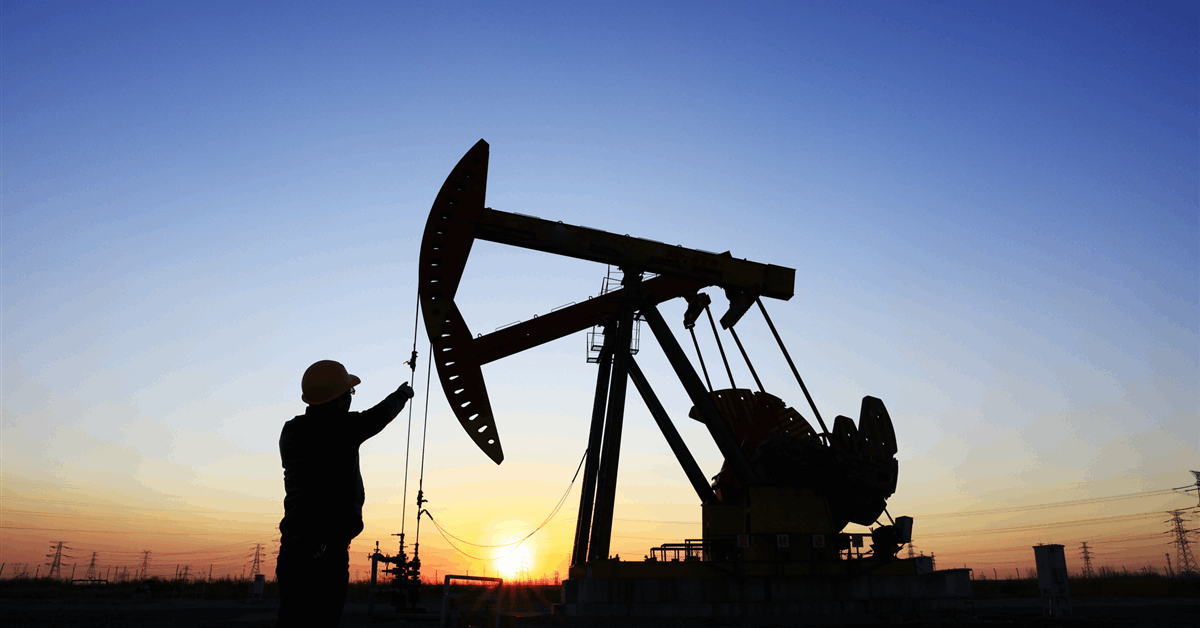

Russia’s crude output declined for a second straight month in January because the world’s third largest oil producer faces problem in advertising and marketing its barrels due to US sanctions.

The nation pumped a median of 9.28 million barrels a day of crude oil final month, in response to folks with information of the info, who requested to not be recognized discussing categorized info.

The determine — which doesn’t embody output of condensate — is 46,000 barrels a day beneath an already-reduced degree in December, and nearly 300,000 barrels a day decrease than what Russia is allowed to supply underneath an settlement with the Group of the Petroleum Exporting International locations and allies.

Russia has categorized its information on oil manufacturing, exports and refinery operations, making unbiased assessments troublesome. Its Vitality Ministry didn’t instantly reply to a Bloomberg request for a touch upon the January output degree and future manufacturing plans.

The decline in manufacturing comes as the quantity of Russian crude held on tankers continues to develop, indicating that some cargoes are taking important time to seek out patrons amid rising US stress on the Kremlin. Earlier this month, US President Donald Trump mentioned he eradicated an additional 25% tariff he had imposed on India in alternate for New Delhi halting oil purchases from Russia.

Whereas India confirmed the commerce deal, it has not commented on particulars together with oil. Nonetheless, almost all state-owned and personal Indian refiners have paused shopping for any spot cargoes since Trump first talked about the deal in a social media submit a couple of week in the past.

By the beginning of February, gathered volumes of Russian crude on water reached 143 million barrels, nearly doubling from a yr in the past and creeping up by greater than 1 / 4 in comparison with late November.

As India has pulled again from purchases, some tankers with sanctioned barrels are actually heading for China, one other key purchaser of Russian crude. But it stays unclear simply what number of further barrels offered by Moscow the Chinese language market is keen to soak up.

Declining manufacturing is a threat for the Russian price range, which final yr relied on the oil and fuel business for round 23% of its revenues. In January, the Russian authorities’s oil proceeds already dropped to a five-year low, pushed by weaker world costs, steeper reductions and a stronger ruble.

If Russia’s manufacturing cuts proceed, the nation may even threat shedding its share within the world oil market to allies in OPEC+. The group agreed to carry output regular within the first quarter of 2026 and up to now has not made any public determination about its technique past March.

Final week, Russia’s Deputy Prime Minister Alexander Novak mentioned the group expects world oil demand to choose up beginning in March or April. Novak’s feedback carry explicit heft as Russia has not too long ago advocated for OPEC+ to be cautious in including barrels.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will probably be eliminated.