In an unique interview with Rigzone late Friday, David Seduski, the Head of North American Fuel at Power Points, revealed that the corporate thought the U.S. pure fuel worth rise that day was “overdone”.

“Our supply-demand balances haven’t moved a lot because of Hurricane Helene or latest climate modifications,” Seduski advised Rigzone. “Nevertheless, there are two components which are probably driving greater costs,” he added.

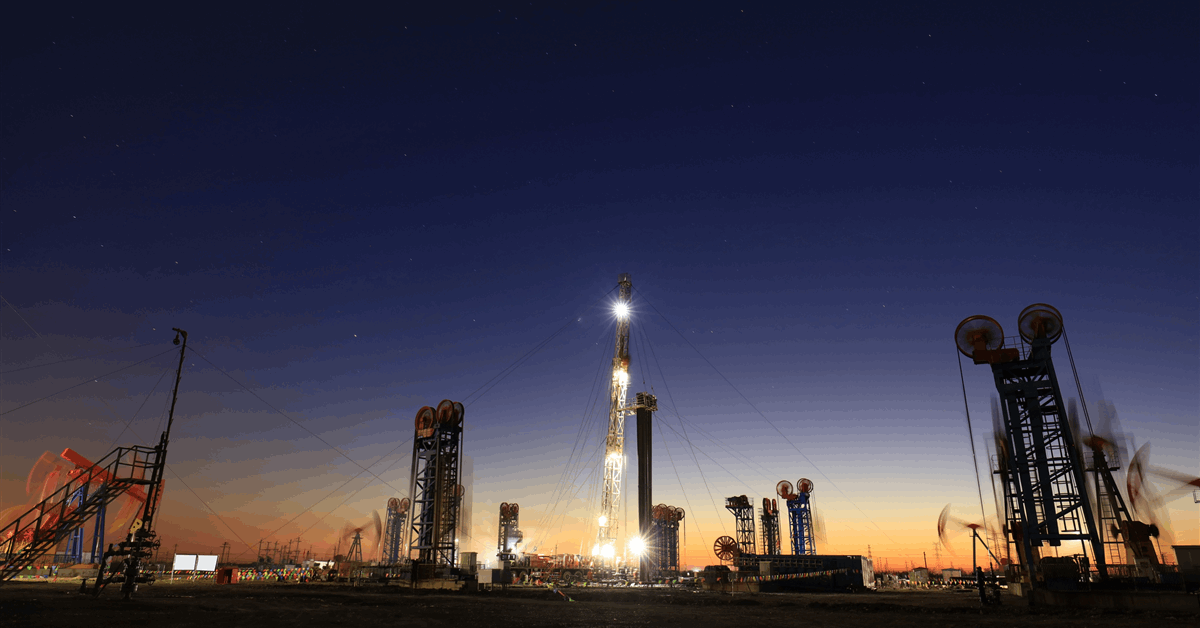

“One is Corpus Christi Stage 3, one of many two huge LNG feedgas demand tasks due on-line in 2025, has began testing its flares … [Friday] per unconfirmed reviews,” Seduski stated.

“This might not lead to a lot pure fuel demand within the short-term, as a result of there may be numerous onsite tools to ramp-up in addition to the flare, however it does point out that the mission is shifting ahead and receiving hydrocarbons,” he famous.

Seduski highlighted that the second issue “is persistently low manufacturing close to 100 billion cubic ft per day (bcfpd) that’s tightening balances within the short-term”.

“Helene has reasonably dented offshore manufacturing (although by about the identical quantity as we’re modelling energy demand losses), together with stagnant Permian manufacturing and upkeep that has minimize Appalachia output,” he said.

“That is extra short-term, in that we count on Gulf flows to recuperate as soon as the storm passes, Appalachia upkeep to fade by late October, and for brand spanking new pipelines to raise Permian output subsequent month, however it’s retaining provide low for now,” he added.

“That is weighing on every day injections and limiting the storage construct in the intervening time,” he went on to state.

In one other unique interview late Friday, Frederick J. Lawrence, the ex-Impartial Petroleum Affiliation of America (IPAA) Chief Economist, advised Rigzone that pure fuel costs rose final week “because of a mix of provide and demand-related components”.

“Concerning necessary climate impacts, Hurricane Helene turned a Class 3 hurricane and reached landfall in Florida late Thursday,” he added.

“The hurricane has brought about widespread energy outages and the prevalence of excessive winds, flooding, and storm surge might additionally impression vitality infrastructure, together with energy vegetation, energy transmission and distribution strains, and utilities getting ready for a big quantity of outages,” he went on to state.

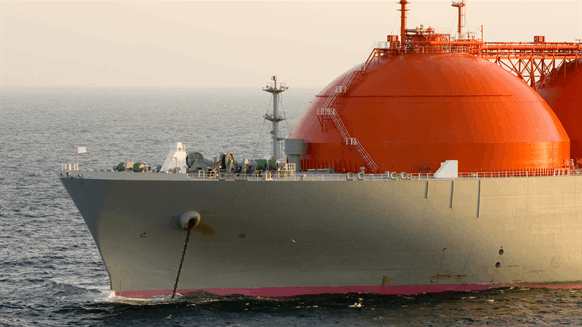

Lawrence additionally famous that “a number of the bigger Gulf of Mexico (GOM) producers have paused manufacturing within the GOM” and warned that “a number of U.S. ports are closed together with the Port of Tampa Bay”.

“As well as, port authorities in a number of states together with Louisiana and Texas have warned of a strike efficient September 30,” Lawrence added.

Within the Friday interview, Lawrence advised Rigzone that “final week, pure fuel provide remained unchanged” however added that “the hurricane might impression future provide in impacted producing areas within the southeast and Gulf of Mexico”. He additionally famous that “pure fuel demand rose final week”.

“The EIA pure fuel weekly reported that pure fuel costs rose 29 cents. Pure fuel demand was up 2.5 % (1.7 bcfpd) with pure fuel energy technology up 4.3 %,” he stated.

“Exports to Mexico have been additionally up 4.3 %. Baker Hughes information launched … [Friday] confirmed that pure gas-directed rigs added three rigs final week, rising to 99 because of greater costs however this might drop over the following week as a result of hurricane,” he added.

Lawrence additionally highlighted to Rigzone within the interview that “on Wednesday, massive fuel producer EQT reported that it plans to reverse some manufacturing curtailments within the October-November time-frame because of pure fuel worth will increase”.

“The corporate decreased manufacturing by one bcfpd within the spring with complete trade manufacturing curtailments reaching roughly two bcfpd in line with the corporate,” he stated.

The Henry Hub worth rose from a detailed of $2.585 per million British thermal models (MMBtu) on Thursday to a detailed of $2.902 per MMBtu on Friday.

The Bureau of Security and Environmental Enforcement (BSEE) issued its remaining replace on Helene on Sunday. In that replace, it famous that, from operator reviews, it estimates that roughly 3.35 % of the present oil manufacturing and 0.91 % of the present pure fuel manufacturing within the Gulf of Mexico is shut-in.

In an replace posted on its website on Friday, the BSEE estimated that roughly 24.39 % of the present oil manufacturing and 18.46 % of the present pure fuel manufacturing within the Gulf of Mexico had been shut-in.

To contact the writer, e mail andreas.exarheas@rigzone.com