Petroleos Mexicanos’ losses are worsening, compounding a disaster for President Claudia Sheinbaum as she seeks to rescue the state oil driller from sliding output, money-losing refineries and virtually $100 billion in debt.

Pemex swung to a 190.47 billion-peso ($9.31 billion) loss throughout the remaining three months of 2024 from a meager 5 billion-peso revenue a yr earlier. It was the third straight interval of unfavorable outcomes and topped off a whopping $30 billion in pink ink for 2024, in line with figures launched Thursday.

The outcomes recommend little has modified for Pemex after a brand new administration took the reigns in October to rescue the world’s most-indebted main oil producer. The corporate is struggling to spice up output that has slumped to about half from its peak twenty years in the past. Crude and condensate manufacturing slipped by 10 p.c within the remaining three quarters of 2024 to 1.67 million barrels a day in contrast with a yr earlier.

“Crude manufacturing, not together with condensates, is on the lowest ranges since 1979, earlier than Pemex exploited its large oil deposits. It’s at all-time low,” stated Oscar Ocampo, an power analyst on the nonprofit Mexican Institute for Competitiveness. “In refining, the operational losses they’re delivering are large. The extra they refine, the extra money they lose.”

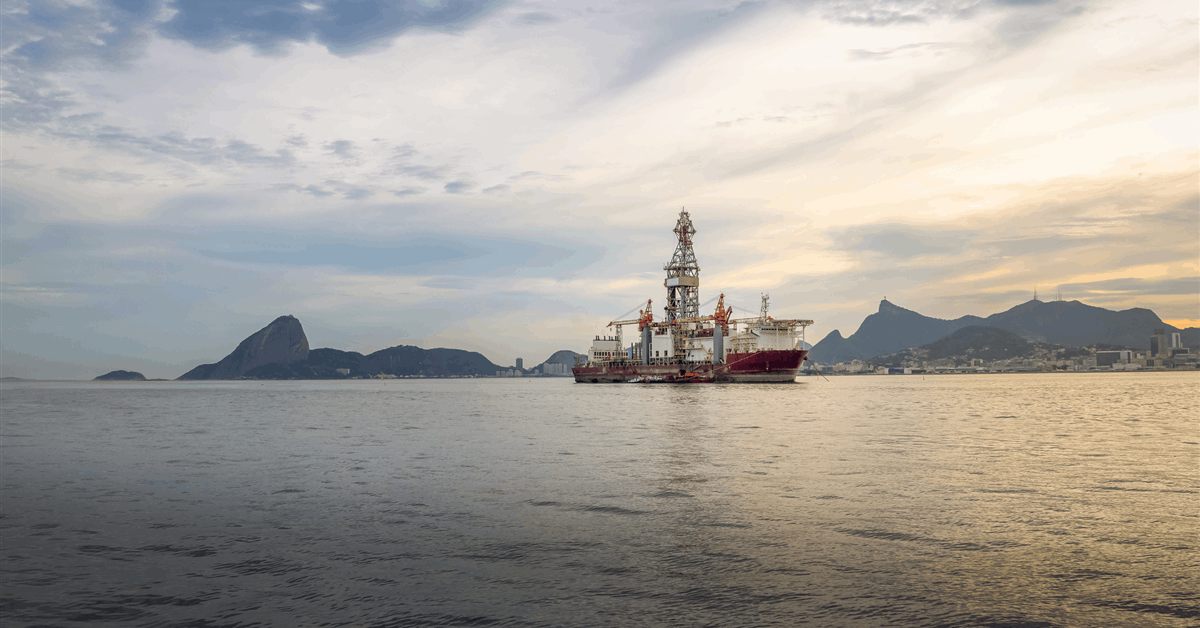

In the meantime, the corporate is struggling pay down a debt load of practically $100 billion as a weaker peso and growing older tools make it tougher for the corporate to generate money. Thursday’s outcomes present Pemex additionally borrowed roughly $7 billion from monetary establishments within the fourth quarter to assist attend to about $20 billion in excellent funds owed to oilfield-service suppliers, Finance Head Alberto Jimenez stated throughout a convention name with analysts.

Sheinbaum is betting a new regulation permitted by Mexico’s Senate Wednesday can flip Pemex round. The laws goals to spice up private-sector participation in power by permitting revenue sharing with Pemex in oil and pure fuel ventures. The regulation, which additionally goals to streamline allowing, would assure state-controlled power corporations Pemex and Comision Federal de Electricidad retain dominance within the sector.

It stays to be seen if the change will likely be sufficient to rescue Pemex, which has been dogged by lethal accidents, explosions, and oil spills in recent times, in addition to a fleet of refineries working at a fraction of full capability.

Dos Bocas, the corporate’s flagship refinery, processed zero oil in January as the corporate works to resolve an oil-contamination drawback. Pemex executives stated Thursday the issue was being resolved and Dos Bocas ought to return to operation within the coming days.

Mexico’s crude oil exports plummeted 34 p.c in January from the month prior as US oil refiners alongside the Gulf Coast and in Europe started snubbing Pemex oil laced with an excessive amount of water. At the least three of Mexico’s home refineries have shuttered operations in latest weeks as the corporate seeks to repair the difficulty.

Regardless of the setbacks, buyers have but to completely abandon Pemex as authorities monetary assist is predicted to stay steadfast, at the same time as the corporate stares down its largest debt funds within the subsequent years, in line with Christine Reed, a portfolio supervisor at Ninety One in New York.

‘Too Huge to Fail’

“We haven’t seen the enhancements within the effectivity of the corporate that we’d wish to, however the assist from the federal government is as robust because it ever was and that provides you a number of consolation as an investor,” Reed stated earlier than the outcomes had been introduced. “We want to see the corporate develop into extra productive, which is a problem.”

Final yr, beneath investor stress Pemex administration issued a sustainability plan focusing on a 54 p.c lower to greenhouse fuel emissions by 2030, nevertheless it’s unclear the way it will give you the money for inexperienced initiatives whereas it scrambles to pay debt, enhance manufacturing and produce its refineries again on-line.

“We aren’t anticipating any main modifications from Pemex within the close to time period,” stated Jared Lou, a portfolio supervisor at William Blair in New York. “We view the establishment as too large to fail.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback will likely be eliminated.

MORE FROM THIS AUTHOR

Bloomberg