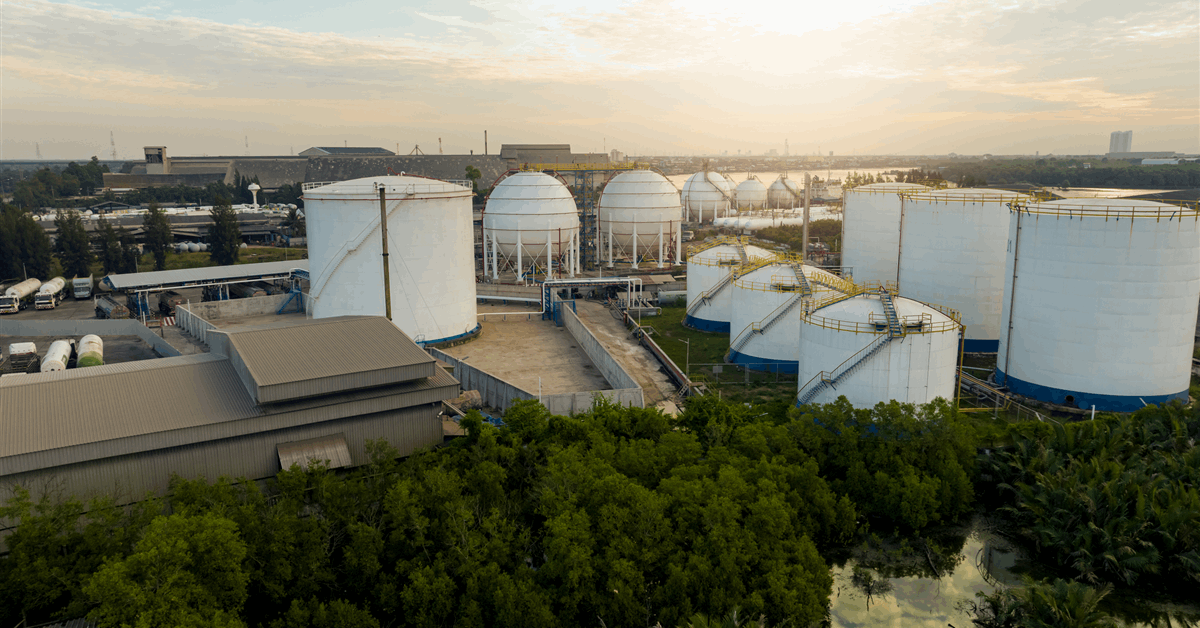

ONEOK, Inc. and MPLX LP are forming a three way partnership that goals to construct a large-scale liquefied petroleum gasoline (LPG) export terminal and pipeline in Texas.

The LPG terminal, to be constructed in Texas Metropolis, Texas, may have a capability of 400,000 barrels per day (bpd) and can connect with ONEOK’s Mont Belvieu storage facility through a brand new 24-inch pipeline, the midstream operator stated in a information launch. The power will deal with primarily low ethane propane (LEP) and regular butane (NC4), with ONEOK and MPLX every contractually reserving 200,000 bpd for his or her respective clients.

The three way partnership Texas Metropolis Logistics LLC (TCX) shall be 50/50 owned by ONEOK and MPLX. The 2 firms will contribute $700 million every in funding, for a complete of $1.4 billion.

MPLX will assemble and function the power, which is predicted to be accomplished in early 2028. The terminal will leverage MPLX dad or mum Marathon Petroleum Company (MPC)’s present location and infrastructure, “offering building timing and price advantages,” based on the discharge.

In the meantime, the pipeline three way partnership MBTC Pipeline LLC is owned 80 p.c by ONEOK and 20 p.c by MPLX, and the previous will assemble and function the pipeline. ONEOK’s and MPLX’s share of the whole funding within the pipeline is predicted to be roughly $280 million and $70 million, respectively, for a complete of $350 million.

ONEOK stated its share of capital funding within the tasks shall be roughly $1.0 billion.

“We’re excited to collaborate with MPLX on these strategically situated tasks which broaden and lengthen our NGL worth chain offering extra optionality and worth to our clients,” ONEOK President and CEO Pierce Norton II stated. “Given our excessive expectations for future progress and demand for extra power infrastructure, together with export capability, these tasks with MPLX complement our disciplined capital allocation technique”.

MPLX describes itself as a diversified, growth-oriented grasp restricted partnership fashioned in 2012 by MPC to personal, function, develop and purchase midstream power infrastructure belongings. The partnership gives providers within the midstream sector throughout the hydrocarbon worth chain.

EnLink Midstream Acquisition Closed

In the meantime, ONEOK introduced the closing of its acquisition of EnLink Midstream, LLC.

ONEOK acquired all the excellent publicly held widespread items of EnLink for $4.3 billion in ONEOK widespread inventory. The transaction was introduced in November 2024.

EnLink unitholders, apart from ONEOK, acquired 0.1412 shares of ONEOK widespread inventory for every excellent EnLink widespread unit. EnLink widespread items will not be publicly traded on the New York Inventory Alternate.

ONEOK issued roughly 37.0 million shares in reference to the transaction, representing roughly 6.0 p.c of the whole ONEOK shares excellent.

“The completion of this acquisition additional enhances ONEOK’s built-in midstream enterprise and gives distinctive worth to all stakeholders, together with EnLink unitholders who we now welcome as ONEOK shareholders,” Norton stated in a separate assertion.

“We welcome EnLink’s staff to the ONEOK staff,” Norton stated. “We look ahead to the various advantages this acquisition can present”.

In October 2024, ONEOK accomplished its acquisition of World Infrastructure Companions’ (GIP) whole curiosity in EnLink for a complete money consideration of roughly $3.3 billion.

To contact the creator, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback shall be eliminated.