Oil rose as bodily markets within the US strengthened and demand from China confirmed indicators of selecting up.

West Texas Intermediate futures climbed 1.4% to settle above $77 a barrel, whereas Brent superior to high $82. Buying and selling volumes had been muted as a number of market contributors attend Worldwide Vitality Week in London, a serious trade gathering, the place they’re set to weigh the outlook for oil this 12 months.

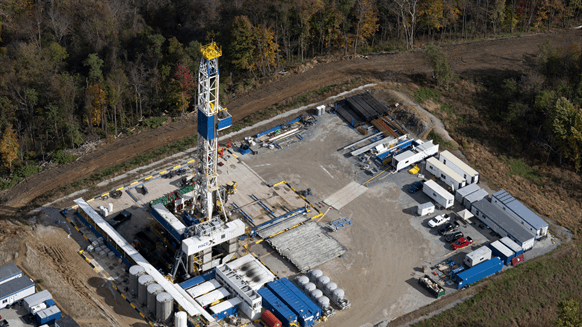

US bodily crude costs strengthened in latest weeks to the highs of the 12 months as refineries benefiting from sturdy margins snapped up barrels and international patrons turned to American crude to keep away from Pink Sea delivery points.

Costs additionally bought help from a quick shutdown in exports from an oil discipline in western Libya throughout the weekend and stepped-up US and allied strikes on Houthi targets to fight industrial delivery disruptions within the Pink Sea area.

Some constructive indicators on demand are also rising. In China, a growth in journey throughout the Lunar New Yr holidays has raised hopes of a extra sustained restoration in consumption. Native refiners have been snapping up cargoes from the world over for the reason that mid-February vacation, based on merchants, in addition to having elevated time period provides from Saudi Arabia for March.

Merchants are awaiting US inflation information that may form expectations for when the Federal Reserve will begin slicing rates of interest. In wider markets, a gauge of the US foreign money was regular, whereas most different commodities, together with copper, had been weaker.

Oil has traded in a slender band for the previous two weeks, with tensions within the Center East and OPEC+ provide curbs offsetting the impression of upper manufacturing from outdoors the group, together with the US.

“Oil costs ought to keep anchored close to time period” amid “substantial non-OPEC+ provide development over the subsequent few years,” Francisco Blanch, commodity strategist at Financial institution of America Corp., mentioned in a report.

The cartel and allies together with Russia are broadly anticipated to lengthen their present cutbacks into the subsequent quarter at their assembly early subsequent month.

Costs:

- WTI for April supply rose 1.4% to settle at $77.58 a barrel.

- Brent for April settlement was up 1.1% at $82.53 a barrel.