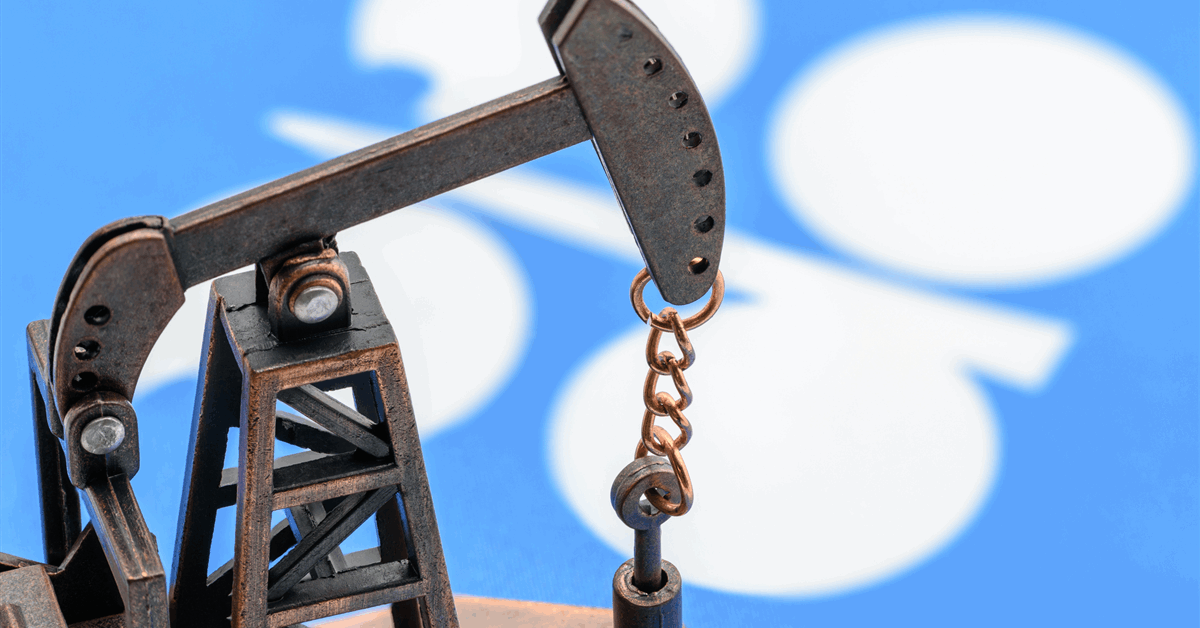

OPEC+ members are discussing making a 3rd consecutive oil manufacturing surge in July, to be determined on the group’s assembly in simply over per week, delegates stated.

An output hike of 411,000 barrels a day for July — triple the quantity initially deliberate — is amongst choices below dialogue, though no ultimate settlement has but been reached, stated the delegates, asking to not be named as a result of the knowledge is non-public. A ultimate choice is because of be taken at a gathering on June 1.

The cartel has helped sink crude costs since asserting 411,000-barrel hikes for Could and June — equal to about 1% of present OPEC+ output — in a historic break with years of defending oil markets. Oil made a recent plunge on Thursday, dropping 0.9% to $64.31 a barrel as of 9:13 a.m. in London.

Whereas OPEC+ says the provision will increase are to fulfill demand, officers have privately proffered a variety of motives, from punishing over-producing members to recouping market share and placating President Donald Trump.

Group chief Saudi Arabia warned errant members comparable to Kazakhstan and Iraq at their final assembly that it might ship additional manufacturing will increase until they fall consistent with their quotas. Regardless of some guarantees of atonement, the Kazakhs have made little effort to rein in worldwide oil corporations working within the nation and proceed to export close to report ranges.

“Our name is for one more 411,000 barrel-a-day enhance within the OPEC quota in July, much like Could and June,” stated Martijn Rats, world oil strategist at Morgan Stanley. “Compliance by the over-producing international locations has not modified a lot, and to this point, the earlier quota will increase have been absorbed by the market.”

In a Bloomberg survey, 25 of 32 merchants and analysts predicted OPEC+ will certainly approve a hike of 411,000 barrels a day. 5 stated they anticipate the group to revert to a earlier schedule of extra modest will increase, with a lift of 138,000 barrels.

Coinciding with the launch of Trump’s commerce warfare in April, the shock provide hikes from OPEC+ initially took a brutal toll on oil costs, sending crude to a four-year low close to $60 a barrel in London. Futures have recovered since then because the White Home rolled again a few of its tariffs.

Even so, many forecasters now have a bearish outlook for the market this yr. Final week, the Worldwide Power Company predicted that world oil demand progress will gradual through the the rest of 2025 after a strong first quarter because of financial headwinds.

Consequently, Goldman Sachs Group Inc. has predicted that the Group of the Petroleum Exporting Nations and its companions will pause additional hikes after agreeing on the rise for July.

Eight key OPEC+ nations will maintain a video-conference on June 1 to settle July manufacturing ranges. The complete 22-nation alliance may even maintain a set of digital conferences on Could 28, the place it can have the chance to assessment underlying manufacturing quotas for 2025 and 2026.

“If there may be certainly a shift in coverage towards market share and away from value protection, it then is sensible to unwind shortly,” stated Harry Tchilinguirian, head of oil analysis and analytics at Onyx Commodities Ltd. “It’s just a little like a band-aid: you pull it off in a single swoop and never slowly.”

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback can be eliminated.

MORE FROM THIS AUTHOR

Bloomberg