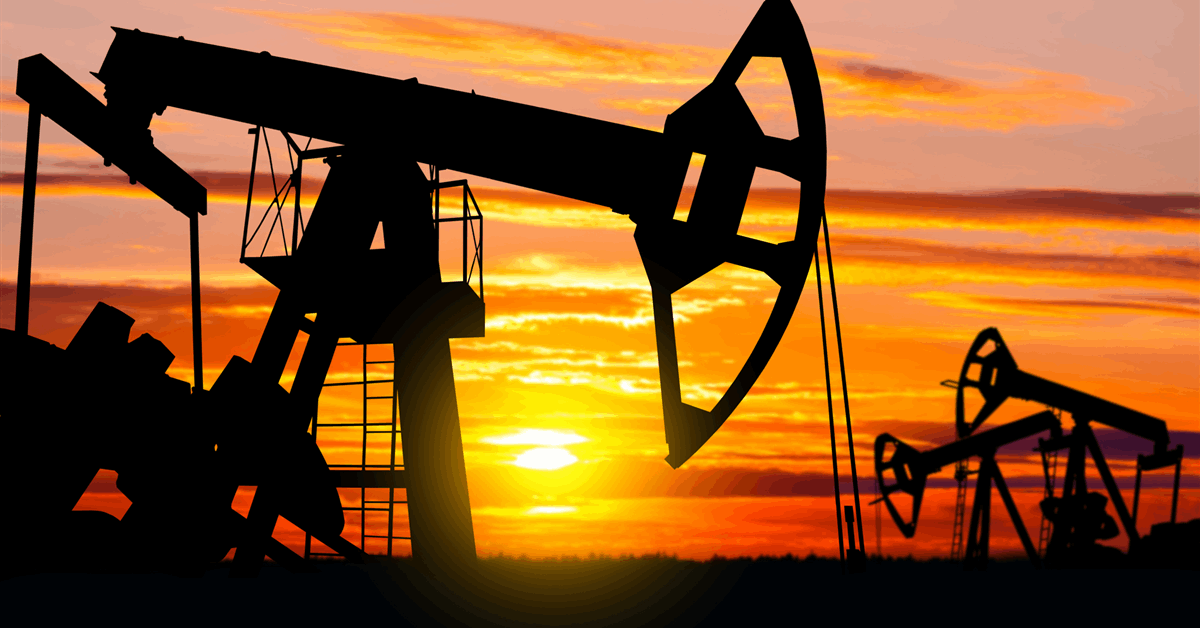

The U.S. Vitality Data Administration (EIA) reduce its Brent spot value forecast for 2025 and 2026 in its newest quick time period power outlook (STEO), which was launched on April 10.

Based on its April STEO, the EIA now sees the Brent spot value averaging $67.87 per barrel in 2025 and $61.48 per barrel in 2026. In its earlier STEO, which was launched in March, the EIA projected that the Brent spot value would common $74.22 per barrel this 12 months and $68.47 per barrel subsequent 12 months.

In its newest STEO, the EIA forecast that the Brent spot value will are available at $66.33 per barrel within the second quarter of 2025, $65.67 per barrel within the third quarter, $64 per barrel within the fourth quarter, $63 per barrel within the first quarter of subsequent 12 months, $62 per barrel within the second quarter, $61 per barrel within the third quarter, and $60 per barrel within the fourth quarter.

In its March STEO, the EIA projected that the Brent spot value would common $74 per barrel within the second quarter of this 12 months, $75 per barrel within the third quarter, $73.02 per barrel within the fourth quarter, $71 per barrel within the first quarter of 2026, $69 per barrel within the second quarter, $68 per barrel within the third quarter, and $66 per barrel within the fourth quarter of subsequent 12 months.

“Crude oil costs fell sharply within the first week of April as oil market individuals assessed bulletins that the USA would impose new tariffs and OPEC+ would speed up manufacturing will increase,” the EIA stated in its newest STEO.

“These bulletins improve the chance that international oil inventories will rise within the coming month and have the potential to place additional downward stress on oil costs,” the EIA added.

“Consequently, now we have lowered our Brent crude oil spot value forecast by $6 per barrel in 2025 and by $7 per barrel in 2026 in contrast with our March STEO,” it highlighted.

In its April STEO, the EIA stated it anticipates that international oil inventories will begin to improve within the second quarter of 2025.

“Inventories start constructing ahead of beforehand anticipated, principally as a result of we raised our expectation of OPEC+ manufacturing within the coming quarters and lowered our expectation of oil demand development,” it stated within the outlook.

“We count on international oil inventories will improve by 0.6 million barrels per day in 2Q25 and by 0.7 million barrels per day on common within the second half of 2025, and inventories will proceed to build up at that tempo in 2026,” it added.

“Given our expectation of great will increase in oil inventories starting in 2H25, we forecast that the Brent crude oil value will typically decline all through the forecast interval,” it continued.

“As international oil inventories rise, we count on the Brent crude oil value will fall from a mean of $76 per barrel in 1Q25 to a mean of $64 per barrel by 4Q25 and can common $61 per barrel general subsequent 12 months,” it went on to state.

In its April STEO, the EIA said that vital uncertainty stays in its value forecast.

“The impact that new or further tariffs may have on international financial exercise and related oil demand remains to be extremely unsure and will weigh closely on oil costs going ahead,” it warned.

The EIA highlighted in its newest STEO that it accomplished modeling and evaluation for its April report on April 7, highlighting that more moderen coverage adjustments are usually not included.

Rigzone has contacted the White Home and OPEC for touch upon the EIA’s newest STEO. On the time of writing, neither have responded to Rigzone.

A Commonplace Chartered Financial institution report despatched to Rigzone by Commonplace Chartered Financial institution Commodities Analysis Head Paul Horsnell on April 8 confirmed that Commonplace Chartered expects the ICE Brent close by future crude oil value to common $77 per barrel in 2025 and $85 per barrel in 2026.

Commonplace Chartered Financial institution sees the commodity averaging $73 per barrel within the second quarter of this 12 months, $77 per barrel within the third quarter, and $82 per barrel within the fourth quarter, based on the report.

A BMI report despatched to Rigzone by the Fitch Group on Monday morning confirmed that BMI expects the Brent crude value to common $68 per barrel in 2025 and $71 per barrel in 2026.

To contact the creator, e-mail andreas.exarheas@rigzone.com