TechnipFMC PLC has reported $285.5 million in adjusted internet revenue for the second quarter, up 99.8 % from the prior three-month interval and 51.1 % towards Q2 2024.

The adjusted diluted earnings per share of 68 cents beat the Zacks Consensus Estimate of $0.57. TechnipFMC stored its dividend at $0.05 per share for Q2 2025.

Earlier than adjustment for nonrecurring gadgets, internet revenue was $269.5 million, up 89.8 % sequentially and 44.5 % year-on-year. Earnings per share landed at $0.64.

Income totaled $2.53 billion, up 13.5 % quarter-on-quarter and 9 % year-on-year.

Backlog grew to $16.6 billion, with the subsea section accounting for $15.8 billion.

“We achieved $2.6 billion of Subsea inbound within the quarter, representing a various set of awards”, chair and chief government Doug Pferdehirt stated. “We proceed to learn from a mixture of iEPCI™ [integrated engineering, procurement, construction and installation], Subsea Providers, and direct awards. Subsea Providers inbound was significantly sturdy, representing one of many highest quarterly ranges ever achieved”.

“The distinctiveness and variety of our order e book give us continued confidence that we’ll attain our three-year objective of $30 billion of Subsea inbound by the top of this yr”, Pferdehirt added.

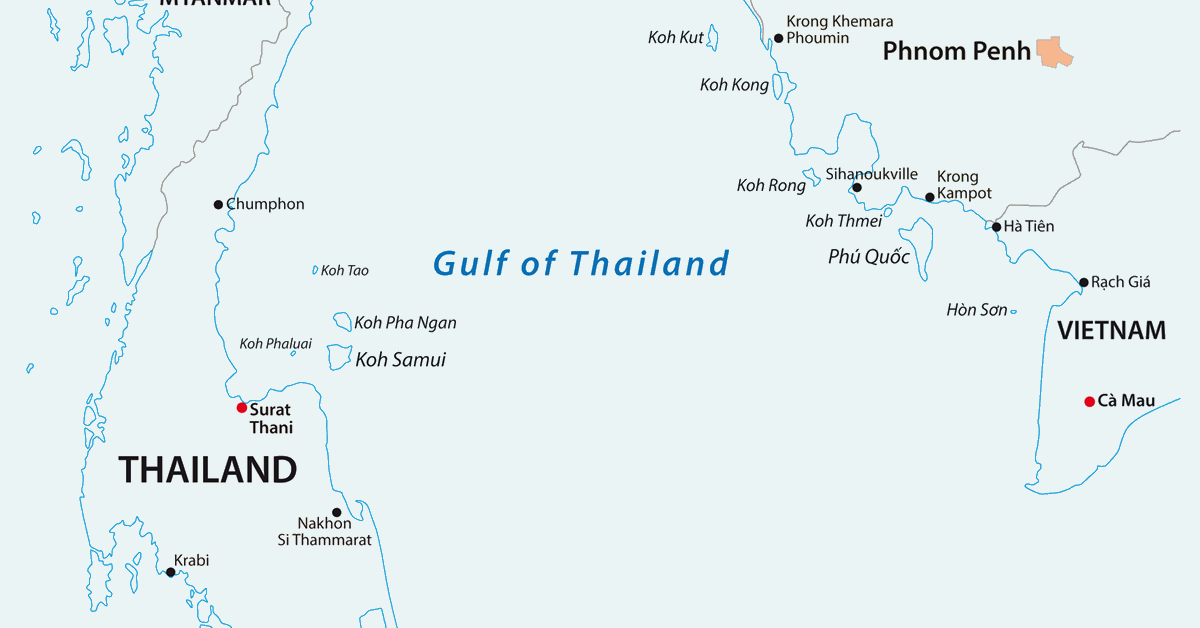

The subsea section accounted for $2.22 billion of Q2 2025 income, up 14.5 % quarter-on-quarter and 10.3 % year-on-year. “The sequential income enchancment was largely pushed by elevated iEPCI™ undertaking exercise within the North Sea and better set up exercise and versatile pipe provide in Brazil, offset partially by undertaking completions in Asia Pacific”, TechnipFMC stated. “Providers income additionally elevated primarily attributable to seasonal enhancements”.

Subsea working revenue rose 53.4 % quarter-on-quarter and 36.9 % year-on-year to $380.3 million. “Working outcomes elevated sequentially attributable to sturdy execution, improved earnings combine from backlog, and better undertaking and companies exercise”, TechnipFMC stated. “Working revenue margin elevated 440 foundation factors to 17.2 %”.

In the meantime the floor applied sciences section contributed $318.4 million to income, up 7.1 % quarter-on-quarter and 0.6 % year-on-year. “The sequential enhance in income was pushed by greater undertaking and companies exercise within the Center East, modestly offset by decrease exercise in North America”, TechnipFMC stated.

Floor applied sciences working revenue fell 22.5 % quarter-on-quarter and 23.5 % year-on-year to $23.4 million. “The sequential lower in working revenue was largely attributable to $17.5 million of upper restructuring, impairment, and different prices within the interval ensuing from enterprise transformation initiatives”, TechnipFMC stated. “Working revenue within the Center East improved sequentially attributable to greater undertaking and companies exercise. Working revenue margin decreased 290 foundation factors to 7.3 %”.

Adjusted earnings earlier than curiosity, taxes, depreciation and amortization totaled $520.8 million, up 51.5 % and 44.1 %.

Operations generated $344.2 million in money move, whereas free money move was $260.6 million.

TechnipFMC paid shareholders $270.7 million via $250.1 million in buybacks involving 8.3 million shares and $20.6 million in dividends.

Quick-term and long-term debt totaled $696.3 million on the finish of Q2 2025, down $208.6 million from the determine on the finish of Q1 2025 after the reimbursement of 5.75 % Non-public Placement Notes due 2025. Money and money equivalents stood at $950 million.

“Offshore exercise stays sturdy. Entrance-end engineering exercise is robust, and our Subsea Alternatives Record stays wholesome, with named initiatives progressing throughout a number of basins over the following 24 months”, Pferdehirt stated.

“Our visibility into the market additionally advantages from the excessive stage of direct awards to our firm. We proceed to see power in offshore markets, supported by shopper discussions for initiatives which are prone to be sanctioned via the top of the last decade”.

To contact the creator, e mail jov.onsat@rigzone.com