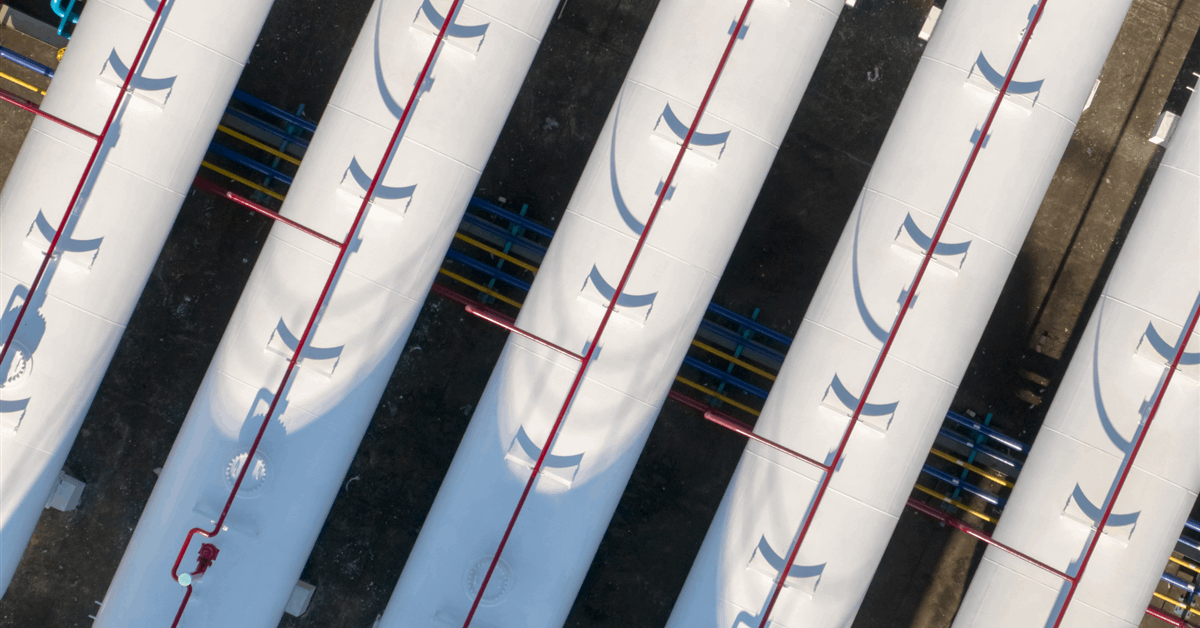

Halliburton has bagged a five-year contract to service Repsol SA’s property on the UK’s aspect of the North Sea.

“Halliburton will present subsurface know-how, drilling and completion companies, and digital options for main new developments”, Houston, Texas-based Halliburton stated in a press launch. The contract additionally covers decommissioning.

“The corporate will ship a rigless intervention framework that allows Repsol Sources UK to optimize nicely building, manufacturing, and intervention to maximise plug and abandonment operations”, Halliburton added.

“The 2 corporations intention to determine an trade customary for innovation and financial progress”.

Repsol-NEO JV

In March Spain’s Repsol and Aberdeen-based NEO Power Group Ltd. introduced a deal to consolidate their UK North Sea property. “The transaction will instantly place the brand new three way partnership as a market chief within the UKCS [UK continental shelf], with a projected 2025 manufacturing of roughly 130,000 barrels of oil equal per day”, a joint assertion stated.

The JV’s portfolio “will guarantee a gradual manufacturing stream and the pliability to capitalize on rising alternatives”, the businesses stated. “This sturdy asset base will allow the corporate to proceed to ship operational efficiencies whereas pursuing natural progress”.

Repsol UK holds pursuits in 48 producing and non-producing oil and fuel fields. NEO UK’s portfolio contains Penguins, Culzean, Gannet, Shearwater, Britannia Space and Elgin Franklin.

The brand new entity, which might be 45 p.c owned by Repsol and 55 p.c owned by NEO, will function 11 manufacturing hubs and “substantial undeveloped reserves”, the businesses stated.

“Repsol contributes operational capabilities on manufacturing, improvement, and decommissioning actions which will probably be mixed with NEO Power experience on monetary and business issues”, stated Repsol chief govt for exploration (E&P) and manufacturing Francisco Gea.

NEO UK chair John Knight commented, “The mixed firm has far more scale and variety and alternatives for value consolidation and portfolio high-grading giving resilience regardless of the powerful situations within the UK”.

“The advantages of synergies from consolidation will create a lot stronger worth creation, revenue and money movement yield for shareholders and extra choices for capital allocation selections nicely into the following decade”, Knight added.

The Repsol-NEO assertion added, “Aligned with market requirements within the UKCS, Repsol E&P will retain a [decommissioning] funding dedication as much as a nominal quantity of $1.8 billion, representing roughly 40 p.c of the decom liabilities associated to its legacy property. Repsol E&P will proceed to supply decommissioning safety for current Repsol E&P legacy property”.

NEO and Repsol anticipate to finish the transaction within the third quarter, topic to customary situations.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in power.