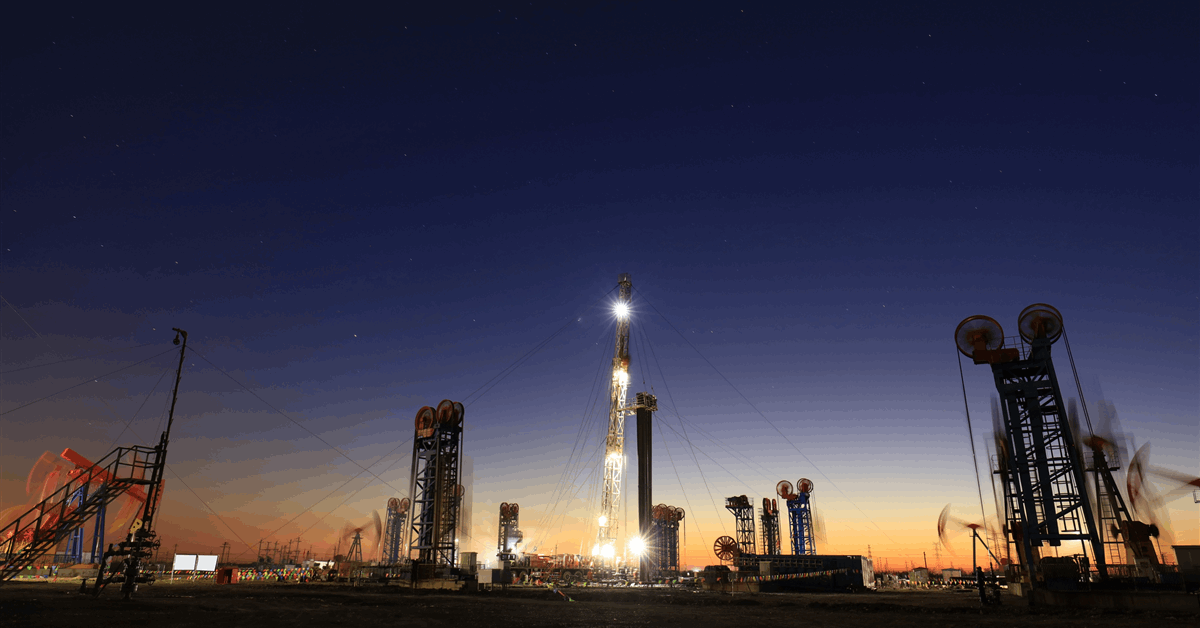

Ovintiv Inc mentioned Tuesday it has entered right into a definitive settlement to divest considerably all its Anadarko property, situated on Oklahoma’s aspect of the basin, to an undisclosed purchaser for $3 billion.

The disposition is a part of Ovintiv’s “portfolio transformation” beneath which the Denver, Colorado-based oil and gasoline producer just lately accomplished a $2.7-billion transaction to accumulate NuVista Power Ltd. Calgary, Canada-based NuVista owns property adjoining to Ovintiv’s Alberta Montney place.

Ovintiv mentioned in a web based assertion Tuesday the Anadarko sale would assist it obtain its goal to chop debt to $4 billion. As of the third quarter of 2025 it had $5.21 billion of debt, together with present debt, and $3.3 billion of liquidity, together with $25 million in money and money equivalents.

Ovintiv plans to publish its This autumn 2025 outcomes, Q1 2026 steerage and new shareholder return framework February 23.

“The [Anadarko] sale consists of roughly 360,000 web acres, which represents considerably the entire firm’s acreage within the play”, Ovintiv mentioned. “Month to this point manufacturing in February is roughly 90,000 barrels of oil equal per day together with roughly 27,000 barrels per day of oil and condensate, roughly 240 million cubic ft per day of pure gasoline and roughly 23,000 barrels per day of pure gasoline liquids”.

Ovintiv president and chief government Brendan McCracken mentioned of the Anadarko sale, “This transaction marks a big milestone by focusing our portfolio, delivering on our debt goal and unlocking elevated returns to our shareholders”.

“Now we have constructed one of many deepest premium stock positions in our trade within the two Most worthy performs in North America, the Permian and the Montney”, McCracken added.

Ovintiv expects to finish the sale within the second quarter topic to customary circumstances.

On February 3 Ovintiv mentioned it had consummated its buy of NuVista, wherein the debt-inclusive buy worth consisted of fifty p.c money and 50 p.c Ovintiv frequent inventory.

The acquisition of NuVista provides Ovintiv round 930 web 10,000-foot equal properly areas and roughly 140,000 web acres, of which about 70 p.c are undeveloped, within the core of the Alberta Montney, based on Ovintiv. Ovintiv expects the property to supply about 100,000 barrels of oil equal a day this yr.

“The property are instantly adjoining to Ovintiv’s present operations and embody entry to processing and downstream infrastructure with vital out there capability”, Ovintiv mentioned in a press launch.

McCracken mentioned of the merger, “We count on to generate price synergies of roughly $100 million yearly, together with per-well price financial savings of roughly $1 million, per our present Montney properly prices”.

In its announcement of the NuVista deal November 4, 2025, Ovintiv mentioned it might fund the acquisition with money available, borrowings from its current credit score facility and a time period mortgage.

Ovintiv mentioned then it had additionally paused its share buyback program for 2 quarters. “Ovintiv’s bolt-on acquisition exercise has successfully been paused till the share buyback program has resumed”, it mentioned. “The corporate’s base dividend is anticipated to stay unchanged”.

“As soon as the corporate has decreased non-GAAP web debt to or beneath its long-term goal of $4 billion, Ovintiv plans to replace its capital allocation framework to direct a larger portion of its post-dividend non-GAAP free money circulation to shareholder returns”, Ovintiv mentioned on the time.

To contact the writer, e mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert neighborhood that can empower your profession in power.