In a market replace despatched to Rigzone late Wednesday, Rystad Vitality outlined that the January U.S. labor market report “shock[d]… to the upside, underpinning power demand”.

Rystad famous within the report that the newest U.S. jobs information “reveals promise, with the unemployment charge falling by 4.3 p.c, pointing to market stability”.

“Non-farm payrolls elevated by 130,000 jobs in January, whereas the rise for December was downwardly revised to 48,000,” it identified, including that the unemployment charge in December was 4.4 p.c.

“The newest information compares with consensus expectations of job beneficial properties of round 70,000 and the unemployment charge holding regular at 4.4 p.c,” Rystad stated.

Within the replace, Rystad Vitality Chief Economist Claudio Galimberti famous that payroll progress exceeded expectations and that unemployment edged decrease.

“Following a sequence of weaker personal indicators, the info suggests stabilization slightly than sturdy acceleration,” Galimberti stated.

“Markets that had positioned for a speedy easing cycle responded by repricing yields increased and scaling again expectations for near-term charge cuts,” he added.

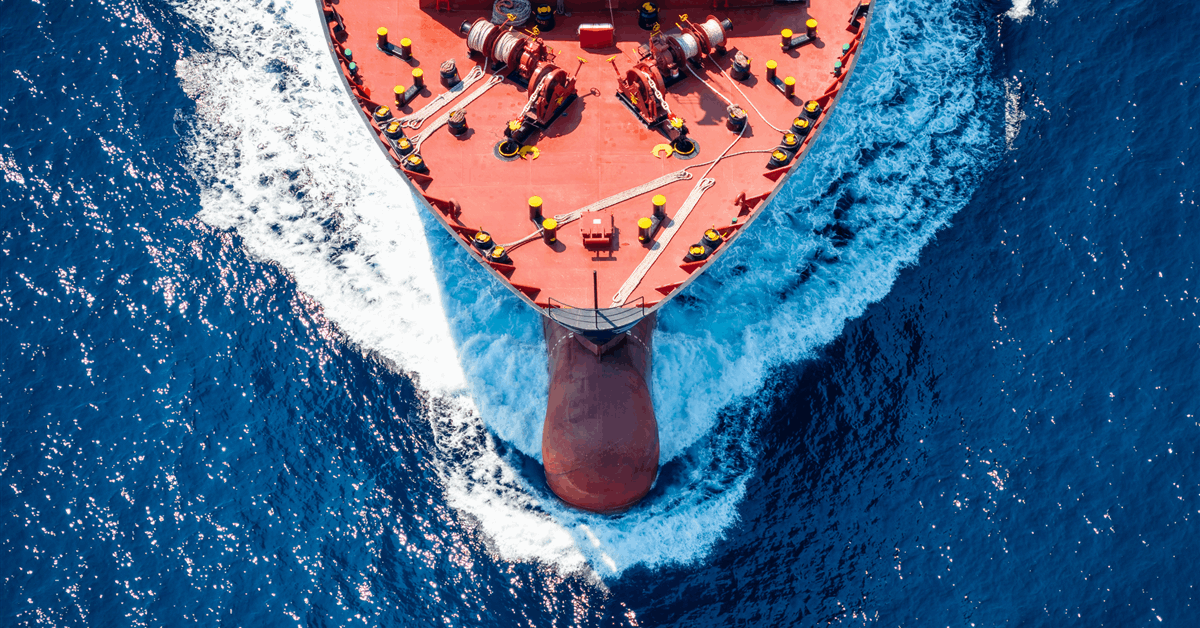

“For power markets, the implications are reasonably supportive. A resilient labor market underpins demand for transport fuels, petrochemicals and energy technology, decreasing draw back dangers to U.S. consumption at a time when macro sentiment had turned cautious,” he continued.

“Whereas the U.S. isn’t the first driver of incremental world oil demand, labor market stability reinforces the view that the demand image is firming up,” he went on to state.

Galimberti famous within the replace that “revisions to prior information verify that the cycle is mature, not accelerating”.

“Nonetheless, in a market already balancing OPEC+ provide administration in opposition to geopolitical threat, a firmer U.S. macro sign marginally strengthens the demand outlook,” he stated.

“The result’s a modestly constructive backdrop for oil costs within the close to time period, with out materially shifting the basics,” Galimberti concluded.

