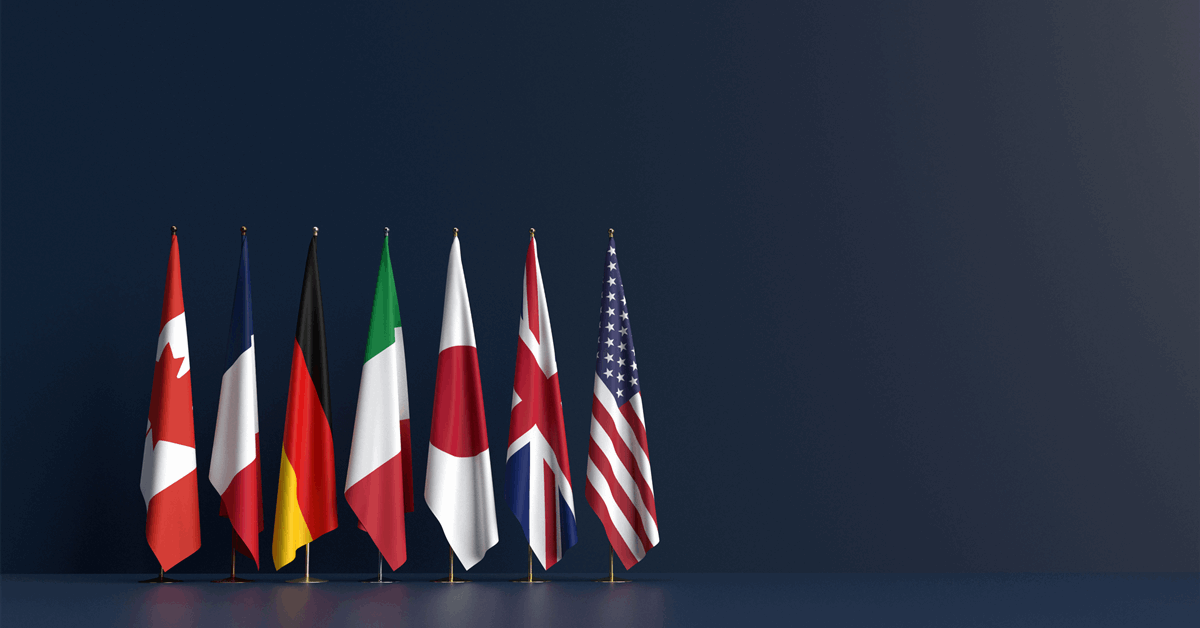

The UK urged its Group of Seven allies to agree a minimize to the worth cap on Russian oil, saying the transfer is critical to place additional strain on President Vladimir Putin to finish Russia’s battle in Ukraine.

“Stress on Russia’s battle machine is required now greater than ever,” the UK’s Treasury stated in a press release on Wednesday, after Chancellor of the Exchequer Rachel Reeves chaired a session on Ukraine on the G7 finance ministers’ assembly in Banff, Canada. “Putin has failed to have interaction in good religion with proposals from Zelenskiy to fulfill instantly and makes an attempt to dealer a ceasefire from his unlawful and brutal battle.”

The G7 international locations, which comprise the UK, US, Germany, France, Italy, Canada, and Japan, have been exploring methods to toughen the worth cap to higher degrade Moscow’s capacity to fund its battle in Ukraine. Below the present phrases of the worth cap, which is about at $60, western operators can insure and transport oil from Russia solely when it’s bought beneath the worth threshold.

On the G7 assembly on Wednesday, Reeves said “an ambition to maneuver rapidly in reducing the $60 value cap on Russian crude oil at this opportune time,” based on the UK assertion. She additionally “known as on G7 allies to be united of their work to make sure a simply and lasting peace is secured,” the assertion stated.

Russia has responded to the worth cap and a wider US and EU embargo on most Russian oil imports by utilizing a covert fleet of tankers, usually working with unknown insurers or homeowners, which transfer its crude to new markets, particularly in Asia. This shadow fleet has helped Russia work across the restrictions.

It stays to be seen whether or not the G7 will comply with a diminished oil value cap on the Banff assembly. France’s finance chief Eric Lombard informed Bloomberg that the proposal is without doubt one of the points on the desk, however he declined to remark additional because the package deal continues to be being mentioned.

The worth cap was initially designed to restrict the amount of cash Russia makes from its oil gross sales whereas maintaining international oil costs from skyrocketing. With costs for oil slipping amid forecasts of a world surplus in 2025, Ukraine’s allies are open to taking extra aggressive motion, Bloomberg beforehand reported.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg