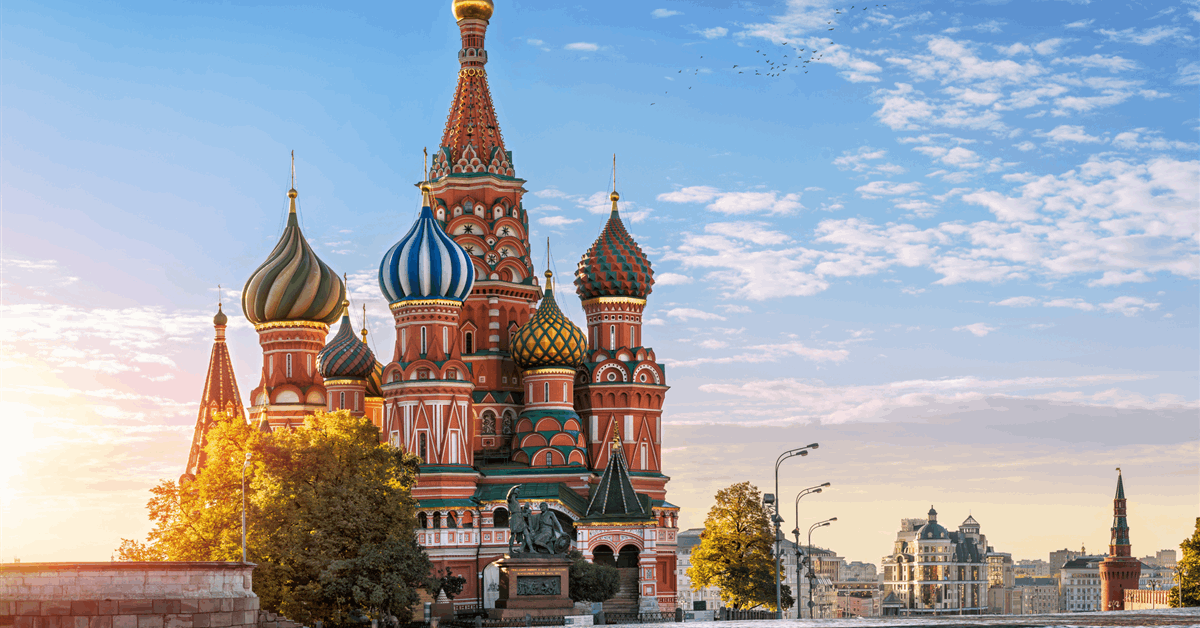

Russia’s oil proceeds to the state price range elevated by virtually a 3rd final 12 months to the very best since at the least 2018, spurred by larger crude costs because the nation tailored to worldwide sanctions.

Oil-related taxes rose to 9.19 trillion rubles ($89.4 billion) 2024, up from 7.04 trillion rubles a 12 months in the past, based on Bloomberg calculations based mostly on finance ministry’s knowledge revealed Monday. These proceeds from crude and refined merchandise accounted for 83% of Russia’s whole oil and gasoline income, which reached 11.13 trillion rubles final 12 months.

The oil-revenue spike displays larger costs for Urals crude, Russia’s key export mix, and its low cost to international Brent benchmark narrowed, even amid a value cap imposed by the Group of Seven nations in response to Kremlin’s invasion of Ukraine. Moscow has tailored to restrictions, together with a European Union ban on Russian oil imports, by utilizing an enormous shadow fleet of tankers and re-directing its oil gross sales to Asian purchasers.

As Joe Biden leaves workplace, his administration imposed its most aggressive sanctions on Russia’s oil business — key to financing the Kremlin’s aggression in opposition to Ukraine. Sweeping sanctions introduced final week goal two giant oil producers, important insurers and merchants linked to tons of of cargoes and about 160 oil tankers.

The typical value of Urals used for tax calculations was $67.6 a barrel final 12 months, virtually 10% above the common stage in 2023. That’s the 12 months when the nation’s oil business confronted the total affect of the G-7 value threshold that restricted entry to Western transport and insurance coverage and pushed Urals under $50 a barrel within the first months of the 12 months.

On the similar time, Russian ruble’s trade fee averaged some 91.37 per US greenback in 2024, a ten% depreciation from the earlier 12 months, contributing to larger price range revenues in native forex.

The Russian price range’s oil proceeds would have been larger final 12 months in the event that they hadn’t been dented by massive state subsidies to the nation’s refiners. The federal government paid 1.82 trillion rubles to gasoline producers for home provides of diesel and gasoline, based on the Finance Ministry. The funds partially compensate refiners for the distinction in automobile gasoline costs in Russia and overseas.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback might be eliminated.

MORE FROM THIS AUTHOR

Bloomberg