Oil rose as merchants weighed the availability impression from disruptions within the Black Sea area together with broader market gyrations within the wake of President Donald Trump’s ambitions to take over Greenland.

West Texas Intermediate’s February contract, which settled Tuesday, rose 1.5% to settle above $60. The extra lively March contract rose by an analogous quantity. Provide disruptions have helped help costs, with Kazakhstan’s largest oil producer not too long ago halting manufacturing on the Tengiz and Korolev fields after two fires at energy mills. The Tengiz subject will likely be shut for an additional seven to 10 days, Reuters reported.

Kazakhstan had already diminished oil manufacturing after drone strikes affecting the Caspian Pipeline Consortium’s transport terminal in Russia, which is the outlet for about 80% of Kazakh exports.

“Crude is buying and selling larger this morning on ongoing considerations round CPC loadings, which have remained constrained following current Ukrainian assaults,” mentioned Rebecca Babin, a senior power dealer at CIBC Non-public Wealth Group. “On the identical time, broader geopolitical dangers stay elevated, conserving merchants targeted intently on headlines.”

In the meantime, Trump unleashed recent social media assaults in opposition to allies, with European leaders signaling a robust response to potential US tariffs over the semi-autonomous territory of Denmark.

The escalation of tensions has pressured inventory markets, helped ship gold and silver to document highs and raised the specter of a US-EU commerce warfare that might dent world progress and drag down oil costs with it. However to this point, the direct impression on crude costs has been extra muted.

“Development considerations because of tariff threats weigh on threat sentiment,” mentioned Giovanni Staunovo, a commodity analyst at UBS Group AG. “Oil is, like fairness markets, not resistant to it.”

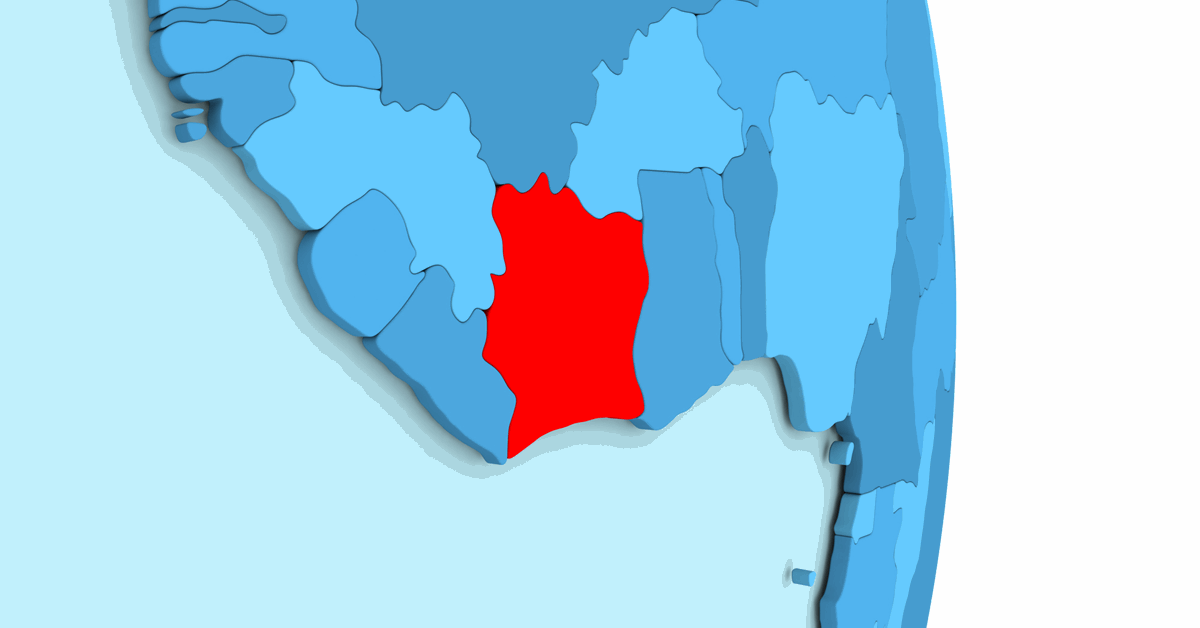

Any new downward strain on costs would add to broader considerations about crude provide outpacing demand, with the Worldwide Vitality Company forecasting a significant overhang of greater than 3.8 million barrels a day this 12 months. Additional provide might emerge from Venezuela, the place the US is scaling up its involvement within the South American nation’s oil trade after its seize of President Nicolas Maduro.

“The outlook for a big surplus suggests costs ought to development decrease, whereas the potential for an extra escalation in US-EU tensions poses additional draw back threat,” mentioned Warren Patterson, head of commodities technique at ING Groep NV.

Elsewhere, Center Jap crude costs are diverging, with heavier grades rising cheaper relative to lighter barrels, a shift that’s encouraging Asian refiners to favor medium and bitter crudes to spice up margins. Chilly climate within the US can be serving to push diesel costs larger, with futures settling 4.5% larger on Tuesday.

Oil Costs

- WTI for February supply, which expired Tuesday, rose 1.5% to settle at $60.34 a barrel in New York

- The extra lively March contract gained 1.7% to $60.36 a barrel.

- Brent for March settlement added 1.5% to settle at $64.92 a barrel.

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that may empower your profession in power.