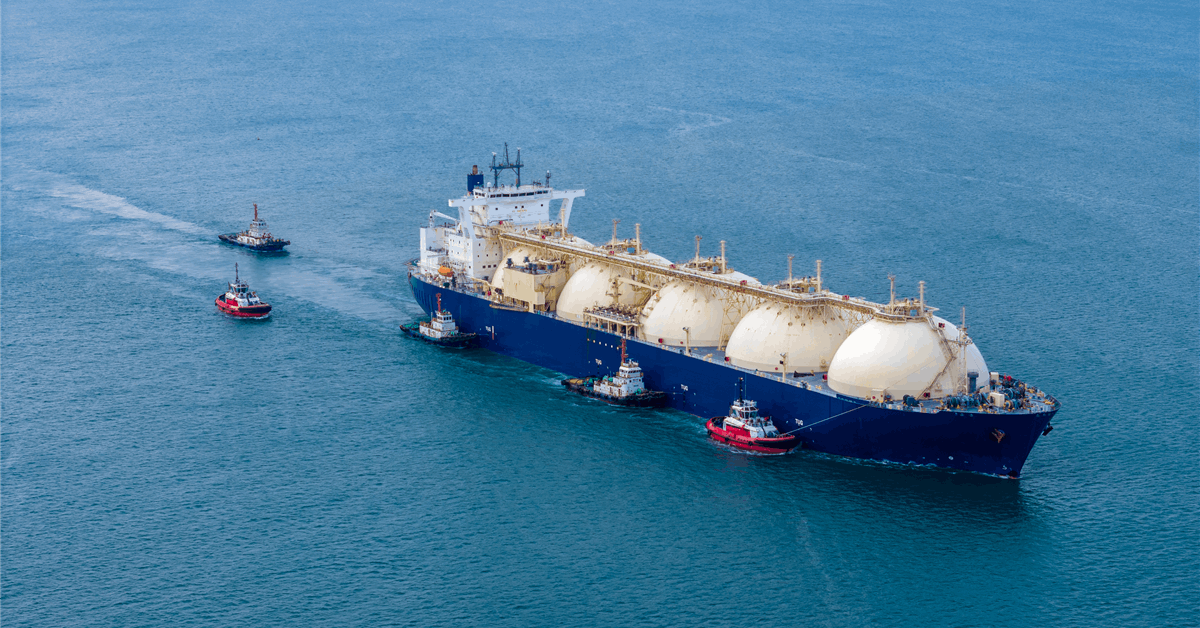

Enterprise International, Inc. and Securing Power for Europe GmbH (SEFE) have entered into an settlement below which SEFE’s subsidiary, SEFE Power GmbH, will buy a further 0.75 million metric tons each year (mtpa) of liquefied pure gasoline (LNG) from CP2 LNG for 20 years.

The settlement amends the present gross sales and buy settlement signed by the businesses in 2023, rising the entire quantity of LNG bought by SEFE from CP2 LNG to three.0 mtpa, Enterprise International stated in a information launch.

“Enterprise International is thrilled to increase our strategic partnership with Germany and SEFE and play a number one position in making certain safety of vitality provide and affordability for not solely Germany however the remainder of the European gasoline market,” Enterprise International CEO Mike Sabel stated.

German state-owned vitality agency SEFE is without doubt one of the LNG clients for CP2, Enterprise International’s third challenge, in Europe, Asia, and the remainder of the world, Enterprise International stated.

Thus far, roughly 11.5 mtpa of CP2 section one has been bought, elevating the entire contracted capability for all of Enterprise International’s tasks to 41.5 mtpa, the corporate stated.

Enterprise International stated it’s anticipated to turn into Germany’s largest LNG provider, with a mixed 5 MTPA of 20-year offtake agreements signed with SEFE and EnBW. Along with its current long-term agreements, Enterprise International has provided Germany with virtually 80 cargoes of LNG from its Calcasieu Cross and Plaquemines LNG services, sufficient to energy 8 million German properties for one yr.

Final week, Enterprise International entered into a brand new 20-year gross sales and buy settlement with PETRONAS LNG Ltd. (PLL), a subsidiary of the Malaysian state-owned oil and gasoline firm, PETRONAS.

