Oil plunged by greater than 7% as Iran’s response to US army strikes spared vitality infrastructure, allaying investor considerations that the battle would severely disrupt provides from the Center East.

West Texas Intermediate slumped under $70 a barrel after Iran fired missiles at a US air base in Qatar in retaliation for President Donald Trump’s weekend airstrikes on three of its nuclear amenities. Merchants had initially feared that Iran’s retaliatory response would contain a closure of the Strait of Hormuz chokepoint, by which a couple of fifth of the world’s oil passes. The barrage was intercepted and didn’t end in any casualties, Qatar mentioned.

Costs traded in a $10-a-barrel vary on Monday, first rising by greater than 6% solely to drop much more, underscoring simply how on edge merchants are and the way vital each growth within the area is to international vitality markets.

“Crude is pulling again because the market digests indicators that vitality infrastructure isn’t Iran’s first alternative for retaliation,” mentioned Rebecca Babin, a senior vitality dealer at CIBC Non-public Wealth Group. “There are indications the US could have had advance warning of the strikes, suggesting this was extra of a face-saving transfer than a real escalation.”

The Center East accounts for a couple of third of worldwide crude manufacturing and there haven’t but been any indicators of disruption to bodily oil flows, together with for cargoes going by the Strait of Hormuz. Since Israel’s assaults started earlier this month, there have been indicators that Iranian oil shipments out of the Gulf have risen somewhat than declined.

Whereas costs could also be cooling for now, vital provide threats linger as tensions stay excessive throughout the Center East. Saudi Arabia condemned Iran’s assault on Qatar and mentioned it was able to assist Qatar with any measures it takes.

Worries about demand are additionally beginning to creep in as a number of nations together with Kuwait, Bahrain, and Iraq mentioned they briefly closed airspace, roiling international air journey.

Iran’s transfer compounded earlier worth weak spot after Trump warned in opposition to rising oil costs in a social media put up, urging the Power Division to facilitate extra drilling “now.” Power Secretary Chris Wright replied, “We’re on it.”

The oil market has been gripped by an intensifying disaster since Israel attacked Iran greater than per week in the past, with crude benchmarks pushing larger, choices volumes spiking, and the futures curve shifting to replicate fears of a near-term interruption to provides.

US crude’s immediate unfold — the distinction between its two nearest contracts — first widened to as a lot as $2.24 a barrel in a bullish backwardation construction, from $1.18 on Friday. The intently adopted metric then retraced a lot of that transfer.

The unprecedented US strikes have been meant to hobble Iran’s nuclear program, and focused websites at Fordow, Natanz, and Isfahan. Tehran warned earlier that the strikes would set off “eternal penalties.”

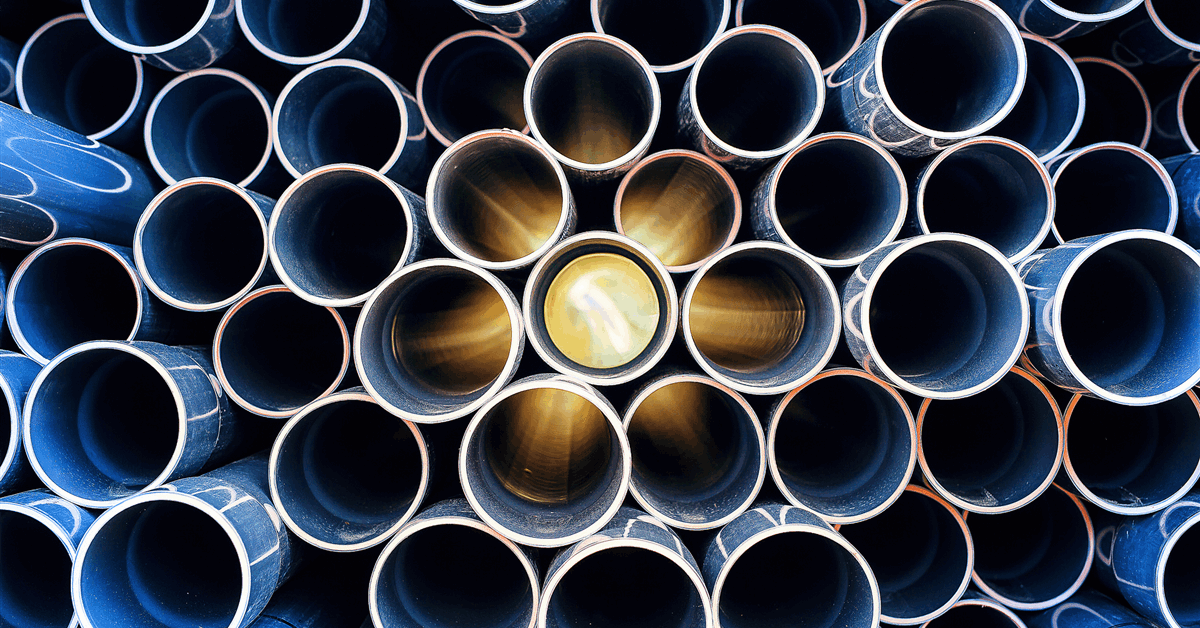

There stay a number of, overlapping dangers for crude flows. The most important of these facilities on the Strait of Hormuz, ought to Tehran search to retaliate by trying to shut the slender conduit. A few fifth of the world’s crude output passes by the waterway on the entrance to the Persian Gulf.

Navies within the area have constantly warned about an elevated risk to tankers, although a liaison between the army and delivery mentioned on Sunday that the continued passage of vessels by the Strait is “a constructive signal for the speedy future.” Two supertankers U-turned away from the strait on Sunday, earlier than subsequently resuming on their authentic course and heading to transit the chokepoint.

Iran’s parliament has referred to as for the closure of the strait, in response to state-run TV. Such a transfer, nevertheless, couldn’t proceed with out the approval of Supreme Chief Ayatollah Ali Khamenei. Authorities could but prohibit flows in different methods.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert group that may empower your profession in vitality.