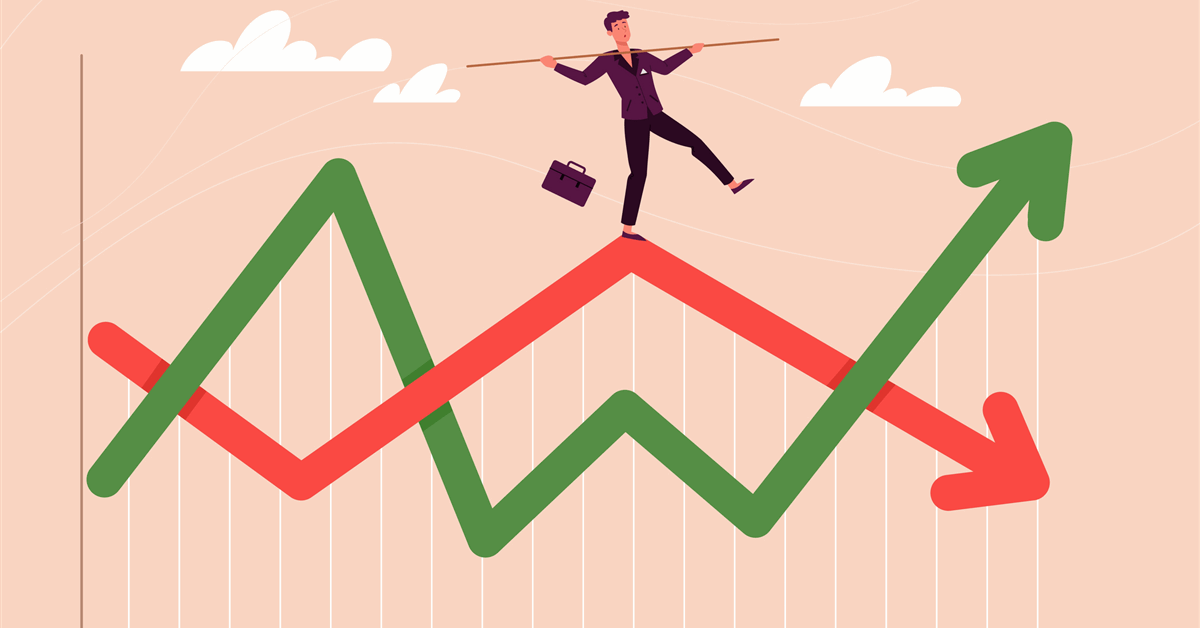

Till not too long ago, oil merchants complained that it was virtually unimaginable to wring income out of a listless and rangebound crude market. After the occasions of the previous two-and-a-half weeks, this may increasingly have been a case of “cautious what you want for.”

In that transient interval, the oil market went from flatlining to experiencing enormous value strikes. The set off was US President Donald Trump’s April 2 unveiling of sweeping tariffs, escalating a commerce warfare. Lower than a day later, OPEC+ shocked markets with plans to spice up output at a faster-than-anticipated charge. The twin shocks despatched US crude futures down virtually 7% for the largest decline since Russia’s invasion of Ukraine, whereas a key gauge of volatility rocketed to a six-month excessive.

However merchants say the turbulence that has since gripped the market is proving equally arduous to earn a living from, with contradictory, rapid-fire developments unpredictably buffeting costs.

“It’s not the sort of volatility you may have a medium-term view on, as a result of it adjustments each day,” mentioned George Cultraro, international head of commodities at Financial institution of America Corp. “A 25% tariff can flip into a ten% or 5% or 2% tariff, or get delay altogether. It has made pricing and managing danger a bit harder.”

Brent Belote, chief funding officer of Cayler Capital, was among the many merchants who earlier this yr had been pining for a rebound in volatility. Market situations had even pushed him to hunt for income in different commodities markets for the primary time in his profession, together with by beginning a metals buying and selling arm.

The sudden turbulence caught him off-guard, leading to losses on some bets.

“Effectively, I stepped in it,” Belote mentioned in a be aware to purchasers. “Not somewhat misstep, not an ‘Oops, missed by a hair’ name, this was me operating full velocity right into a brick wall. I genuinely believed Trump’s new spherical of tariff speak could be modest.”

The resurgence in volatility, whereas offering a short-term increase in buying and selling volumes, threatens the market’s liquidity over the long run.

Traders pulling out of crude and gas markets triggered a $2 billion web outflow within the week ending April 11, JPMorgan Chase & Co. analyst Tracey Allen wrote in a be aware to purchasers. Volumes throughout the futures curve have retreated to late March ranges and WTI’s open curiosity is fading after the preliminary spike as buyers bail somewhat than check their luck predicting Trump’s subsequent tariff salvo.

“This headline-driven volatility is often not good for liquidity as bids and affords get wider and volumes smaller as market members retreat,” mentioned Ryan Fitzmaurice, a senior commodities strategist at Marex. “This usually creates a suggestions loop with extra volatility, forcing deleveraging from systematic funds that modify place sizes primarily based on how a lot the market is shifting.”

The fast-evolving commerce warfare has compelled buyers to overtake their total market view in a matter of days on a number of events. Hedge funds reversed their place on Brent oil on the quickest tempo on report within the week ended April 8, figures from ICE Futures Europe present. In the meantime, long-only bets on West Texas Intermediate fell to the bottom since 2009, in contrast with a six-week excessive every week prior, in response to the Commodity Futures Buying and selling Fee.

Since that information was calculated, Trump introduced a 90-day halt on larger tariffs towards dozens of countries, in addition to a rise in duties on China to 145%.

Whereas fleeing outright bets on crude, merchants have been taking extra unfold positions, which supply extra restricted danger. Speculators added the most important variety of unfold bets in WTI since 2007 final week, whereas the equal positions in Brent climbed essentially the most since 2020.

Indicators are also rising that oil customers are in search of to keep away from the volatility by locking of their single largest prices. Swap sellers added essentially the most lengthy positions in Brent and ICE gasoil on report final week, usually a sign of shopper hedging, as industrial patrons sought to sidestep the danger of heightened volatility within the longer run.

One other complicating issue for merchants is that whereas massive value drops might start with a elementary driver like tariffs, they’ll quickly spiral additional due to different components like choices markets and the positioning of trend-following funds.

These funds, referred to as commodity buying and selling advisers rushed to show 100% brief in WTI through the 5 days following the tariff-induced market meltdown, in response to information from Bridgeton Analysis Group. Simply previous to that swing, these corporations had been seeking to provoke lengthy positions after steadily turning extra bullish since March 28, the researcher added. That’s essentially the most dramatic shift in positioning for the reason that collapse of Silicon Valley Financial institution in 2023.

The months after the financial institution’s breakdown supplied oil merchants a number of alternatives to revenue, with crude first plunging virtually 20% earlier than rebounding 40% to new highs for the yr.

“Sideways-trending markets get boring,” mentioned John Kilduff, a associate at Once more Capital. “However the place we’re at proper now, there’s a brand new stage of issue. Should you’re an individual who likes ache and tumult, you’re going to like this.”

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback might be eliminated.

MORE FROM THIS AUTHOR

Bloomberg