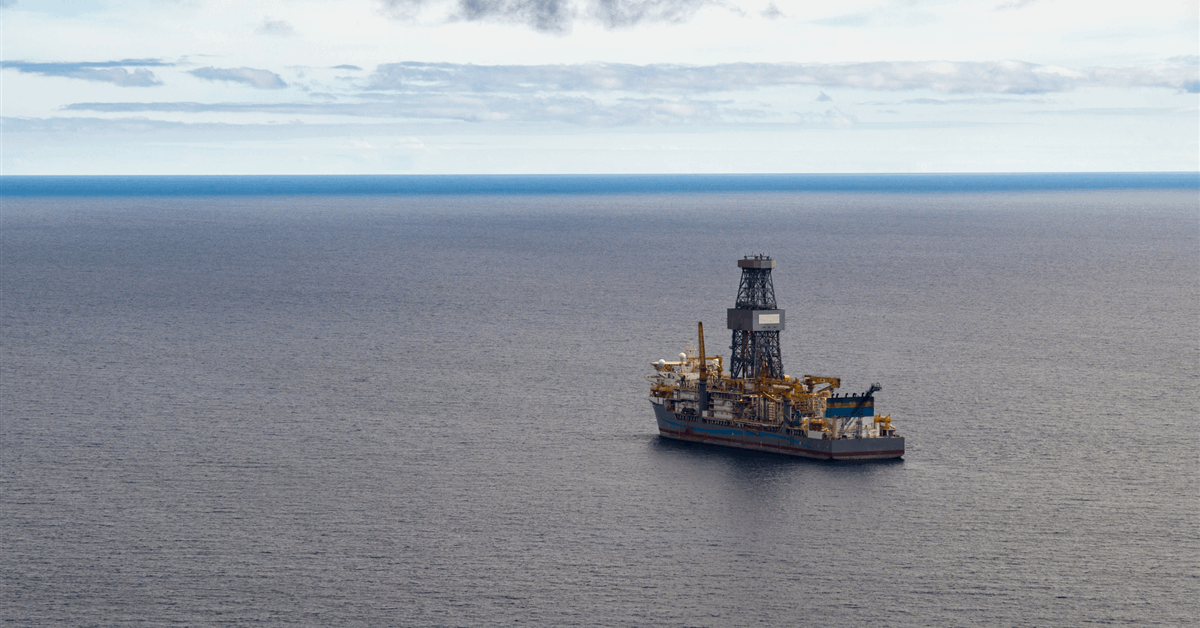

Valaris Ltd on Thursday reported $537.4 million in income for the fourth quarter of 2025, down 10 p.c from the prior three-month interval partly as a consequence of idle time for some rigs.

Whereas This autumn web revenue rose 281 p.c quarter-on-quarter to $717.5 million, the rise was as a consequence of a tax good thing about $680 million, the Hamilton, Bermuda-based drilling contractor stated in a web-based assertion.

EBITDA adjusted for extraordinary or nonrecurring gadgets dropped 41 p.c sequentially to $97 million.

Income from floaters excluding reimbursable gadgets decreased to $255.4 million from $293 million for Q3 “primarily as a consequence of drillships Valaris DS-15 and DS-18 finishing contracts mid-third quarter with out rapid follow-on work and semisubmersibles Valaris MS-1 and DPS-1 finishing contracts mid-fourth quarter”, Valaris stated. “Each drillships are scheduled to start new contracts within the second half of 2026, whereas each semisubmersibles have been mobilized to Malaysia and are at present stacked”.

Floater contract bills climbed on “increased restore prices related to deliberate upkeep tasks, a rise in accruals associated to sure claims and better mobilization bills for Valaris DPS-1 and MS-1 given their mobilization to Malaysia”, Valaris stated.

Income from jackups excluding reimbursable gadgets fell to $208.8 million from $216.7 million for Q3 primarily because of the sale of Valaris 247 to BW Power.

Income excluding reimbursable gadgets from ARO Drilling, which Valaris equally co-owns with Saudi Arabian Oil Co, fell to $140 million from $157 million “primarily as a consequence of extra out of service time associated to deliberate shipyard tasks for Valaris 116 and 250”, Valaris stated. Contract bills decreased as a consequence of decrease bareboat constitution bills.

The corporate’s complete working earnings fell 70 p.c quarter-on-quarter to $39.4 million.

On the finish of the yr, backlog stood at round $4.7 billion. “Since our final quarterly report, we secured practically $900 million of further backlog, additional strengthening our strong contract protection throughout 2026 and 2027”, stated president and chief government Anton Dibowitz.

“After addressing the white house on our open drillship capability earlier this yr, we lately introduced contract awards for Valaris DS-7 and DS-9, and we anticipate all 10 of our energetic drillships to be working as we enter 2027, which was a key goal for us”.

Earlier Valaris signed a definitive settlement underneath which it could be acquired by Transocean Ltd in an all-stock transaction of round $5.8-billion. The events anticipate the enlarged Transocean, which might be 47 p.c owned by Valaris, to have an offshore fleet of 73 rigs consisting of 33 ultra-deepwater drillships, 9 semisubmersibles and 31 trendy jackups, in keeping with a joint assertion February 9.

Valaris ended 2025 with $1.23 billion in present property together with $599.4 million in money and money equivalents. Present liabilities totaled $691.6 million.

“We imagine the outlook for the offshore drilling trade stays constructive, with prospects persevering with to emphasise the necessity for sustained upstream funding to assist guarantee safe, dependable and reasonably priced power provide”, Dibowitz stated.

To contact the writer, electronic mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in an expert group that may empower your profession in power.