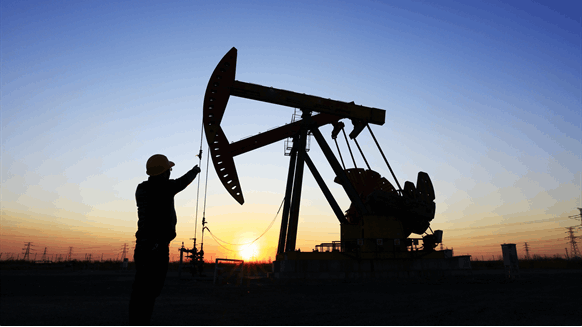

Russia plans to scale back day by day diesel exports from key western ports in April to the bottom in 5 months, after Ukrainian drone assaults on refineries and seasonal upkeep sharply lowered crude processing charges.

Diesel loadings from the nation’s three main ports on the Black and Baltic Seas, together with some volumes originating in Belarus, are set to fall to round 2.29 million tons this month, based on trade information seen by Bloomberg.

That equates to simply over 569,000 barrels a day, down 21% in contrast with precise day by day exports of about 724,000 barrels from the identical ports in March, calculations based mostly on information from intelligence agency Kpler present.

Russia is slicing seaborne diesel provides after weekly crude-processing charges dropped to a 10-month low following the Ukrainian drone assaults because the battle between the 2 nations entered its third yr. Seasonal upkeep that’s set to final into summer time, quickly decreasing crude throughput at some Russian refineries additional down, can be placing stress on the nation’s diesel flows.

Russia now not sends diesel to Europe on account of Western vitality sanctions. But decrease flows from one of many phrase’s prime producer of the gasoline is about to boost volatility out there that’s already been affected by assaults on transport within the Purple Sea and regional refinery outages.

|

Diesel Loading Plans, hundreds of thousands of tons

|

April

|

|

Baltic port of Primorsk

|

1.603

|

|

Baltic port of Vysotsk

|

0.211

|

|

Black Sea port of Novorossiysk

|

0.475

|

Thus far, Russia has no plans to ban diesel exports, Deputy Prime Minister Alexander Novak stated Friday, based on Russian newswires. “We produce sufficient diesel, twice as a lot because the home market wants,” Novak stated in Moscow, based on state information company Tass. If Russia have been to impose the ban, the nation’s refining trade would face overstocking, he stated.

The diesel-export plan for April seen by Bloomberg solely exhibits flows delivered to the three key home ports by pipeline. It doesn’t embody smaller volumes despatched to export shops by rail and out of doors of Transneft PJSC’s oil-product pipeline system. Precise flows could differ, relying on the climate and demand from overseas clients.

Transneft, which compiles the loading schedules, didn’t instantly reply to a Bloomberg request for remark.