Oil fell after the shut, wiping out a day of features after US President Donald Trump stated he had been assured that Iran would cease killing protesters, signaling he may maintain off on a threatened navy response to the repression of widespread demonstrations within the nation.

West Texas Intermediate was down as a lot as 3% after settlement on Wednesday, dropping to round $59 a barrel in a fast reversal earlier than paring a few of these losses. Costs had settled on Wednesday at $62.02. Oil had gained in every of the final 5 classes as merchants awaited the US response to political upheaval in Iran, with the US shifting navy employees and Tehran warning neighboring nations in opposition to helping an assault.

Considerations a few disruption to Iran’s roughly 3.3 million barrel-per-day manufacturing and key transport lanes had helped push costs to their highest since October.

However costs fell sharply after US President Donald Trump advised reporters within the Oval Workplace Wednesday, “we have been advised that the killing in Iran is stopping – it is stopped.” The feedback lessened expectations of an instantaneous US navy response to the demonstrations in opposition to the federal government of Supreme Chief Ayatollah Ali Khamenei. Trump stated he can be “very upset” if the data proved unfaithful and the violent crackdown continued.

Oil has pushed larger within the new yr as turmoil in OPEC’s fourth-largest producer, together with upheaval in Venezuela, restored a premium to costs following a run of 5 month-to-month losses spurred by expectations for a glut.

The bumper rally in crude over latest days had caught off guard a market that had been steeped with bearish bets, whereas additional boosts got here from bullish choices wagers, the place volumes soared to a report this week, and an annual commodity index rebalancing that added inflows to crude markets.

On the bodily entrance, a authorities report confirmed that US crude stockpiles rose 3.4 million barrels final week, the most important improve in two months however smaller than forecast by a intently adopted trade report. The market’s ambivalence signifies that investor focus is decisively pointed on the drama unfolding in Iran. Refined product stockpiles additionally elevated.

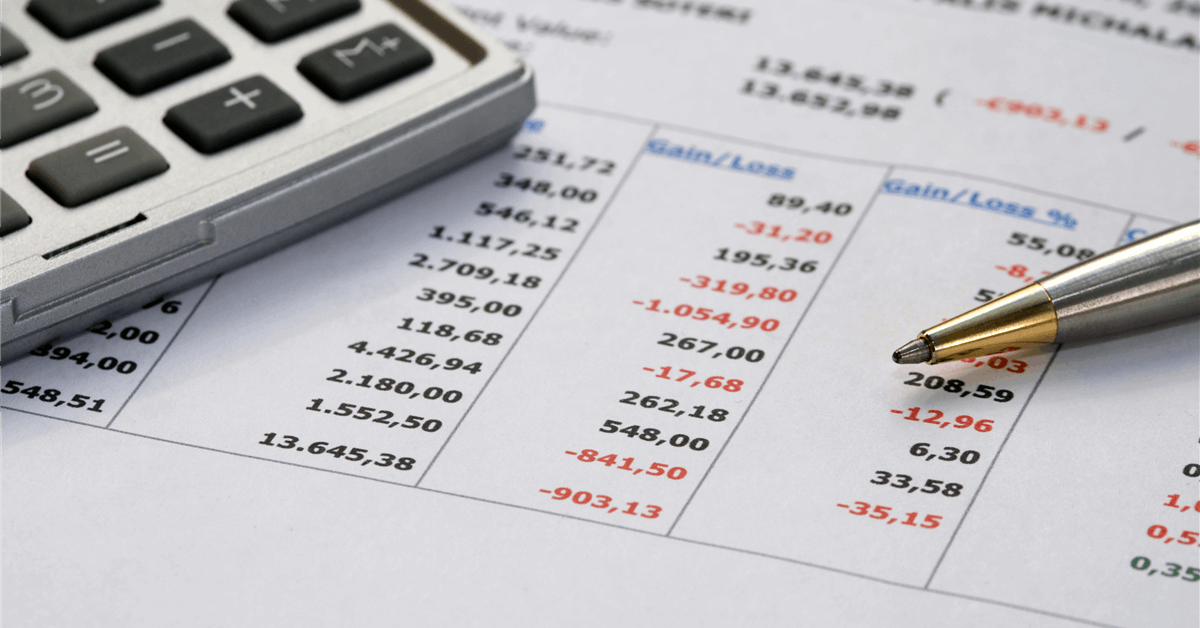

Oil Costs

- WTI for February supply fell 1.6% to $60.16 a barrel at 3:53 p.m. in New York after beforehand settling at $62.02.

- Brent for March settlement fell 1.5% to $64.48 a barrel after beforehand settling at $66.52.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in power.