Oil was little modified as merchants weighed rising navy exercise within the Center East towards diplomatic efforts to alleviate the battle.

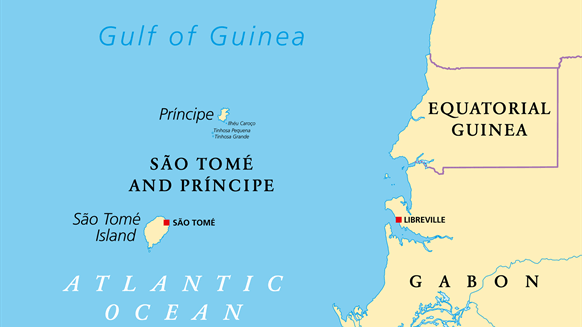

West Texas Intermediate settled close to $77 a barrel as Israel’s navy carried out strikes in Gaza within the southern metropolis of Rafah, the place greater than 1 million individuals have sought refuge. Including to the turmoil, Yemen’s Houthis mentioned they attacked one other ship within the Pink Sea, underscoring the continued menace to vessels within the area.

Additionally supporting crude was declining crude manufacturing from Iraq, the second-largest producer within the OPEC+ alliance. The higher-than-expected compliance by OPEC to produce cuts contributed to Morgan Stanley elevating its worth forecast for Brent to $82.50 a barrel within the first quarter, up from $80.

Retaining a lid on costs had been indicators of progress towards a diplomatic answer to the battle. Iran international minister Hossein Amirabdollahian over the weekend mentioned the potential launch of Israeli hostages captured by Hamas throughout a gathering with the heads of Palestinian resistance teams.

Oil has traded inside a band of about $10 this 12 months as dangers from the battle within the Center East have been partially offset by ample international provides and a shaky demand outlook — particularly in China, the second-biggest client.

Demand forecasts for China have further draw back dangers, Goldman Sachs Group Inc. analysts mentioned in a be aware, citing a surge in electric-vehicle gross sales and conversations with native shoppers.

Merchants this week might be seeking to month-to-month studies from each OPEC and the Worldwide Power Company for additional indications of provide and demand.

Costs:

- WTI for March supply was little modified, settling at $76.92 a barrel in New York.

- Brent for April settlement edged decrease 19 cents to settle at $82 a barrel.