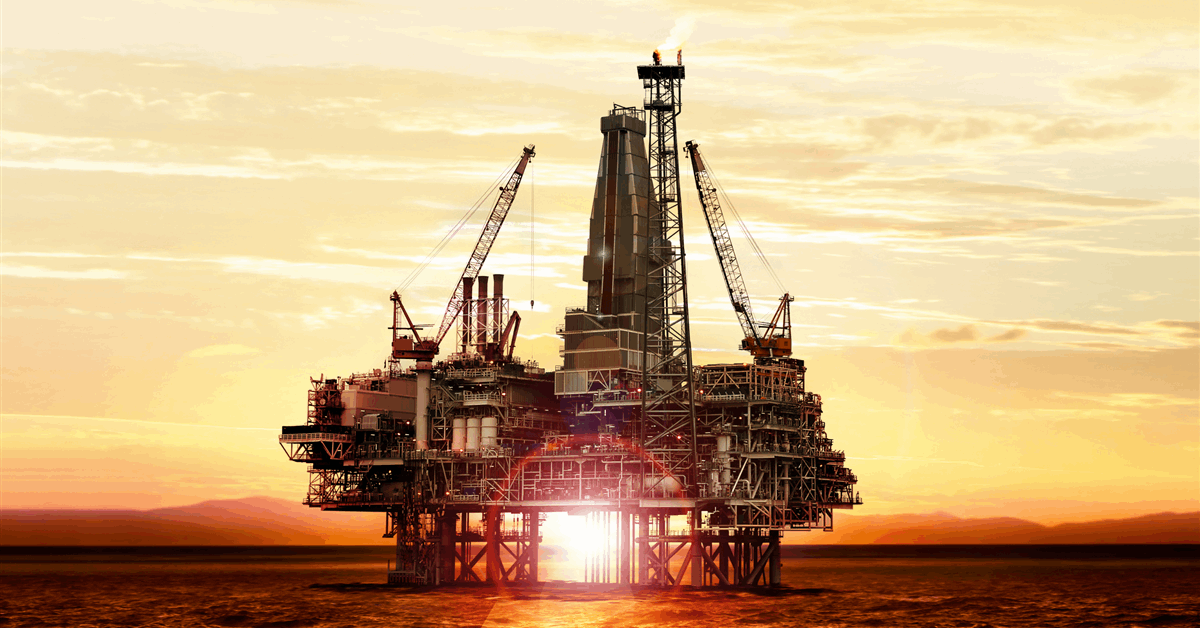

Shell PLC on Tuesday introduced a ultimate funding resolution (FID) to develop the HI discipline to provide as much as 350 million customary cubic toes of pure gasoline a day to Nigeria LNG.

The venture is a part of a three way partnership by which Shell owns 40 p.c by means of Shell Nigeria Exploration and Manufacturing Co Ltd and Sunlink Energies and Assets Ltd holds 60 p.c. At Nigeria LNG, which has a declared capability of twenty-two million metric tons of liquefied pure gasoline a 12 months, Shell owns 25.6 p.c.

“The rise in feedstock to NLNG, by way of the practice VII venture that goals to broaden the Bonny Island terminal’s manufacturing capability, is in keeping with Shell’s plans to develop its world LNG volumes by a mean of 4 to 5 p.c per 12 months till 2030”, Shell stated in an announcement on its web site.

HI additionally helps Shell’s plan introduced on Capital Market Day 2025 to begin up upstream and built-in gasoline tasks with a complete capability of 1 million barrels of oil equal per day between 2025 and 2030. It additionally contributes to the corporate’s goal to develop high line manufacturing throughout its upstream and built-in gasoline enterprise by one p.c per 12 months by means of the tip of the last decade, Shell stated.

HI is estimated to carry about 285 million barrels of oil equal, Shell stated. The sector, found 1985, lies 50 kilometers (31.07 miles) from shore in waters 100 meters (328.08 toes) deep, in accordance with Shell.

The event consists of a wellhead platform with 4 wells, a pipeline to move the gasoline to Bonny and a gasoline processing plant on the island, from the place the processed gasoline shall be transported to Nigeria LNG and the condensate to the Bonny Oil and Fuel Export Terminal, Shell stated.

“Following latest funding choices associated to the Bonga deepwater growth, right this moment’s announcement demonstrates our continued dedication to Nigeria’s power sector, with a concentrate on deepwater and built-in gasoline,” stated Shell upstream president Peter Costello. “This upstream venture will assist Shell develop our main built-in gasoline portfolio, whereas supporting Nigeria’s plans to change into a extra vital participant within the world LNG market”.

Shell introduced a constructive FID on the Bonga North deepwater venture on December 16, 2024. Shell expects the venture to provide as much as 110,000 barrels per day, sustaining manufacturing on the present Bonga facility. Startup is deliberate by 2030.

On Could 29, 2025, Shell introduced an settlement to amass TotalEnergies SE’s 12.5 p.c stake within the block containing the Bonga discipline, Oil Mining Lease 118. The acquisition will increase operator Shell’s stake within the license to 67.5 p.c.

Earlier this 12 months Shell divested its Nigerian onshore belongings to refocus funding within the West African nation to deepwater and built-in gasoline belongings.

The sale, priced $1.3 billion, noticed Renaissance Africa take over Shell Petroleum Growth Firm of Nigeria Ltd and consequently purchase a 30 p.c working stake within the SPDC Joint Enterprise.

“The divestment of SPDC aligns with Shell’s intent to simplify its presence in Nigeria by means of an exit of onshore oil manufacturing within the Niger Delta and a spotlight of future disciplined funding in its deepwater and built-in gasoline positions”, Shell stated in a web based assertion March 13, 2025.

To contact the writer, electronic mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in power.