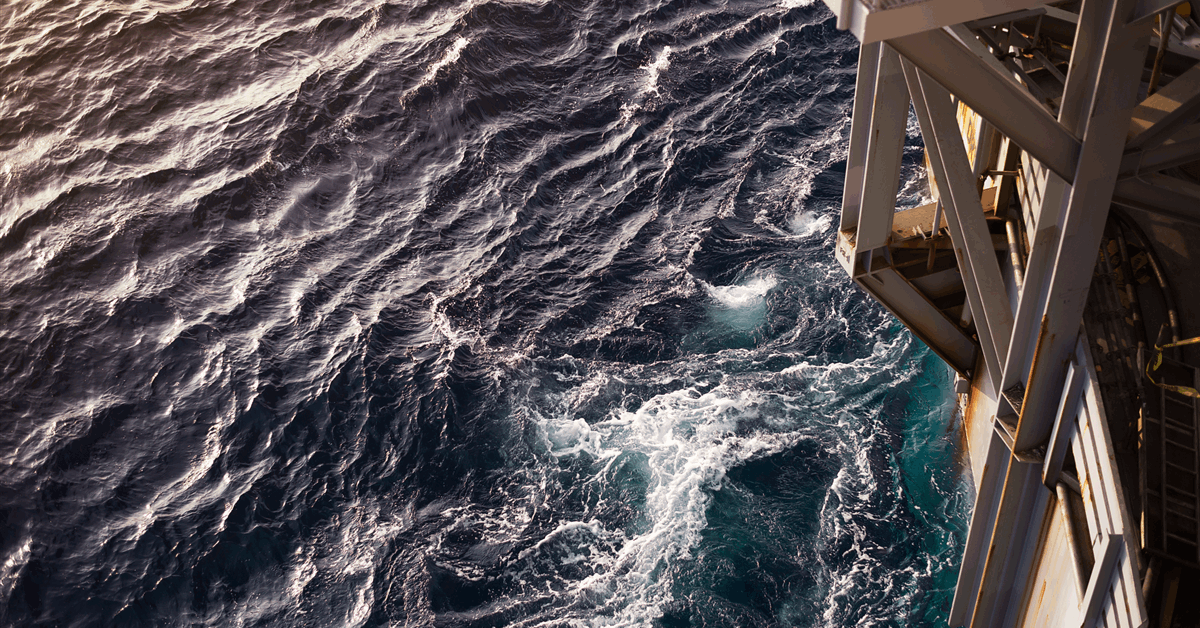

Oil rose 1.4% to settle above $64 a barrel as tightening US crude and gas inventories eased investor fears a couple of looming provide glut.

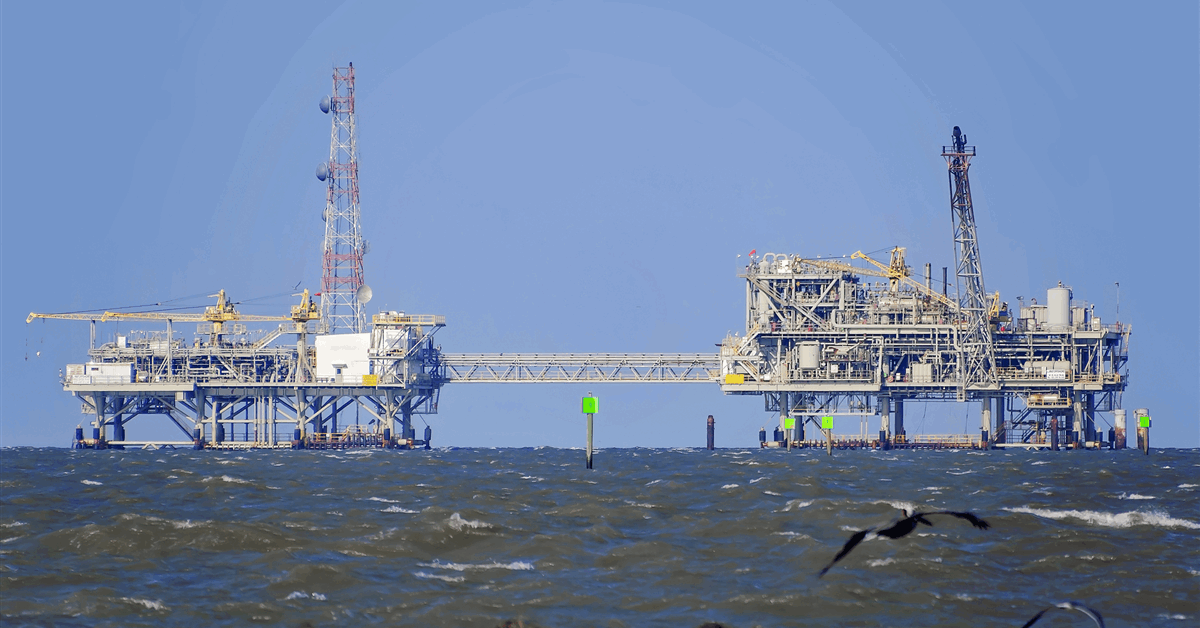

Whereas costs proceed to commerce inside a $5 band this month, West Texas Intermediate’s so-called immediate unfold — a measure of provide tightness — strengthened to the widest in additional than every week. The transfer adopted a US authorities report displaying stockpiles on the key Cushing, Oklahoma, storage hub fell for the primary time in eight weeks whereas nationwide crude inventories declined by 2.4 million barrels, greater than anticipated.

Gas provides additionally contracted, suggesting demand stays sturdy regardless of tariffs weighing on longer-term consumption expectations. The bullish knowledge belies a worsening world commerce backdrop that has contributed to a 12% drop in US oil futures this yr.

The US on Wednesday raised its tariff on some Indian items to 50% — the very best levy utilized to any Asian nation — to punish the nation for purchasing Moscow’s oil. However Indian processors plan to keep up the majority of their purchases, suggesting the commerce limits gained’t ease investor worries a couple of world provide surplus, Arne Lohmann Rasmussen, chief analyst at A/S International Threat Administration. With OPEC+ unwinding output curbs, the Worldwide Power Company has warned of a document glut subsequent yr.

Trump, in the meantime, has lauded falling oil costs, saying Tuesday that crude futures would break $60 a barrel “fairly quickly.”

Oil Costs

- WTI for October supply rose 1.4% to settle at $64.15 a barrel in New York.

- Brent for October settlement added 1.2% to settle at $68.05 a barrel.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in knowledgeable neighborhood that can empower your profession in power.