Below the phrases of the settlement, PETRONAS will buy 1 mtpa of LNG from CP2 LNG for 20 years. This builds upon Enterprise International’s current settlement with PETRONAS for 1 mtpa of LNG provide from Plaquemines LNG, Enterprise International stated in an earlier information launch.

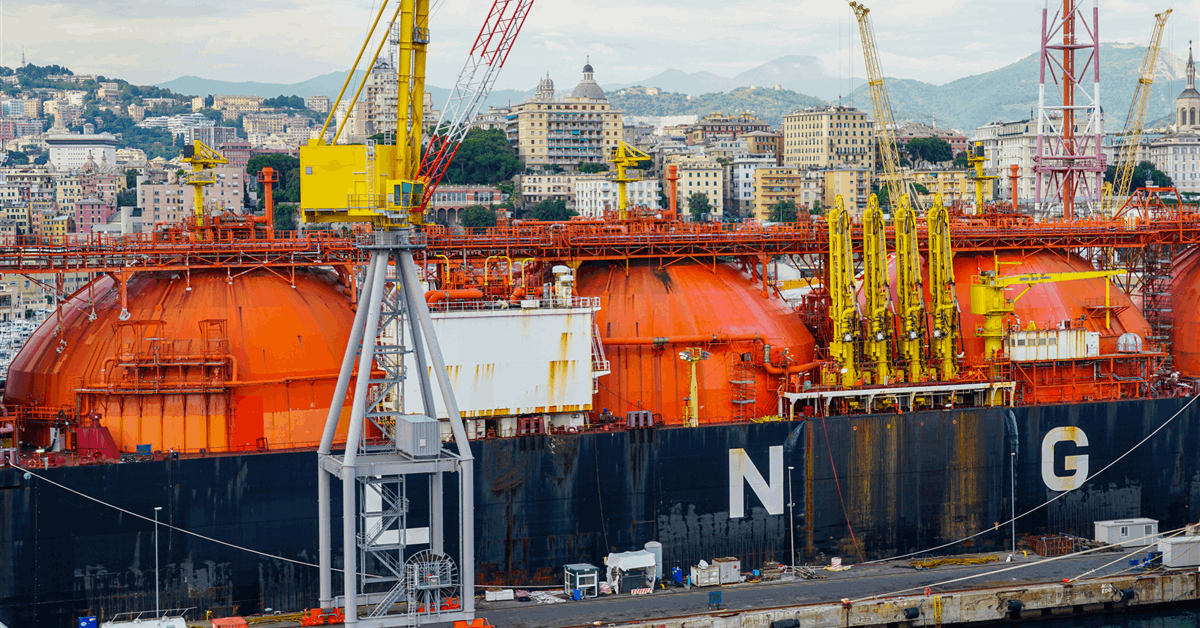

VGPL Closes $4 Billion Providing of Senior Notes

In the meantime, Enterprise International stated its subsidiary, Enterprise International Plaquemines LNG (VGPL), has closed an providing of $4 billion of senior secured notes issued in two sequence.

The primary is a sequence of 6.50 p.c senior secured notes due 2034 amounting to $2 billion, and the second is a sequence of 6.75 p.c senior secured notes due 2036 amounting to $2 billion. The 2034 notes will mature on January 15, 2034, and the 2036 notes will mature on January 15, 2036, the corporate stated in a separate assertion.

Enterprise International stated it had beforehand introduced the issuance of $2,5 billion of senior secured notes by VGPL on April 21. This brings the mixed mixture quantity of senior secured notes issued by VGPL to $6.5 billion for the reason that challenge started producing LNG in December 2024, the corporate stated.

VGPL stated it intends to make use of the online proceeds from the providing to prepay sure quantities excellent below its current senior secured first lien credit score services and pay charges and bills in reference to the providing.

The notes are assured by Enterprise International Gator Specific, LLC ,which is VGPL’s affiliate. The notes are secured “on a pari passu foundation by a first-priority safety curiosity within the belongings that safe the present credit score services and the present notes,” in accordance with the assertion.

To contact the creator, e-mail rocky.teodoro@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that can empower your profession in vitality.