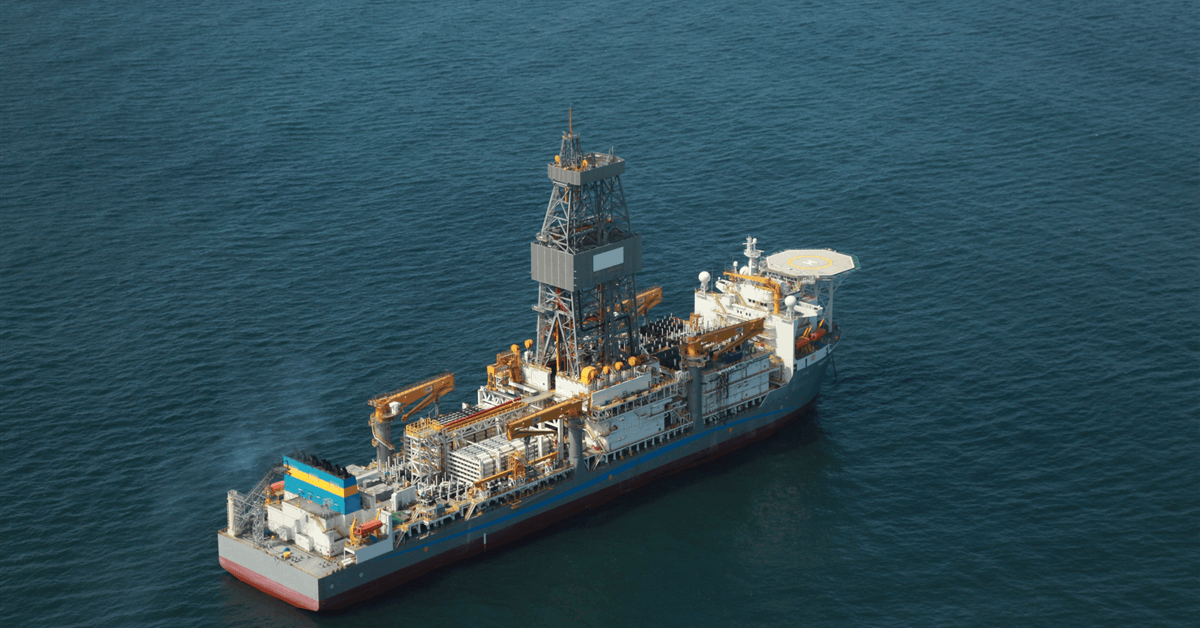

Shell Plc mentioned second-quarter outcomes will likely be undermined by a weaker efficiency from the power large’s fabled oil and gasoline buying and selling operation.

Earnings from the division are anticipated to be “considerably decrease” quarter-on-quarter, the London-based firm mentioned Monday in a press release, which prompted a decline in its shares to a four-week low.

Shell’s sprawling however secretive in-house buying and selling enterprise is commonly one in all its largest revenue boosters, and Chief Govt Officer Wael Sawan mentioned in March that its merchants haven’t misplaced cash in a single quarter over the previous decade. But current value swings have been laborious to navigate, with crude whipsawed by US President Donald Trump’s commerce struggle, OPEC+ coverage and Israel’s assaults on Iran.

The character of final quarter’s volatility — pushed extra by geopolitics than by provide and demand fundamentals — was difficult, an individual aware of the matter mentioned.

Shell slid as a lot as 3.3% in London buying and selling, and was down 2.9% at 2,552.5 pence as of 11:32 a.m. native time. European friends BP Plc and TotalEnergies SE, which even have giant buying and selling operations, fell too.

‘Disappointing’ Replace

The weaker contribution from buying and selling eroded a rise in margins from refining and chemical substances, although the latter division is however anticipated to report a loss when Shell publishes leads to late July.

Monday’s replace “does present how levered the corporate is to buying and selling volatility,” Biraj Borkhataria, an analyst at RBC Europe Ltd., mentioned in a notice. “It is a disappointing replace,” although “we don’t count on this to change the longer-term thesis.”

Sawan has centered on chopping prices, boosting reliability and shedding underperforming belongings in an effort to shut a valuation hole between Shell and its US rivals. The technique, which prioritizes the core oil and gasoline enterprise and shareholder returns, has helped the inventory outperform rivals this 12 months however left questions relating to future oil-production development.

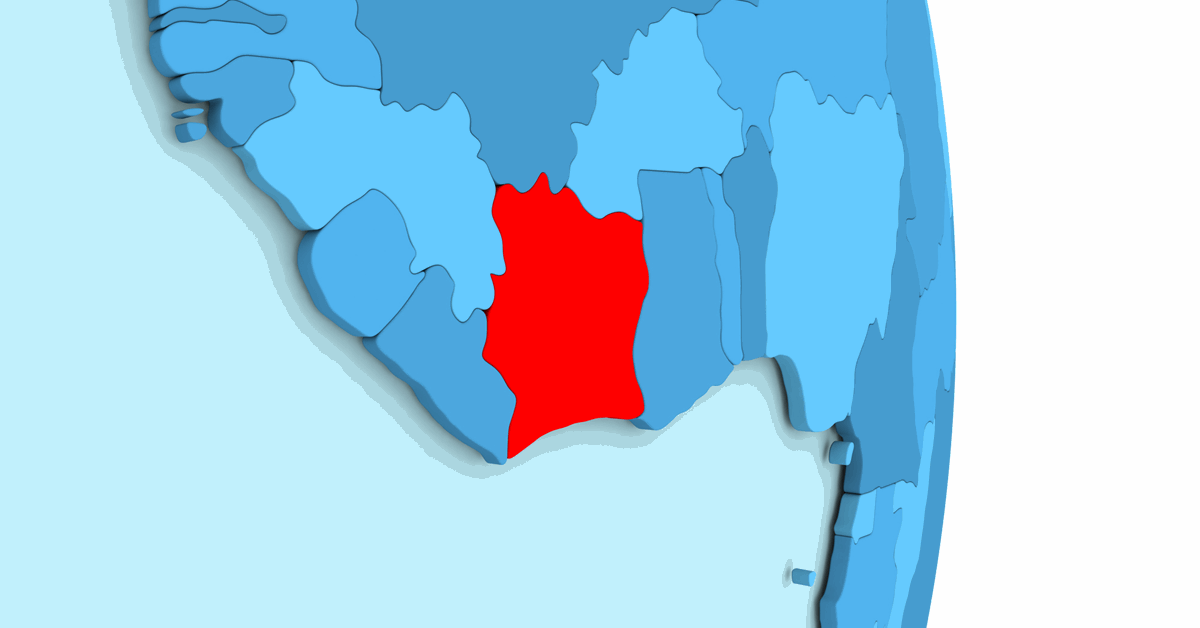

Output dropped by virtually 100,000 barrels a day from the primary quarter, largely reflecting the sale of Shell’s onshore Nigeria subsidiary and deliberate upkeep. The corporate had already notified buyers of its manufacturing expectations.

Shell is the world’s largest dealer of liquefied pure gasoline, and has forecast that world demand for the gasoline will develop about 60% by 2040. Its LNG Canada mission, which started exporting in current weeks, is one in all a slew of recent ventures coming on-line globally within the subsequent few years. Liquefaction volumes within the second quarter had been consistent with the primary.

Shell’s buying and selling replace comes lower than two weeks after the corporate mentioned it had no intention of constructing a suggestion for UK competitor BP. Its announcement quelled a protracted interval of hypothesis and tied its fingers for the following six months underneath UK takeover guidelines.

The corporate is scheduled to report second-quarter outcomes July 31.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will likely be eliminated.