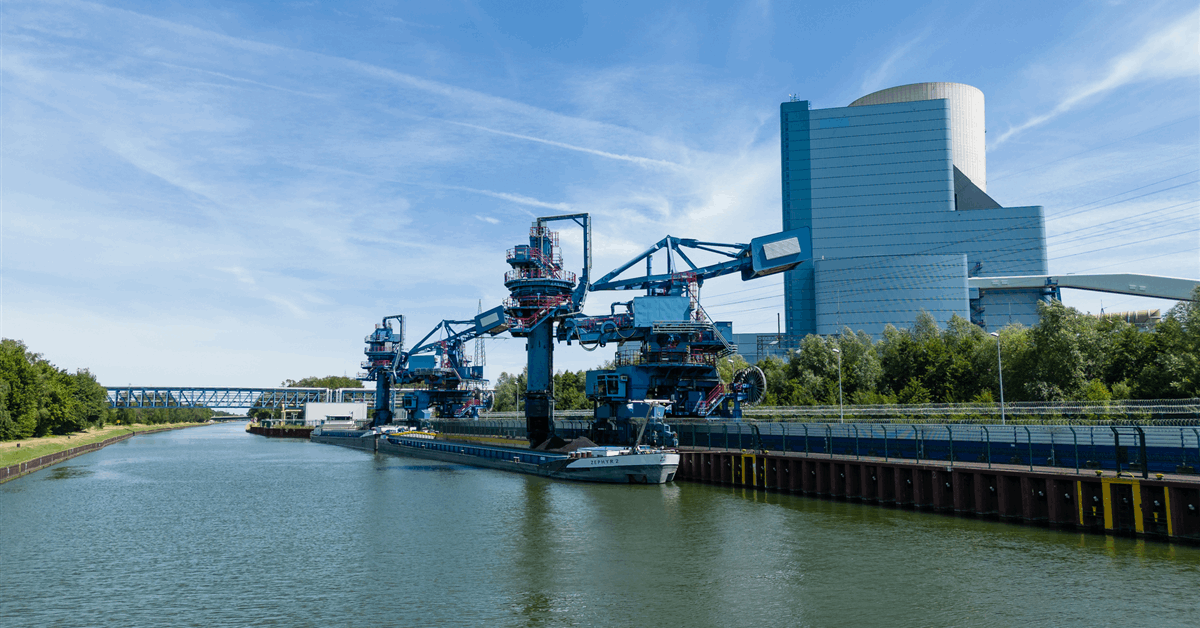

Uniper SE stated Monday it had consummated the divestment of the Datteln 4 coal-run energy plant in North Rhine-Westphalia to ResInvest Group.

The plant is among the many property it has agreed to promote to fulfill fair-competition guardrails imposed by the European Fee in approving Uniper’s bailout by the German authorities in late 2022.

Commissioned 2020, the Datteln plant has a web output of 1,052 megawatts (MW). It provides electrical energy and district heating to households, in addition to traction energy to rail operator Deutsche Bahn, in keeping with German energy and fuel utility Uniper.

In accordance with its announcement of the sale settlement September 19, the over 100 workers on the website have been to switch to Czechia’s ResInvest.

The events agreed to not disclose the acquisition value, Uniper stated then.

On November 3 Uniper stated that as a part of the bailout-related divestment package deal, it had accomplished the sale of Uniper Waerme GmbH, a district heating community serving over 14,400 clients in Germany’s Ruhr space, to Steag Iqony Group’s Iqony Fernwaerme GmbH.

Waerme has a community of over 750 kilometers (466.03 miles), in keeping with Uniper. Waerme “is an skilled within the environment friendly use of warmth that’s generated throughout electrical energy manufacturing in mixed warmth and energy crops”, Uniper stated in a press launch. “As well as, they use a wide range of different environmentally pleasant options for warmth technology. This contains warmth from mine fuel, waste warmth from industrial processes and warmth generated in electrical boilers and smaller decentralized CHP crops”.

On July 9 Uniper stated it had offered its 18.26 p.c stake in AS Latvijas Gaze, which is concerned in pure fuel buying and selling and gross sales within the Baltics, to co-venturer Power Investments SIA.

Latvijas Gaze sells fuel in Estonia, Finland, Latvia and Lithuania. In Latvia’s family sector, it’s the largest fuel provider, Latvijas Gaze says on its web site.

On February 5 Uniper stated it had accomplished the sale of its North American energy portfolio. The sale lined “energy buy and sale contracts and vitality administration agreements within the North American energy markets ERCOT (North, South, West and Houston), WEST (WECC and CAISO) and CENTRAL (MISO and SPP) by way of various transactions with a number of counterparties”, Uniper stated then.

The North American inclinations excluded Uniper’s fuel portfolio and hydrogen-related actions.

On January 7 Uniper stated it had accomplished the sale of its pure gas-fired energy plant in Gonyu, Hungary, to the native subsidiary of France’s Veolia SA. Commissioned 2011, the ability plant generates as much as 430 MW, in keeping with Uniper.

Within the different divestments accomplished as a part of the bailout circumstances, Uniper in Could 2023 offered its marine gasoline buying and selling enterprise within the United Arab Emirates and its 20 p.c oblique stake within the BBL fuel pipeline linking the Netherlands and the UK.

The opposite property within the divestment package deal, which have to be accomplished 2026, include an 84 p.c stake in Unipro in Russia, a 20 p.c stake within the OPAL pipeline and Uniper’s worldwide helium enterprise, Uniper says on its web site.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share information, join with friends and business insiders and have interaction in knowledgeable neighborhood that can empower your profession in vitality.