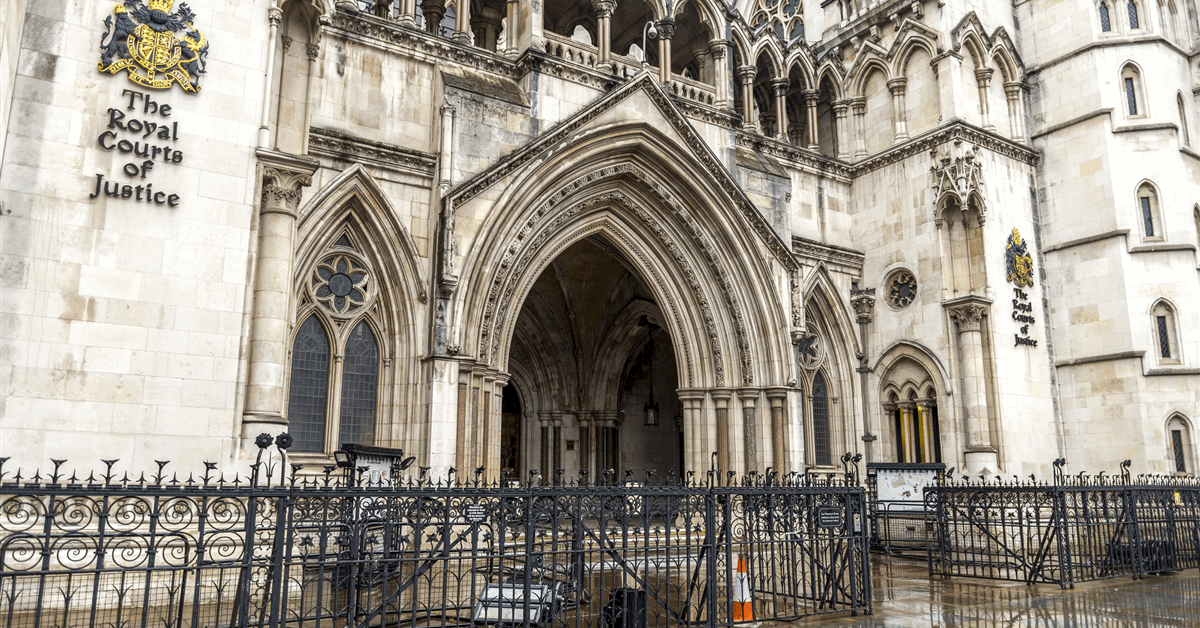

Petrofac Ltd. has obtained approval from the Excessive Court docket of England and Wales to implement its monetary restructuring plan that might unlock $355 million in new funding.

Nonetheless, an current attraction introduced by sure collectors linked with the Thai Oil undertaking is contesting the convening order earlier than the Court docket of Enchantment. The appellate courtroom reserved June 2-4 for the overview of the attraction, the Jersey-based vitality engineering firm stated in an internet assertion.

The funding unlocked by the courtroom approval will “considerably scale back the Group’s indebtedness, materially strengthening its monetary place”, Petrofac stated.

In its newest outcomes report, for the primary half of 2024, Petrofac noticed a year-on-year improve in internet losses of $26 million to $162 million resulting from “the continued impression of legacy contracts, the challenges in securing efficiency ensures and opposed working leverage”.

Petrofac has deferred the publication of its annual outcomes till after the restructuring effectivity date.

“Along with the assist displayed by shareholders, lenders, buyers and key shoppers, the Excessive Court docket’s sanctioning of the Restructuring Plan confirms it’s the greatest path ahead, and follows huge efforts to develop and implement it during the last 18 months”, stated chair René Medori.

“The broader Board and I are aware of the calls for this course of has positioned on all of the Group’s stakeholders”.

Medori additionally confirmed Aidan de Brunner will depart the board on Could 31, having joined to assist engagement with stakeholders in the course of the restructuring negotiations.

On December 23, 2024, Petrofac signed a lock-up take care of collectors laying the phrases for the monetary restructuring, which incorporates new debt and fairness.

The lock-up settlement “formalizes the in-principle settlement introduced by the Firm on 27 September 2024 with sure key stakeholders together with an advert hoc group of holders of senior secured notes and sure different senior secured noteholders, which collectively comprise roughly 57 % of the senior secured notes”, Petrofac stated in a press launch then.

Noteholders have a number of occasions prolonged a forbearance settlement with Petrofac, withholding themselves from pursuing their authorized claims over the corporate’s failure to pay $29 million in curiosity.

The lock-up settlement consists of dedicated new funding for Petrofac amounting to $325 million, comprising $194 million of recent fairness and $131 million of recent debt. The brand new fairness issuance is enabled by the advert hoc group of noteholders, new and current shareholders and an unnamed new investor. The brand new debt is pledged by the advert hoc group of noteholders, different noteholders and the brand new investor.

“The Firm might upsize the brand new fairness issuance by as much as US$25m in combination previous to the Restructuring Efficient Date, and it intends to undertake a retail providing of roughly US$8m in 2025”, Petrofac stated.

The agreed restructuring additionally includes the conversion of about $772 million of current debt into fairness, “which is able to considerably deleverage and strengthen the Group’s stability sheet”, Petrofac stated. “Put up-Restructuring whole gross debt (together with new funding) might be roughly $250m”.

Moreover core shoppers agreed on various efficiency safety for sure contracts awarded to Petrofac final yr and contracts anticipated to be awarded after the restructuring.

The restructuring additionally includes “extinguishing sure historic precise and contingent liabilities together with, notably, in relation to the Thai Oil Clear Fuels contract”, Petrofac stated.

Additionally agreed is a “transformation plan to formalize the assemble of the Group’s E&C, ETP and Asset Options supply models”.

Furthermore Petrofac’s board will see adjustments, together with the instalment of a brand new chair in 2025.

On the time, a remaining settlement was but to be reached on $72 million of recent efficiency assure amenities, which might allow the discharge of $56 million of money collateral to Petrofac.

On February 21, 2025, Petrofac stated it had secured agreements with buyers to facilitate the discharge of $80 million of money collateral that might be used to safe a efficiency bond in relation to a key contract. The association replaces the brand new assure amenities.

Petrofac additionally stated within the February replace it had determined to “supply sure collectors the chance to take part within the fairness elevate by as much as an incremental $25 million, on the similar worth as different buyers”.

“On the Restructuring Efficient Date, the prevailing shareholders of the Firm are anticipated to be allotted 2.2 % of the Firm’s whole share capital (versus the two.5 % outlined within the 23 December announcement)”, it added.

To contact the creator, e mail jov.onsat@rigzone.com