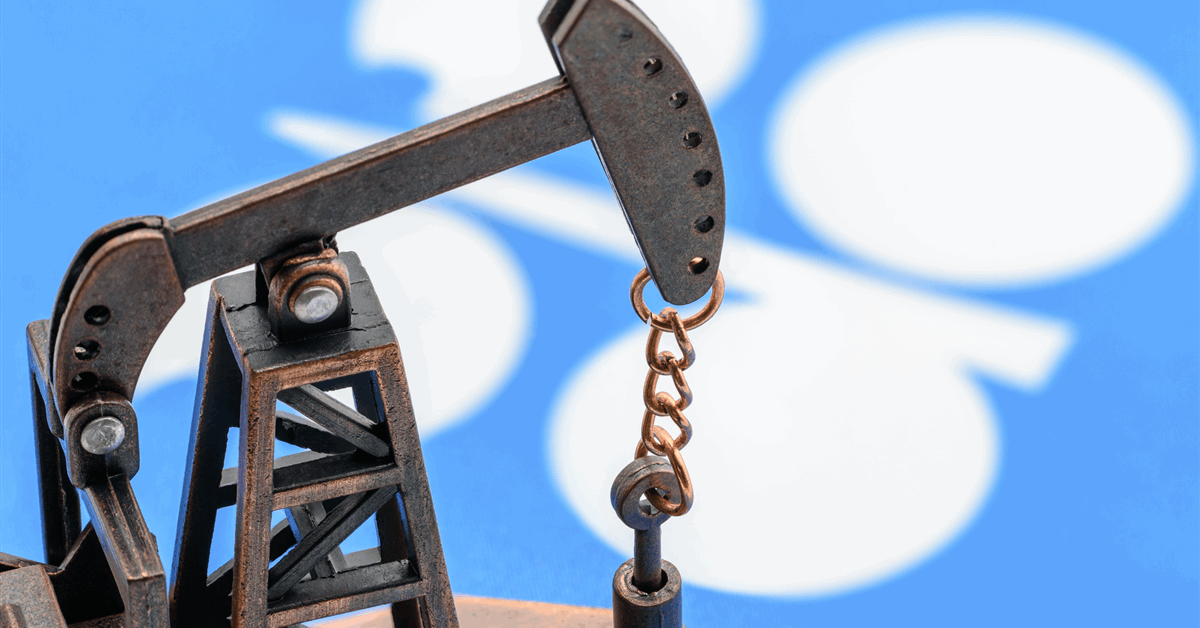

OPEC+ is contemplating accelerating its manufacturing will increase by discussing a possible hike of greater than 411,000 barrels a day for July because it seeks to recoup misplaced market share, in keeping with individuals accustomed to the matter.

Eight key members of the Group of the Petroleum Exporting Nations and its companions, led by Saudi Arabia, are as a consequence of maintain a video convention on Saturday to debate output coverage. Their final two calls resulted in super-sized manufacturing will increase that drove down costs, and the cartel might go even additional this time, the individuals stated.

Some delegates among the many eight nations stated they had been unaware of plans for an outsize increase and anticipated a rise nearer to the 411,000-barrel-a-day hikes set for Might and June. But the group’s deliberations are more and more confined to a smaller group of its strongest members, who generally solely share selections with their counterparts at brief discover.

OPEC+ has made a radical coverage shift from defending costs to actively looking for to drive them decrease. It shocked merchants in early April by saying a provide enhance that was thrice the quantity deliberate. The transfer got here at the same time as markets faltered amid slowing demand and President Donald Trump’s commerce conflict, briefly dragging crude to a four-year low beneath $60 a barrel, and was repeated the next month.

Brent futures slipped to commerce beneath $64 a barrel in London on Friday.

Kazakhstan’s Deputy Vitality Minister Alibek Zhamauov had already alluded to the potential for an larger surge in feedback to reporters on Thursday. “There shall be a hike, however whether or not it is going to be 400, 500, 600, we don’t know — that shall be introduced on Saturday,” he stated in Astana, in keeping with the information company.

Delegates have supplied a variety of explanations for the pivot by Riyadh. Some assert that OPEC+ is solely satisfying strong demand, whereas others say Saudi Arabia seeks to punish members like Kazakhstan and Iraq for dishonest on their output quotas. Officers have additionally recommended the dominion is making an attempt to appease Trump, or to reclaim the market share relinquished to US shale drillers and different rivals. The last word motive might mix a number of of those aims.

If Riyadh’s technique was to self-discipline the cartel’s quota cheats via a “managed sweating,” it doesn’t appear to be working.

Kazakhstan, probably the most blatant offender, continues to exceed its limits by a number of hundred thousand barrels a day and has publicly acknowledged that it has no plans to atone. Vitality Minister Yerlan Akkenzhenov advised reporters on Thursday that the nation can neither implement cutbacks on worldwide company companions, or dial again at state-run fields.

The technique transition hasn’t been and not using a value. Whereas crude’s pullback presents aid for shoppers and central banks grappling with cussed inflation, it poses monetary peril for oil producers in OPEC+ and all over the world.

The Worldwide Financial Fund estimates the Saudis want costs above $90 to cowl the lavish spending plans of Crown Prince Mohammed bin Salman. The dominion is contending with a hovering price range deficit, and has been pressured to chop funding on flagship tasks such because the futuristic metropolis, Neom.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback shall be eliminated.