Oil climbed as US President Donald Trump warned Hamas of stark penalties if it would not comply with his plan to finish the struggle in Gaza. The feedback overshadowed an impending OPEC+ choice on crude provides.

West Texas Intermediate futures rose 0.7% to settle close to $61 a barrel, however have been down 7.4% for the week. Trump set a Sunday night deadline for Hamas to just accept his proposal. The president earlier mentioned Israel would have his “full backing” to destroy Hamas, which has been designated a terrorist group by the US and EU, if it rejects the deal.

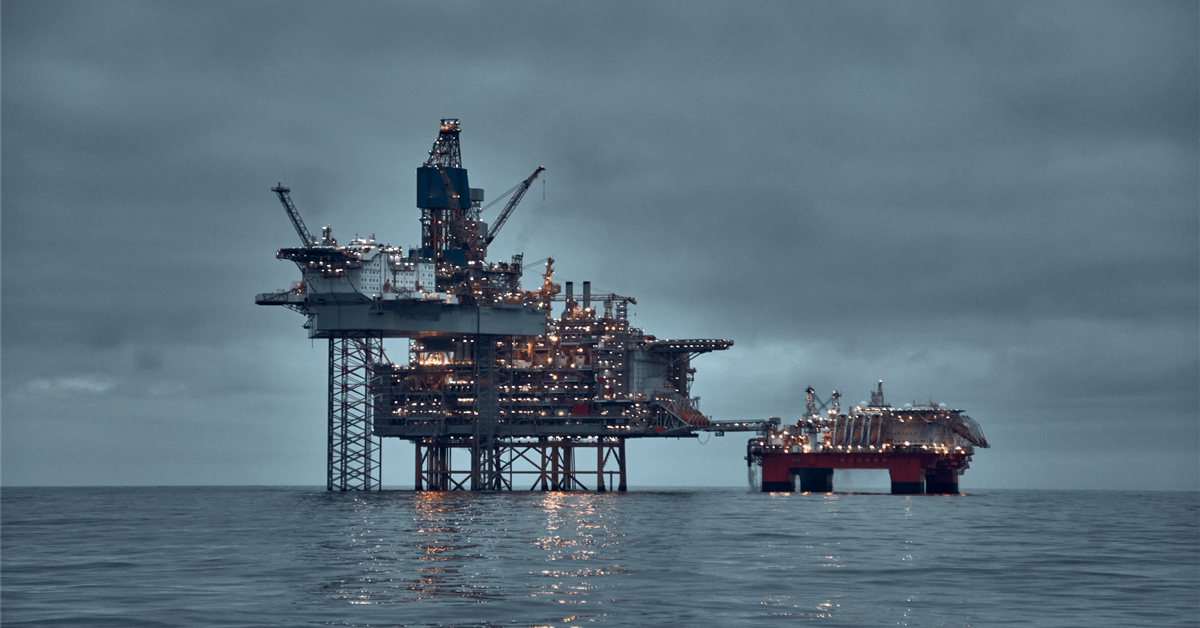

The approaching deadline is rising issues of a wider conflagration that would disrupt oil flows from the Center East, the supply of about one-third of the world’s provides. Any premium related to the two-year battle in Gaza had beforehand dissipated because the battle did not materially have an effect on provides.

Elsewhere, Ukraine claimed an assault on Russia’s Orsk oil refinery close to the border with Kazakhstan. Merchants have honed in on Russian flows over current weeks amid intensifying Ukrainian assaults on the nation’s power infrastructure.

Nonetheless, these tailwinds weren’t sufficient to shake costs out of their bearish stupor. Oil has declined 4 out of the previous 5 periods amid expectation OPEC+ will talk about fast-tracking provide hikes. In the meantime, efforts by the Trump administration to maintain oil exports flowing from northern Iraq, in addition to a US authorities shutdown, have added to bearish sentiments.

The OPEC+ assembly comes because the oil market heads for a file surplus subsequent 12 months, in accordance with the Worldwide Power Company. Merchants have been intently watching China’s shopping for, which has till now helped forestall a surfeit in a slim set of hubs within the US Midwest and Northwest Europe.

“Trying again on the previous 4 days’ efficiency, it’s tempting to conclude that the long-awaited glut anticipated to characterize the second half of the 12 months is lastly loudly knocking on the doorways of our market,” Tamas Varga, an analyst at brokerage PVM, wrote in a report.

The Group of the Petroleum Exporting Nations raised output by 400,000 barrels a day in September, formally finishing the restart of two.2 million barrels a day shuttered by the group and its companions in 2023, in accordance with a Bloomberg survey.

Oil Costs

- West Texas Intermediate for November supply was up 0.7% to settle at $60.88 a barrel in New York.

- Brent for December settlement edged up 0.7% to settle at $64.53 a barrel.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in knowledgeable neighborhood that can empower your profession in power.