The UK vitality system is drowning in pure fuel. There may be a lot of the stuff on this nation that in the interim at the least no-one is sort of certain what to do with it.

If at this stage you are questioning whether or not I’ve misplaced my thoughts or that you just’re studying an article from a 12 months or two in the past: no.

It’s the center of Could 2022; the battle in Ukraine remains to be raging; Europe is trying desperately to pivot away from Russian pure fuel and UK family vitality payments (together with, sure, fuel payments) are at document ranges.

And I promise I have never misplaced my marbles. The UK actually is experiencing an nearly unprecedented glut of pure fuel.

This in all probability nonetheless sounds implausible, so take into account as proof, the spot worth of fuel on wholesale markets proper now. We’re speaking right here about what are generally known as “day forward” costs: the worth you’d pay for pure fuel for those who needed it delivered tomorrow.

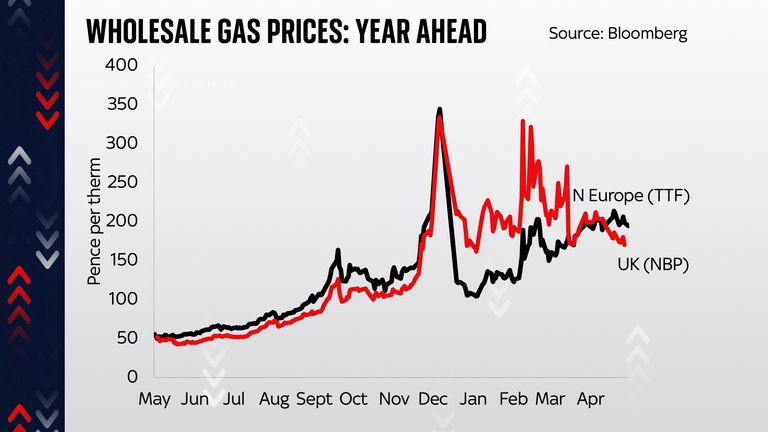

The primary North European worth (TTF, because it’s recognized) has come down somewhat because the Russian invasion of Ukraine however it’s nonetheless significantly increased than earlier than the invasion, and greater than double the extent it was final summer season.

Now take a look at the principle UK wholesale fuel worth, the NBP or “nationwide balancing level” to offer it its technical title. It has fallen from round 285p a therm in late March to simply 38p a therm a number of days in the past. On the time of writing it had bounced as much as 100p a therm, however was nonetheless far decrease than earlier than the Russian invasion. In reality, these wholesale costs are on the lowest stage for practically 18 months.

What is going on on right here? Why are UK costs so low, whereas they continue to be so excessive on the opposite facet of the Channel?

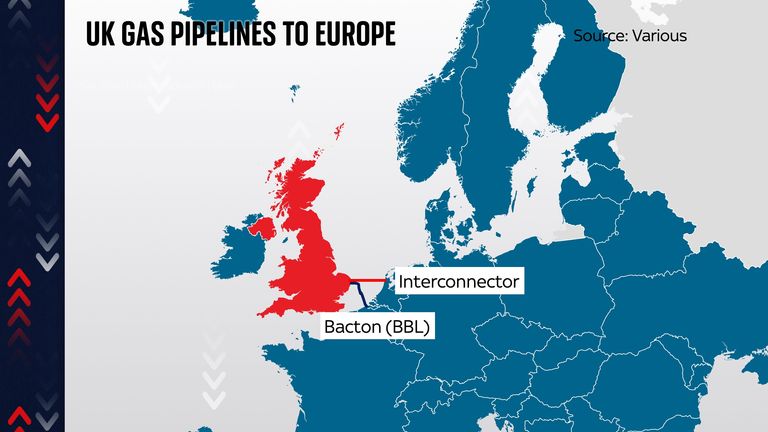

To grasp the reply, it’s essential to bear in mind vitality markets are largely, a product of bodily infrastructure. Not solely do it’s essential to get pure fuel out of the bottom, you additionally have to construct the pipelines to get it into individuals’s properties. In the case of fuel, geography issues; metal tubes matter.

A lot of Europe is, as everyone knows, extremely reliant on Russian fuel, most of which is piped in by way of a string of pipelines throughout japanese Europe, the Baltic and Black Sea into central Europe. Germany, particularly, is deeply depending on this circulation of fuel.

And, as you additionally know, everybody in Europe is doing every little thing they will to cut back their reliance on Russian fuel.

Excellent news…and never so good

Now, Europe may doubtlessly get extra fuel from North Africa and a few too from Azerbaijan, which is setting up new pipelines into the continent. It might probably’t get rather more fuel from the North Sea, both from Norway or the UK – largely as a result of they (primarily Norway) are already pumping as a lot as they bodily can proper now.

That leaves the opposite possibility: getting the fuel in by way of tanker from additional afield. The excellent news right here is there may be doubtlessly various fuel obtainable, particularly from the US, whose shale fields are producing methane at a speedy fee.

