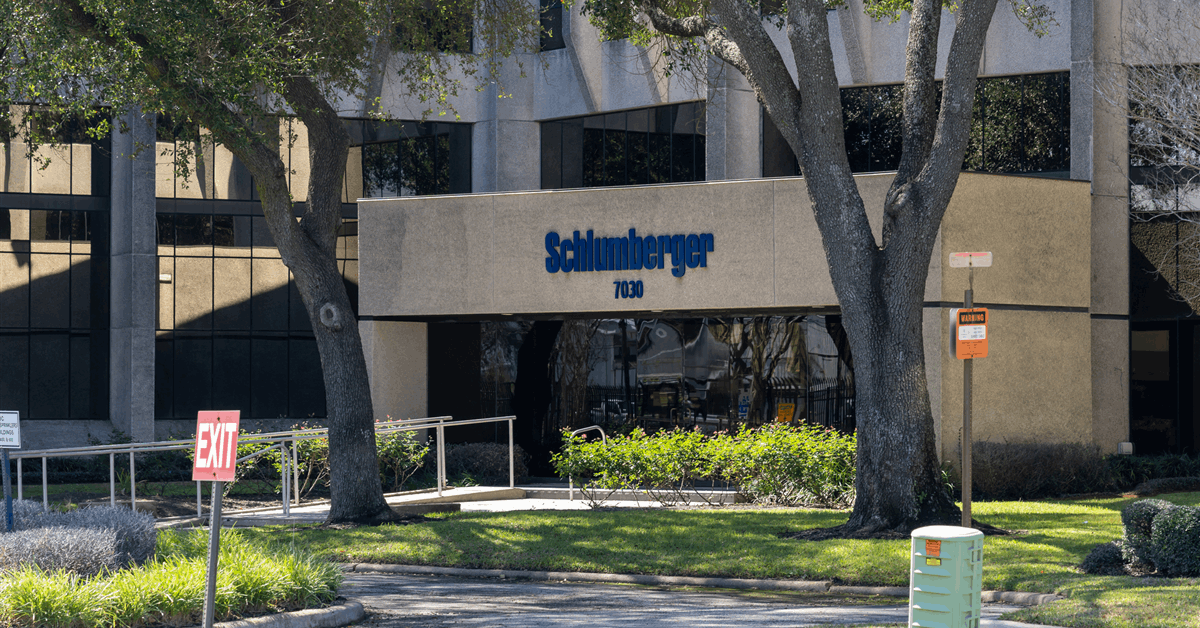

Schlumberger Ltd./NV (SLB) mentioned Wednesday it had accomplished the acquisition of ChampionX Corp., after the oilfield tech firms resolved competitors considerations raised by a number of international locations.

ChampionX shareholders obtained 0.735 SLB shares per share they held at ChampionX. “With the closing of the transaction, former ChampionX shareholders now personal roughly 9 % of SLB’s excellent shares of widespread inventory”, SLB confirmed in an announcement on-line.

“This strategic acquisition strengthens SLB’s management within the manufacturing and restoration house”, SLB mentioned. “The combination of ChampionX manufacturing chemical substances and its complementary synthetic raise, digital, and emissions applied sciences enhances the SLB portfolio, serving to to drive efficiency and prolong asset life alongside the manufacturing lifecycle.

“The mix of ChampionX’s main production-focused options and buyer relationships all through North America and past, with SLB’s robust worldwide presence and historical past of innovation, will drive vital worth for purchasers and stakeholders globally.

“The acquisition additionally brings collectively two distinct units of specialists with area information and buyer insights throughout the complete manufacturing and restoration house”.

The assertion added, “SLB stays on monitor to return $4 billion to shareholders in 2025 and expects to appreciate annual pretax synergies from the ChampionX acquisition of roughly $400 million throughout the first three years post-closing by income progress and price financial savings”.

SLB chief government Olivier Le Peuch commented, “This acquisition comes at a pivotal time within the business as our clients more and more prioritize developments in manufacturing to maximise restoration of oil and gasoline”.

“It extends {our capability} to offer built-in manufacturing options and gives one other platform for accelerating digital adoption, optimizing manufacturing and decreasing complete value of possession for our clients”, Le Peuch added.

Regulators in the US, Canada, Norway and the UK had held off the merger on dangers to market competitors.

To clear the regulatory hurdles, SLB and ChampionX agreed to make sure divestments and licensing preparations.

Within the U.S., SLB mentioned February 25 it had agreed to promote ChampionX’s fairness stake in US Artificial Corp. (USS) to a 3rd social gathering. SLB later mentioned it might make the divestment to LongRange Capital.

To fulfill a remedial resolution in Norway, along with the ussale, SLB and ChampionX have entered into agreements with different third events and dedicated to providing services to different clients on non-discriminatory phrases.

“The events additionally decide to getting into into a world license settlement to facilitate entry of a brand new provider of quartz transducers to be used in everlasting properly monitoring and directional drilling on the Norwegian continental shelf”, the Norwegian Competitors Authority mentioned in an announcement Might 26.

On Monday, the Authority mentioned because it introduced clearance for the merger to proceed, “ChampionX has signed long-term provide agreements guaranteeing oil service suppliers Baker Hughes and Weatherford continued entry to services from ChampionX’s Quartzdyne enterprise”.

“These agreements come along with the final provide obligations within the Authority’s 26 Might resolution”, the Authority mentioned. “The provision obligations will stay in impact for 5 years.

“Lastly, ChampionX has entered into a world license settlement with the sensor producer Précis. This settlement is supposed to facilitate Précis’ entry into the marketplace for quartz transducers, which are utilized in everlasting properly monitoring and directional drilling on the Norwegian Continental Shelf”.

Within the UK, the Competitors and Markets Authority (CMA) mentioned Tuesday it had opted to not proceed with a part 2 investigation in trade for a number of concessions that embody the ussale, the agreements with Baker Hughes and Weatherford and the divestment of SLB’s UK PCT (manufacturing chemical applied sciences) enterprise. SLB ought to give the customer of its UK PCT enterprise an mental property license for the PCT merchandise for 10 years.

The CMA additionally agreed to the businesses’ supply “to enter into a world licensing association with a 3rd social gathering for a commercially cheap royalty, overlaying all important mental property and know-how required to develop the quartz sensors and transducers provided by ChampionX’s Quartzdyne enterprise, to speed up the event of rival quartz merchandise”, the CMA resolution said.

In Canada, the Competitors Bureau mentioned Wednesday it had determined to clear the merger on the grounds of SLB promoting USS and licensing “mental property referring to quartz transducers owned by Quartzdyne”.

To contact the writer, e-mail jov.onsat@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback can be eliminated.