Strathcona Sources Ltd. has closed its Montney asset sale in Western Canada, consisting of Groundbirch, Kakwa, and Grande Prairie property, for a complete worth of roughly $2.09 billion (CAD 2.86 billion), together with closing changes.

Strathcona mentioned it’s now a pure-play heavy oil firm producing roughly 120 million barrels per day (MMbpd) with a 50-year 2P reserve life index. The corporate has plans to develop to 195 MMbpd by 2031, based on a information launch.

After deducting all debt, Strathcona mentioned it presently has roughly CAD 200 million in constructive internet money and marketable securities, inclusive of roughly 4.6 million shares in Tourmaline Oil Corp. and 23.4 million shares in MEG Power Corp.

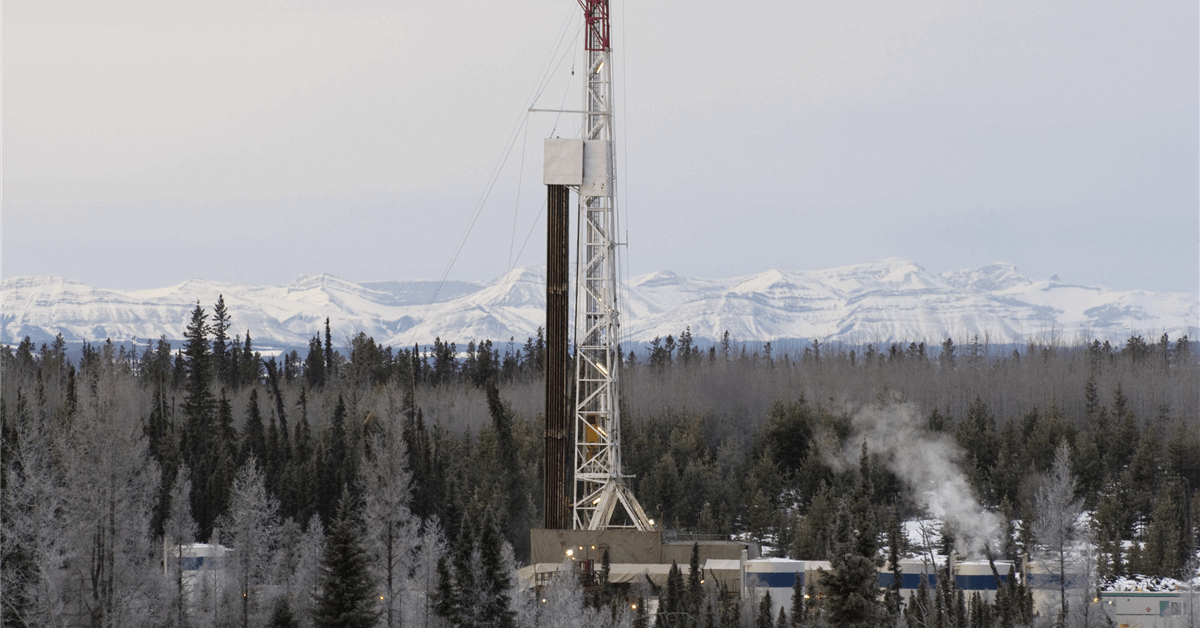

ARC Sources Ltd. acquired the condensate-rich Montney property in Alberta’s Kakwa in an all-cash transaction valued at roughly CAD 1.6 billion.

The property are “underpinned by a considerable drilling stock and embody owned and operated infrastructure, reinforcing ARC’s place as Canada’s largest Montney and condensate producer,” the corporate mentioned in a separate assertion.

For the rest of 2025, the property are anticipated to ship common manufacturing between 35,000 and 40,000 barrels of oil equal per day (boepd), consisting of roughly 50 p.c crude oil and liquids and 50 p.c pure gasoline, ARC mentioned.

The acquisition will increase ARC’s Kakwa manufacturing 24 p.c to over 210,000 boepd and will increase the Montney stock length at Kakwa from 12 years to over 15 years, based on the assertion.

The transaction contains one hundred pc possession of two pure gasoline processing amenities and condensate dealing with infrastructure. As well as, the property embody a 19 p.c curiosity in a third-party pure gasoline processing facility with deep-cut pure gasoline liquids (NGL) restoration, ARC mentioned.

ARC mentioned its growth plans for the property will goal the Montney, which is roughly one hundred pc working curiosity land. ARC may even retain future stock in different formations “that would additional lengthen the event runway at Kakwa over the long-term,” the corporate mentioned.

MEG Acquisition Bid Feedback

In the meantime, Strathcona mentioned it was “disillusioned” that the MEG board declined to have any dialogue concerning its deliberate takeover of the corporate since its authentic written supply on April 28.

“The MEG board’s habits doesn’t match [the] suggestions Strathcona has obtained so far from MEG shareholders, who’ve indicated they want to see the MEG board have interaction with Strathcona to see if a win-win end result may be reached for each Strathcona and MEG shareholders,” Strathcona mentioned.

“Strathcona stays prepared and keen to interact with the MEG Board, together with as a part of its strategic alternate options course of. Alternatively, Strathcona stays dedicated to persevering with its direct dialogue with MEG shareholders upfront of the September 15 tender deadline for its supply,” the corporate added.

On Could 30, Strathcona made a proper supply to accumulate all of the issued and excellent MEG shares it doesn’t already personal for a mixture of 0.62 of a Strathcona share and $4.10 in money per MEG share.

In June, MEG’s board launched a press release saying that the acquisition bid was “insufficient, opportunistic, and never in the most effective pursuits of MEG or its shareholders”.

To contact the writer, e-mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will probably be eliminated.