Oil reversed earlier losses and shortly moved greater after it was reported that the US and its allies imagine main missile or drone strikes by Iran or its proxies in opposition to navy and authorities targets in Israel are imminent.

West Texas Intermediate rallied as a lot as 1.4% to commerce above $86 a barrel on Wednesday earlier than paring some beneficial properties. Costs are up about 22% in 2024, partly on geopolitical dangers within the Center East.

The information comes after Iran mentioned it was making ready a response to a suspected Israeli assault on its consulate in Syria. Merchants have been carefully monitoring the state of affairs, seeing the potential escalation as the following catalyst for crude.

“Oil’s subsequent transfer will now rely on the kind of response from Iran” if the potential escalation will disrupt world oil provides, mentioned Giovanni Staunovo, an analyst at UBS Group AG.

Earlier, WTI traded little modified close to $85 a barrel as a stronger US greenback and growing US stockpiles added bearish headwinds to crude’s current rally.

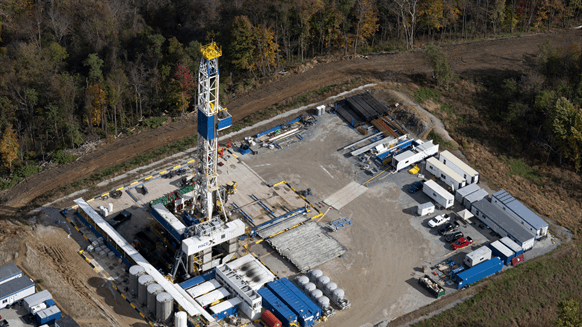

Crude’s rise this 12 months has additionally been underpinned by OPEC+ provide cuts. Traders will get a broader snapshot of the market outlook when OPEC and the Worldwide Power Company launch month-to-month stories this week.

Costs:

- WTI for Could supply added 98 cents to settle at $86.21 a barrel in New York.

- Brent for June settlement gained $1.06 to settle at $90.48 a barrel.