partially attributed to the big quantity of high-value merchandise invoiced within the previous-year quarter that didn’t recur, the corporate mentioned in its most up-to-date earnings launch.

Vallourec reported earnings of $0.19 (EUR 0.16) per diluted share, in contrast with $0.54 (EUR 0.46) within the previous-year quarter, reflecting a rise in peculiar shares as a result of vesting of shares beneath administration incentive plans and a rise in probably dilutive shares associated to the corporate’s excellent warrants.

Income for the corporate’s Tubes section have been down 26 % 12 months over 12 months as a consequence of an 11 % discount in common promoting worth and a 17 % quantity lower pushed primarily by decrease shipments within the Jap Hemisphere, in line with the discharge. Vallourec mentioned it additionally invoiced a big quantity of high-value merchandise that didn’t recur within the second quarter.

Guillemot mentioned, “Within the second quarter, Vallourec as soon as once more demonstrated the energy of its enterprise mannequin. Regardless of decrease shipments within the Jap Hemisphere, our Tubes EBITDA [earnings before income tax, depreciation, and amortization] margin expanded to 19 %, pushed by sequential enhancements in profitability in our North and South American manufacturing hubs. Our Mine & Forest enterprise additionally continued to carry out extraordinarily properly regardless of sequentially decrease iron ore market costs. Additional, we continued our streak of optimistic complete money technology, which now marks eleven straight quarters of this efficiency”.

“The worldwide OCTG market has been impacted by latest macroeconomic volatility; nevertheless, our stream of latest contract awards highlights the worth of Vallourec’s premium product providing. We proceed to see additional alternatives forward as our resilient buyer base is progressing on main multi-year drilling applications which would require the assist of refined suppliers like Vallourec. The worldwide shift in the direction of elevated gasoline and unconventional drilling may also present important alternatives for Vallourec to capitalize on its differentiated premium market positioning,” Guillermot continued.

“Within the US, market costs additional improved over the second quarter in response to the metal tariffs carried out earlier this 12 months. US oil drilling exercise has fallen in response to weaker and extremely unstable oil costs, although this has been partially offset by a rebound in gasoline drilling exercise. Regardless of this, our newest bookings point out a wholesome degree of demand that may hold our mills properly utilized at present staffing ranges. In the meantime, imports will doubtless reasonable from their second quarter ranges following the change in tariff charges introduced in early June. This could assist US-based industrial gamers similar to Vallourec,” he concluded.

To contact the writer, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.