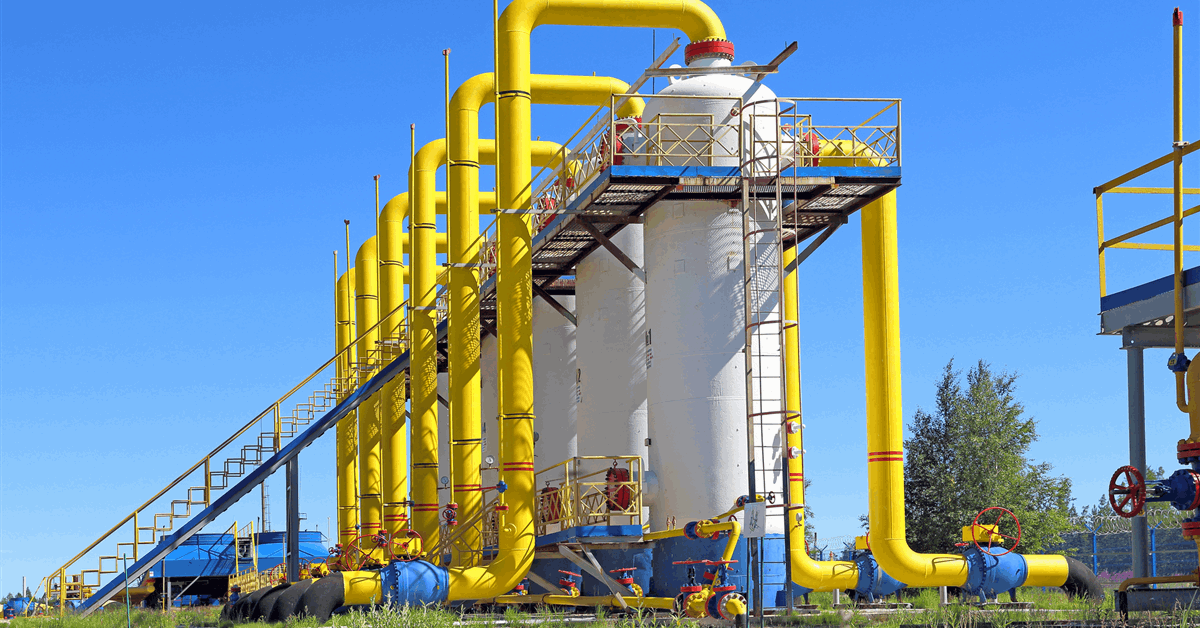

Tidewater Midstream and Infrastructure Ltd. stated it has entered right into a definitive settlement with Parallax Vitality Working Inc. for the sale of its Sylvan Lake gasoline plant and related gasoline gathering infrastructure for whole proceeds of roughly $4 million (CAD 5.5 million), topic to customary changes.

The Sylvan Lake Gasoline Processing Facility is a non-core asset of Tidewater situated in central Alberta, the corporate stated in a information launch.

The transaction is anticipated to have an immaterial impression on Tidewater’s 2025 working outcomes, and the proceeds obtained therefrom are anticipated for use to repay quantities excellent on the corporate’s senior credit score facility, Tidewater stated.

The transaction is anticipated to shut within the third quarter, topic to customary closing situations and sure regulatory approvals, together with the receipt of approval from the Alberta Vitality Regulator, in keeping with the discharge.

“The disposition of the Sylvan Lake Gasoline Processing Facility represents yet one more milestone for Tidewater as we glance to optimize our asset portfolio and enhance monetary flexibility. Within the first half of 2025, Tidewater introduced cumulative non-core asset gross sales of roughly CAD 30 million, at what we consider to be very wholesome and engaging valuation ranges. We consider these gross sales spotlight the power of Tidewater’s asset base, and look ahead to additional advancing the rest of our non-core asset gross sales program,” Tidewater CEO Jeremy Baines stated.

First Quarter Internet Loss Reported

In Could, Tidewater reported a consolidated internet loss attributable to shareholders of CAD 31.8 million for the primary quarter, in comparison with $11.3 million a 12 months in the past. The rise in internet loss was “as a consequence of decrease refined product gross sales and decrease product margins offset partially by decrease depreciation, curiosity expense, favorable adjustments within the truthful worth of by-product contracts, and better revenue from fairness investments,” the corporate stated in its most up-to-date earnings launch.

The corporate’s consolidated first-quarter adjusted EBITDA was a lack of CAD 3.7, in comparison with $39.8 million within the first quarter of 2024. The lower in EBITDA is “primarily pushed by decrease refined product gross sales and decrease product margins within the first quarter of 2025, offset partially by decrease losses on realized by-product contracts and better revenue from fairness investments,” the corporate stated.

“This has been a troublesome quarter because of wider reductions on our refined product volumes and producer shut ins affecting our midstream operations,” Baines stated.

“As we talked about throughout our 12 months finish outcomes convention name, we proceed to progress our three key initiatives: sustaining protected and dependable operations, driving ongoing operational efficiencies, and optimizing our asset portfolio to make sure we now have the right combination of belongings which can be producing acceptable returns. To this finish, we proceed to progress on non-core asset gross sales and can replace the market as warranted. We stay centered on money circulation and bettering working outcomes,” Baine continued.

“Our lately introduced transaction to accumulate the Western Pipeline is anticipated to yield value enhancements of roughly CAD 10.0 million to CAD 15.0 million yearly. We additionally anticipate to make the most of steadily bettering refined product margins over the course of the 12 months ensuing from the BC Authorities’s adjustments to the Low Carbon Fuels Act,” he concluded.

On February 27, the Authorities of British Columbia introduced adjustments to the Low Carbon Fuels Act, which elevated the renewable gasoline requirement for diesel from 4 % to eight % for the 2025 compliance interval. Efficient April 1, 2025, the amendments additionally require such renewable gasoline content material to be produced inside Canada, in keeping with the discharge.

To contact the creator, electronic mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback can be eliminated.