In a Skandinaviska Enskilda Banken AB (SEB) report despatched to Rigzone on Thursday, SEB Commodities Analyst Ole R. Hvalbye highlighted that Brent crude “continues to hover across the $70 per barrel mark, at the moment buying and selling barely under yesterday’s intraday excessive of $70.7 per barrel”.

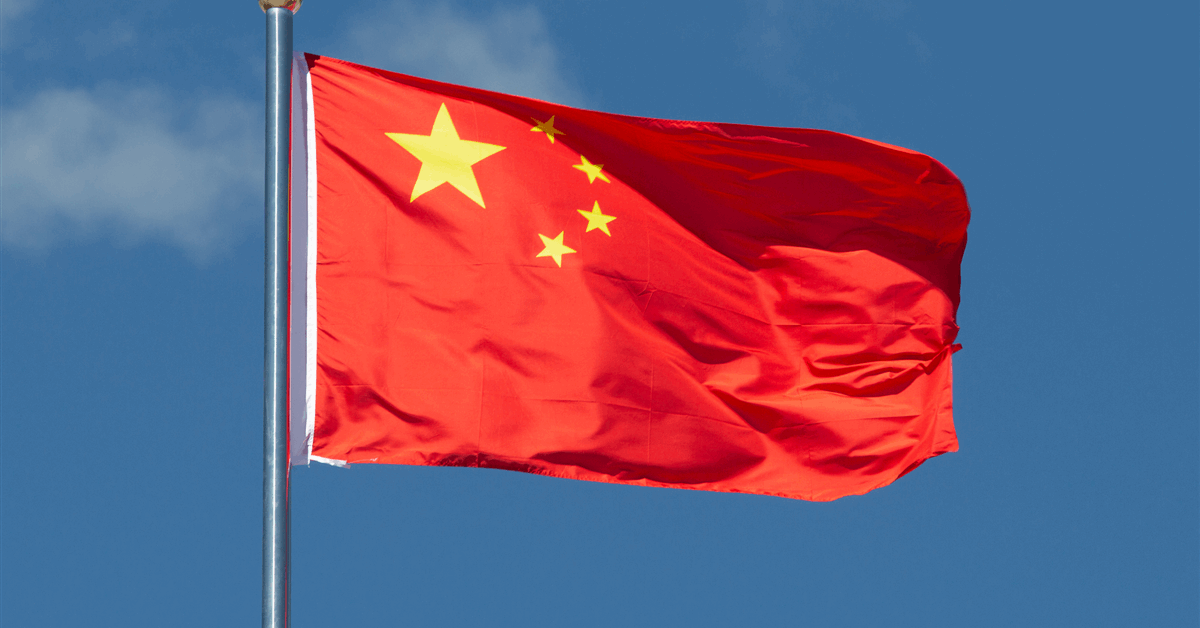

“The late session decline yesterday was largely triggered by Trump’s assembly with PM Netanyahu, the place he signaled a choice for a negotiated resolution with Iran slightly than quick escalation,” Hvalbye stated within the report.

“Nothing concrete was agreed, however that was sufficient for the market to trim among the geopolitical threat premium,” he added.

Hvalbye went on to state within the report that the market “is now naturally ready for the subsequent spherical of U.S.-Iran dialogue”.

“Either side are nonetheless publicly agency on their very own final result, however the truth that talks stay alive is sufficient to forestall any additional spike costs right here and now,” he stated.

In its newest quick time period power outlook (STEO), which was launched on February 10, the U.S. Vitality Info Administration (EIA) projected that the typical Brent spot value will drop in 2026.

Based on this STEO, the EIA sees the Brent spot value coming in at $57.69 per barrel this 12 months. The Brent spot value averaged $69.04 per barrel in 2025, the STEO confirmed.

A quarterly breakdown included within the EIA’s newest STEO confirmed that the group expects the Brent spot value to return in at $64.44 per barrel within the first quarter of this 12 months, $57.32 per barrel within the second quarter, $55.35 per barrel within the third quarter, $54.00 per barrel within the fourth quarter.

Within the STEO, the EIA highlighted that the Brent crude oil spot value averaged $67 per barrel in January, which it identified was $4 per barrel increased than the typical in December. The EIA famous that day by day Brent crude oil costs elevated from a mean of $62 per barrel on January 2 to $72 per barrel on January 30.

To contact the creator, e mail andreas.exarheas@rigzone.com