However now we run into different downside with the bodily infrastructure: even when there have been a limitless provide of fuel in America and a limitless variety of LNG (liquefied pure fuel) tankers to move it to Europe, there aren’t sufficient terminals via which we will obtain it. Really it is barely extra refined than that: there aren’t sufficient LNG terminals within the proper locations.

There may be really a number of LNG capability within the Iberian peninsula, however the issue is piping that fuel from Spain to Germany could be very tough certainly. There are three massive terminals within the UK. There are some terminals in France. However there is not a single LNG terminal in Germany.

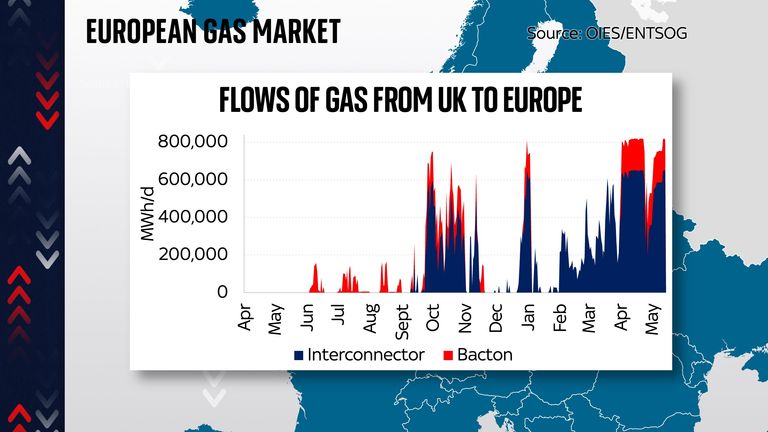

In current months, there was an infinite quantity of LNG redirected to Europe (attracted by the excessive fuel worth), however the ships are operating out of locations to place their fuel. This brings us again to the UK, the place loads of LNG has been flowing off tankers, via regasification amenities and into the fuel grid in current weeks. The 2 fuel pipelines which join the UK with the remainder of Europe are operating at full capability proper now (certainly, they’ve been operating at 20 per cent above capability just lately).

The issue, nevertheless, is these pipes merely aren’t sufficiently big to push all of the fuel coming into the UK by way of these LNG tankers via into continental Europe. And since we do not have a lot home storage on this nation and because it’s fairly heat proper now and most of our boilers are turned off, there is not actually wherever else for the fuel to go.

There have been some odd penalties. One is that with all this low-cost day-ahead fuel knocking round, Britain’s energy turbines have been making merry, turning on their gas-fired energy stations and producing as a lot electrical energy as they probably can.

The upshot is the UK, which usually has to depend on imports of electrical energy from the continent, has quickly change into an enormous exporter of electrical energy, sending energy at a fee of greater than 4 gigawatts throughout to mainland Europe in current days.

The opposite upshot is that not solely are pure fuel costs very low, so too are wholesale electrical energy costs, which at the moment are decrease on this nation than in most different components of Europe.

Attention-grabbing footnote: if Britain had extra home storage (as an alternative of getting run down our largest underground fuel reservoir a number of years in the past) we could possibly be placing extra of this low-cost fuel apart, forward of what could possibly be a grisly winter. As a substitute we’re burning it in energy stations. On the flip facet, if we had a number of storage then that is further demand for the fuel, which may imply this worth anomaly would not be taking place.

Anyway, at this stage you are maybe questioning: how quickly till that is mirrored in my invoice? Is the price of residing disaster now over?

I am afraid the reply in each circumstances is miserable. For whereas it is definitely true wholesale costs of fuel and electrical energy for next-day supply are certainly at all-time low ranges, the home vitality suppliers with whom all of us have our accounts say they have a tendency as an alternative to enroll to contracts for vitality delivered months and even years forward.

And if you take a look at the year-ahead worth for fuel, it’s at practically the identical stage as in north Europe, and remains to be significantly increased than earlier than the invasion. In different phrases, although the UK is drowning in fuel, markets recommend we can’t be in a number of months’ time, and that as a consequence, customers get little or no reduction from these very low costs.

One motive these markets is likely to be proper, is that many nations in northern Europe are transferring in a short time to put in LNG capability.

Whereas it takes some years to construct a full-blown fuel terminal such because the three we now have within the UK, in response to Mike Fulwood of the Oxford Institute of Power Research, there’s a non permanent resolution: particular tankers generally known as floating storage rig items (FSRUs).

The Dutch are already bringing a number of of them into operation and Germany is planning to start out one up within the winter. So come the chilly months, the market may certainly be confirmed proper.

These very low costs may simply be a brief anomaly.

Even so, there’s something surreal concerning the scenario. If just for a brief interval, in an period of pure fuel scarcity, of document pure fuel costs, Britain rapidly has a pure fuel glut.